US futures

Dow futures +0.36% at 34328

S&P futures +0.5% at 4178

Nasdaq futures +0.8% at 13521

In Europe

FTSE +0.1% at 7026

Dax +0.35% at 15491

Euro Stoxx +0.2% at 4029

Learn more about trading indices

Tech stocks lead the risers as inflation fears fade

US futures are pointing to a stronger start on Monday, after a mixed closed on Friday. Amid a weekend of light news flow and with an empty economic calendar today, the mood in the market is cautiously optimistic.

Concerns have faded surrounding runaway inflation and the Fed tightening policy sooner. The reaction to those FOMC minutes last week which revealed that some policy makers were ready to talk about tapering support was short lived. The high growth tech sector looks set to outperform.

China cracks down on commodity prices

A move by China to crackdown on commodity prices, excessive speculation in the commodity market and spreading of fake news appears to be helping to calm inflation fears further. Commodity prices had been surging in recent weeks with copper hitting an all time high as well as strong gains in base metals. The rally in commodity prices had raised questions over how transitory inflation would actually be.

PCE figures on Friday

This is unlikely to be the end of the inflation story that has stalked the markets. With PCE figures, the Fed’s preferred gauge of inflation, due on Friday inflation jitters are bound to return as the week progresses.

The economic calendar is very quiet across the start of the week giving investors little to sink their teeth into. Sentiment is likely to be a principal driving force which could be a positive given the stabilization within cryptocurrencies.

Bitcoin has bounced higher although the mood surrounding the crypto currency remains weak.

Equities

Earning season is winding up with few companies reporting on Monday. Later in the week Costco, Nordstrom and Best Buy are set to report.

AMC Entertainment could be in focus after Cineworld, the world’s second largest cinema chain said it saw a strong reopening weekend thanks to the release of Peter Rabbit 2.

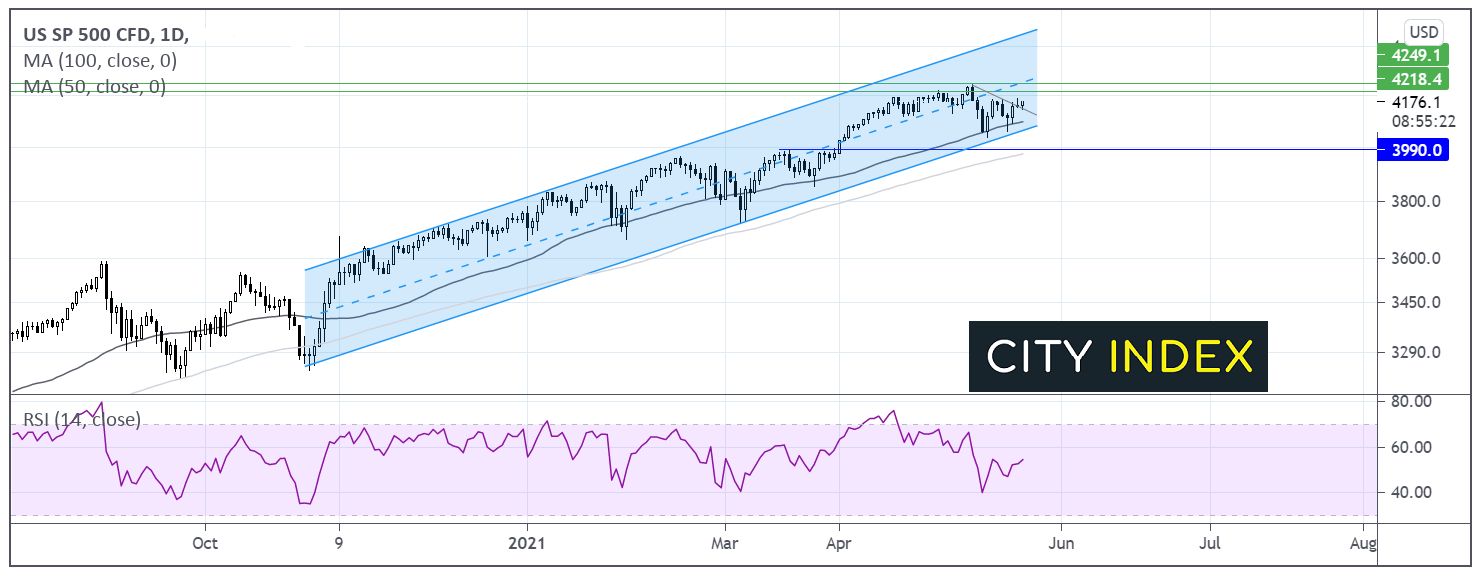

Where next for the S&P 500?

The S&P has traded within an ascending channel since early November. After hitting an all time high in early May of 4250, the price had been trending lower. Friday’s jump higher, saw the S&P 500 push back above the two descending trendline. Whilst the price remains above that trendline and within the ascending channel, the buyers could be optimistic of a move back towards 4215 and 4250.

FX – USD weakens, GBP trades under pressure

The US Dollar is trading lower as concerns fade over inflation and the Fed acting sooner to tighten policy. The USD had spiked higher after the release of the Fed minutes. However, the effect as short lived. The start of the week is quiet as far as data is concerned. Attention will turn to Fed speak Brainard for further clues over the Fed’s next moves.

GBP/USD trades lower whilst UK reopening optimism underpins the Pound, Brexit jitters and concerns over rising covid cases are dragging on demand. Andrew Bailey is due to speak shortly.

GBP/USD -0.2% at 1.4126

EUR/USD +0.2% at 1.2206

Oil rebounds as revival of Iran nuclear deal encounters problems

Oil is rebounding on Monday after falling over 2.5% last week. Reports of the Iran US nuclear talks running into trouble have eased concerns that Iran will be supplying the oil market again soon. Whilst talks are set to continue between the two sides, Iran prepares to end UN watchdog’s access to nuclear sites which will throw a dampener on progress. Furthermore, the US Secretary of State Blinken stated that there was no sign that Iran is willing to comply with nuclear commitments, raising doubts over progress.

Elsewhere re-opening optimism in the West continues to support the outlook for demand. However, rising covid cases in Japan and tighter restrictions could keep a lid on gains.

US crude trades +1.3% at $64.45

Brent trades +1.42% at $67.32

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

14:00 Fed Brainard speech

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.