US futures

Dow futures -0.07% at 34567

S&P futures +0.05% at 4448

Nasdaq futures +0.15% at 15411

In Europe

FTSE -0.02% at 7036

Dax -0.11% at 15701

Euro Stoxx -0.4% at 4173

Learn more about trading indices

Stocks steady, Microsoft announces buyback

US stocks are heading for broadly higher start after booking losses across the board on Tuesday. Even so, today’s gains are set to be mild as concerns over the strength of the economic recovery and the outlook for monetary policy remain in question.

Data has been a real mixed bad lately making the Fed’s job tougher. Job growth slowed considerably in August prompting speculation that the Delta covid hit to the economy is coming at a time when the Fed is considering reining in support. This of course is making the markets nervous.

Tech stocks will be in focus, more so than usual as Microsoft announced a buyback of up to $60 billion and a quarterly dividend rise.

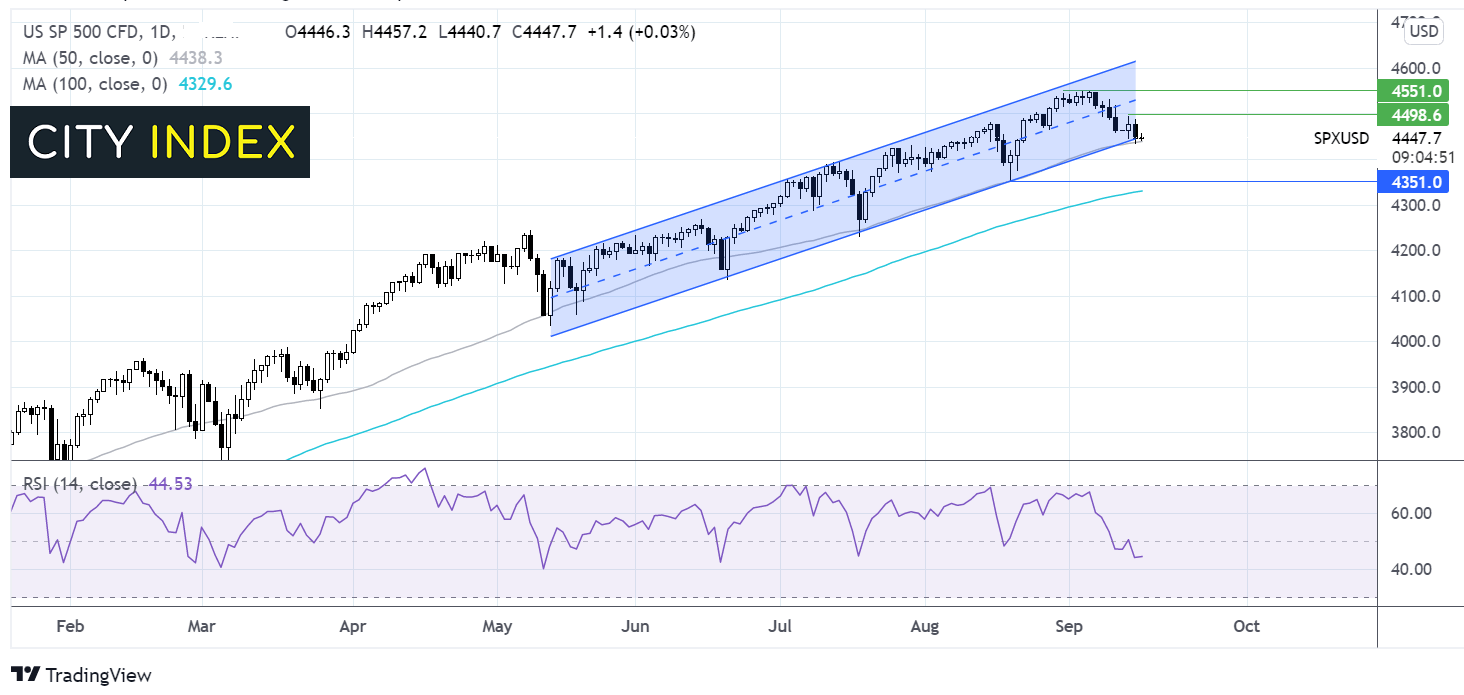

Where next for the S&P?

The S&P has been trading in a rising channel since mid-May. The price trades at the very bottom of the channel testing the lower band which runs with the 50 sma at 4435. A daily close below this level could open the door to 4350 and the 100 sma at 4330. It would take a move over 4500 for the bulls to gain traction.

FX – USD extends fall, GBP rises post CPI data

The US Dollar is extending losses following the softer than forecast CPI data yesterday.

GBP/USD is edging higher despite the strongest CPI print in almost a decade. UK inflation jumped 3.2% YoY in August, up from 2% in July and well above the 2.9% forecast. The stronger inflation data comes following encouraging labour market numbers yesterday and could encourage the BoE to hike rates sooner rather than later.

GBP/USD +0.07% at 1.3818

EUR/USD +0.16% at 1.1821

Oil rises on as stockpiles decline

Oil prices are pushing higher trading after industry data revealed that US stock piles declined by more than anticipated. The API figures showed that crude stockpiles fell by 5.4 million barrels compared to the 3.5 million forecast.

Separately his year’s hurricane season is having a larger and longer lasting impact on the oil market than we typically see. Output is still recovering from Hurricane Ida as Tropical storm Nicholas hits.

The mood surrounding oil remained upbeat following the IEA’s report yesterday which sees oil demand rebounding thanks to the COVID vaccine uptake.

WTI crude trades +1.3% at $71.18

Brent trades +1.1% at $74.11

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:30 EIA Crude Oil Stockpiles

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.