US futures

Dow futures -0.03% at 34983

S&P futures -0.02% at 4508

Nasdaq futures -0.01% at 15612

In Europe

FTSE -1.2% at 7012

Dax -0.19% at 15594

Euro Stoxx -0.18% at 4170

Learn more about trading indices

Futures head a few ticks lower

US stocks area heading towards a mildly softer open, extending losses for a fourth straight session despite encouraging jobless claims data.

Initial jobless claims rose by 310k, the lowest level since the pandemic started and last weeks’ was also revised lower to 345k. Whilst jobless claims are trending in the right direction they weren’t remarkable enough for the market to shake off the grey cloud which has been looming over the markets this week.

Uncertainty over the timing of the Fed’s plans to taper coupled with concerns over slowing economic growth have dragged on sentiment keeping bulls on the sidelines as stocks fall back from record highs. Whilst the move lower has been technically significant for the Dow, an index more closely tied to cyclical stocks, which has slipped below the 50 sma. The move lower so far on the S&P is not so far technically significant, thanks to high growth tech stocks which have continued to draw inflows.

That said, tech stocks but more particularly gaming stocks will be under the spotlight amid the ongoing crackdown in China. Beijing has temporarily suspended approval for all new online video games. US listed gaming stocks such as Roblox, Activation Blizzard and Take-Two have fallen pre-market.

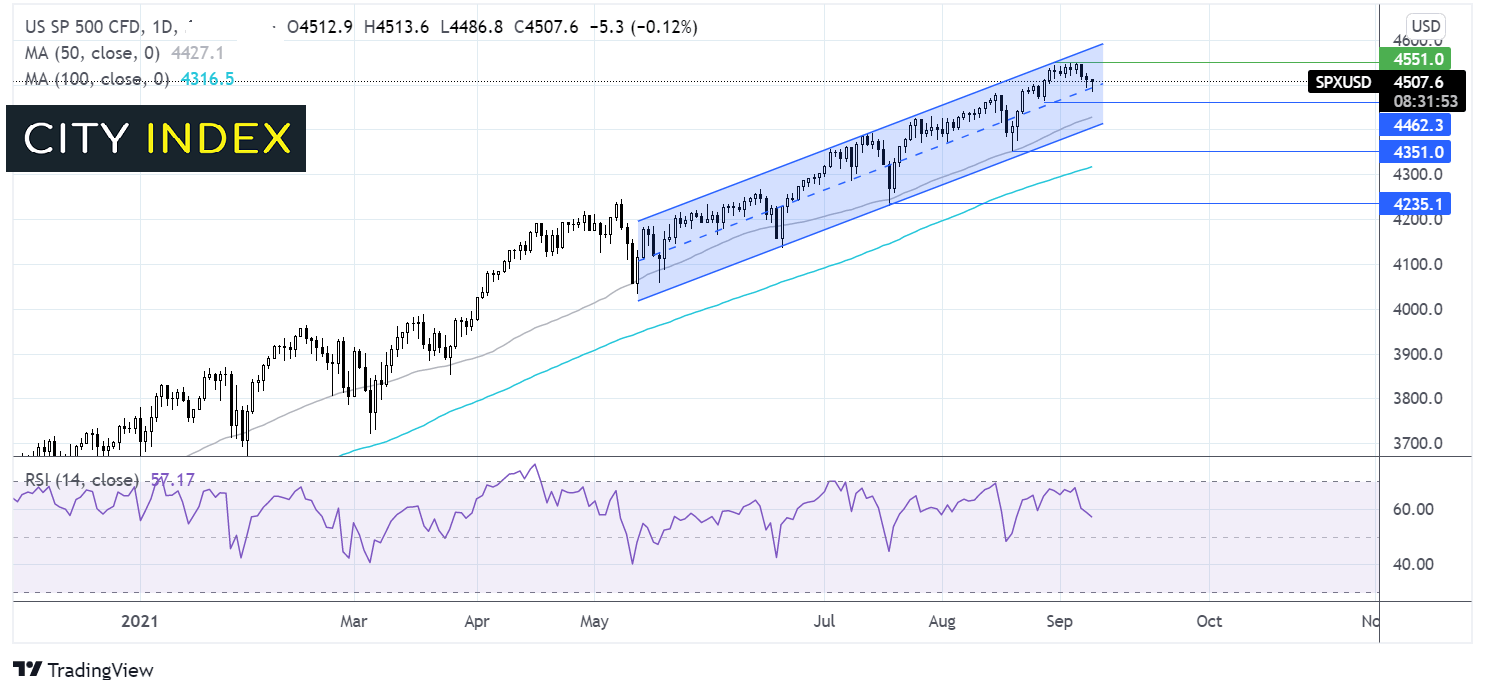

Where next for the S&P 500?

The S&P500 continues to trade in its ascending channel dating back to early May. After hitting an all time high of 4550 the price has been easing lower. However, the overall trend remains bullish and no key levels have been breach so far. Support could be tested at 4465 and 4427 the 50 sma. A break below here could see sellers gain traction to 4350. A move beyond 4550 is needed for fresh all time highs.

FX – USD falls on Fed uncertainty, ECB tapers

The US Dollar is edging lower amid growing concerns over the health of the US economic recovery and after Atlanta Fed President Raphael Bostic said that it is unlikely that the Fed will move to taper bond purchases at the September meeting. After the ECB’s move this highlights policy divergence between the 2 central banks.

EUR/USD – The ECB voted to keep interest rates unchanged, as expected. The central bank also agreed to moderately reduce the PEPP in Q4 but confirmed it will run until at least the end of March. In other words they took steps to dial back support but reassured that there would be plenty to come if necessary. The Euro has pushed moderately higher following the announcement. Attention is now on the ECB press conference.

GBP/USD +0.48% at 1.3813

EUR/USD +0.25% at 1.1840

Oil weighs up demand concerns vs slow output

Oil prices are holding steady on Thursday as demand concerns amid rising Delta covid cases offset a decline in output from the Gulf of Mexico owing to Hurricane Ida. Around 77% of production in the region has yet to start following on from the storm.

Separately the US Energy Information Administration cut its 2021 global oil demand outlook although the 2022 outlook remains constant. The move comes amid growing concerns over the health of the global economic recovery.

Yesterday API inventory data revealed that the crude drawdown was smaller than expected. EIA crude stockpile data is due later today.

US crude trades +0.06% at $69.20

Brent trades +0.12% at $72.47

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:30 EIA oil stock change

17:00 BoC Governor Macklem speech

19:00 Fed Williams speech

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.