US futures

Dow futures +0.36% at 34134

S&P futures +0.35% at 4318

Nasdaq futures +0.25% at 14520

In Europe

FTSE +0.5% at 7050

Dax +0.28% at 15085

Euro Stoxx +0.85% at 4020

Learn more about trading indices

Mood improves but caution remains

US stocks are set to rebound on turnaround Tuesday after steep tech led losses in the previous session. Yet, demand for tech remains lackluster as the rotation out of high growth and into cyclicals continues.

Oil prices continue to advance as do US treasury yields. However, the blind state of panic from yesterday has eased.

Upbeat earnings from PepsiCo and Facebook’s various social media and messaging services returning to normal operations are helping to give the market a more even tone.

There are still plenty of potential potholes for the market to fall down, such as fears surrounding spiraling energy costs in Europe as high demand and scarce supply send prices sky high. Or systemic risk rising in China as a second real estate developer missed a coupon payment. Or the lack of agreement in Washington over the debt ceiling. Today’s advance is moving on eggshells.

Attention is now turning to US ISM services PMI. All eyes will be on the employment and prices paid sub components which will provide further clues over the health of the US labour market and surging inflation.

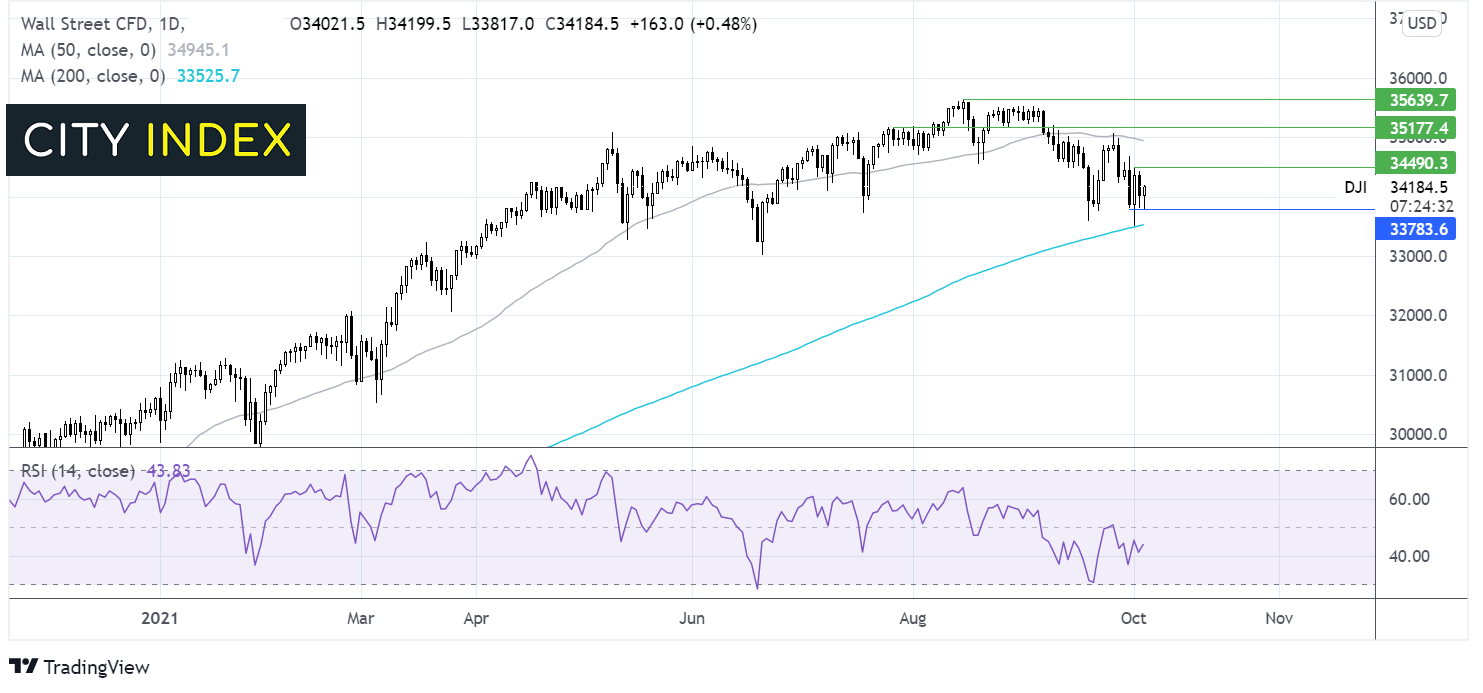

Where next for the Dow Jones?

The Dow Jones trades caught between its 50 sma on the upside and its 200 sma protecting the downside. The price rebounded lower off the 50sma finding support at the 200 sma. The RSI is giving away few clues and the price trades in a familiar range. Buyers could be looking for a move above 34500 Friday’s high to cement a bullish bias. Whilst sellers will be looking for a move below 33800 today’s low and the low last Thursday to expose the 200 sma a 33550.

FX – USD eases, UK Mfg PMI beats forecasts

The US Dollar is rebounding after yesterday’s weakness. The greenback is tracing treasury yields higher over the lack of agreement in Washington and amid expectations that the Fed will move to taper bond purchases potentially as soon as next month.

EUR/USD trades lower after upward revisions to the composite PMI data but PPI inflation numbers came in below forecasts at 1.1% MoM increase in August, down from 2.5% in July

GBP/USD +0.14% at 1.3627

EUR/USD -0.13% at 1.1600

Oil surges as OPEC stays pat

Oil prices surged to the highest level in 7 years on Tuesday after OPEC+ agreed to stick to the oil production increase plan agreed in July to raise production by 400k from November. Heading into the meeting there had been growing expectations that the oil cartel could raise output by an additional 400k.

The agreement comes as, according to the JTC, the supply deficit is expected to reach between 1.1 million barrels per day and 1.4 million barrels per day.

Whilst demand outstrips supply the price of oil will remain supported. Few are brave enough to short the oil market under such conditions.

WTI crude trades +1.02% at $78.31

Brent trades +1.2% at $82.11

Learn more about trading oil here.

Looking ahead

15:00 US ISM services PMI

21:30 API weekly crude oil stocks

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.