US futures

Dow futures +0.2% at 34867

S&P futures +0.25% at 4411

Nasdaq futures +0.21% at 15107

In Europe

FTSE -0.11% at 7112

Dax +0.2% at 15718

Euro Stoxx +0.3% at 4158

Learn more about trading indices

Jobs data, earnings & covid in focus

US futures are edging higher as investors continue to digest corporate earnings, jobs data and concerns over the spread of the delta variant and its potential impact on the US economic recovery.

Initial jobless claims came in at 385k in line with forecasts and a mild improvement on last week’s 399k. Initial claims have been hovering around this level since early July, meanwhile layoffs are at the lowest level in 21 years as firms held onto workers amid labour shortages.

Data surrounding the labour market has painted a mixed picture so far this week with ADP report yesterday massively missing forecasts, whilst the employment subcomponent of the ISM services report was much more encouraging. As a result, it is harder to guage whether tomorrow’s all important non-farm payroll will beat or miss estimates.

With stocks trading around record high investors are keeping an eye covid developments. With half the population fully vaccinated the spread of Delta is not expected to create the same large spread shutdown that it caused previously. However. there are concerns that rising covid cases could slow the labour market recovery, particularly in states where there is a low vaccine take up.

Earnings continue to roll in. Uber will be under the spotlight as it trades down 4% pre-market. The ride hailing food delivery company reported widening losses.

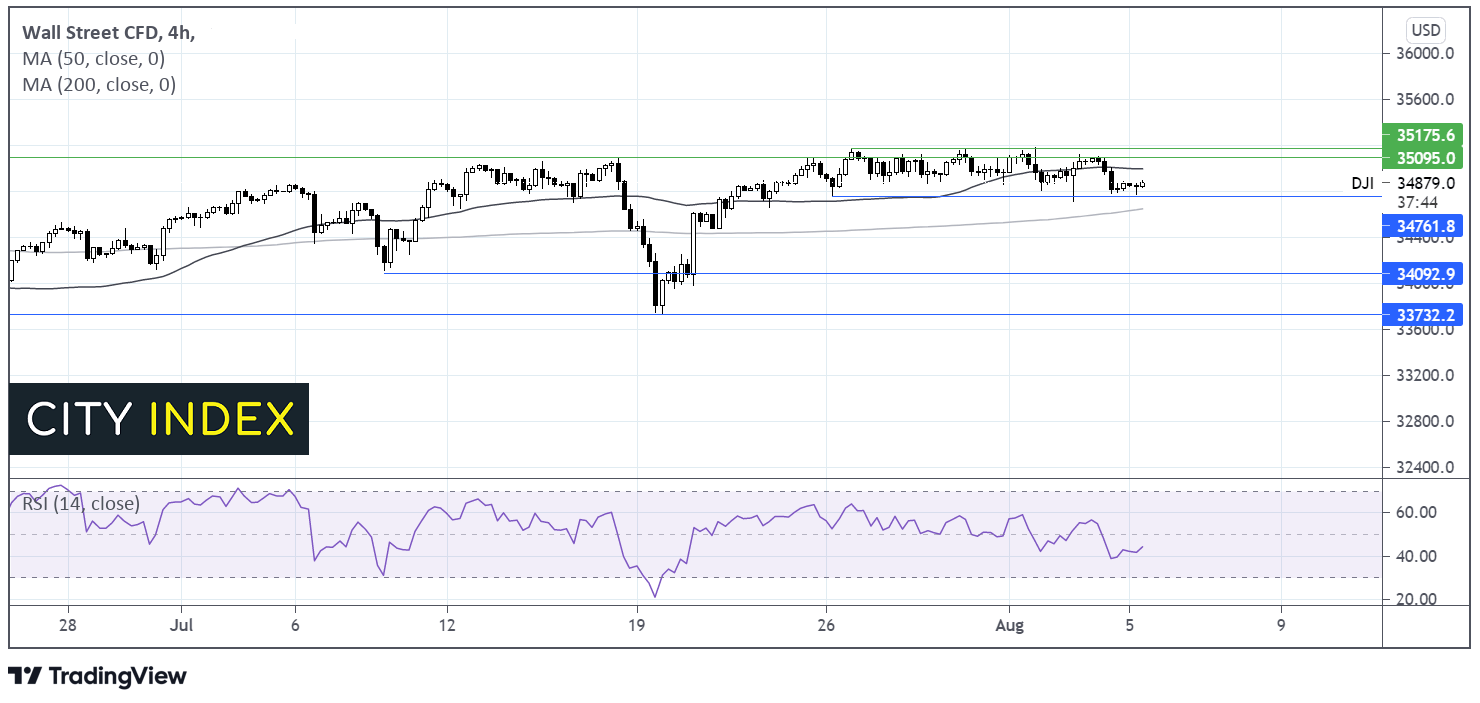

Where next for the Dow Jones?

The Dow Jones continues to trade within a fairly tight range over the past two weeks capped on the up side by 35190 and on the downside by 34800. A meaningful move out of the current holding pattern is needed for further clues on direction. A break below 34800 is needed to open the door to 34635 the 200 sam on the 4 hour chart. A move below here could see the sellers gain traction. Meanwhile buyers could look for a move above 35190 for fresh all time highs.

FX – USD subdued, GBP rises post BoE

USD is drifting lower paring some of yesterday’s strong gains. Fed official Richard Clarida had said that he was in favour of tapering this year with the necessary conditions for a rate rise being met in late 2022 which had lifted the greenback. Investors now await tomorrow’s non-farm payroll.

GBP/USD trades higher after the BoE, as expected voted to keep monetary policy on hold. The BoE voted 8-0 to keep rates unchanged and 7-1 to keep asset purchases unchanged. The quarterly inflation report saw CPI upwardly revised to 4% in Q4 2021, higher than expected. Some officials said that some modest tightening could be needed in due course to keep price inflation under control, boosting the Pound. UK GDP is expected to reach pre-pandemic levels by the last quarter of this year.

GBP/USD +0.1% at 1.3906

EUR/USD -0.01% at 1.1837

Oil attempt to stabilise

Oil prices are attempting to rise after steep losses across the start of the week. Middle Eastern tensions are offering some support to oil. However, concerns that fresh restrictions imposed in some countries to curb surging COVID cases could threaten the demand recovery is limiting gains in oil.

Japan to set to expand emergency restrictions whilst China has imposed curbs and travel restrictions in some cities.

Growing tensions between Iran and Israel come as nuclear talks between Iran and the West which could see the easing of export restrictions on Iran’s oil, appear to have stalled.

US crude trades +0.15% at $68.08

Brent trades +0.13% at $70.37

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 Fed Weller speech

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.