US futures

Dow futures +0.4% at 34294

S&P futures +0.66% at 4378

Nasdaq futures +0.96% at 14302

In Europe

FTSE +0.7% at 7536

Dax +0.16% at 15480

Euro Stoxx +0.3% at 4176

Learn more about trading indices

Strong GDP data calms Fed fears

Stocks are set for a mixed open, with the Nasdaq outperforming as bargain hunters come out in force. The tech heavy Nasdaq had been hit hard by fears of a more hawkish Fed in the lead up to the US central bank’s rate decision, making this a case of sell the rumor buy the fact.

The Fed kept interest rates on hold and teed the market up for a March. Whilst the Fed didn’t go into the frequency of the rate rises, Fed fund futures are pricing in as many as five hikes across the year. Fed Powell certainly sounded significantly more hawkish than in previous meetings.

The concern had been that the US economy won’t be able to cope with the level of aggression needed from the Fed in order to bring inflation under control. However, stellar Q4 GDP data has helped calm those fears. US Q4 rebounded strongly growing an impressive 6.9% across the final three months of the year, triple the growth experienced in Q3.

Elsewhere tensions between Russia and the Ukraine continue to mount, and investors are monitoring developments cautiously. Russia criticizing the US and NATO’s security proposal to diffuse the situation doesn’t bode well.

In other corporate news:

Tesla trades mildly higher after posting record results. The EV makers saw profits jump to $5.5B, 10% higher than analysts’ forecasts. Investors are disappointed that there will be no new models this year and will be wary of comments that supply chain issues are expected to continue across the year.

Other big names that reported today include Mastercard and Visa. Whilst Apple is due to report after the closing bell.

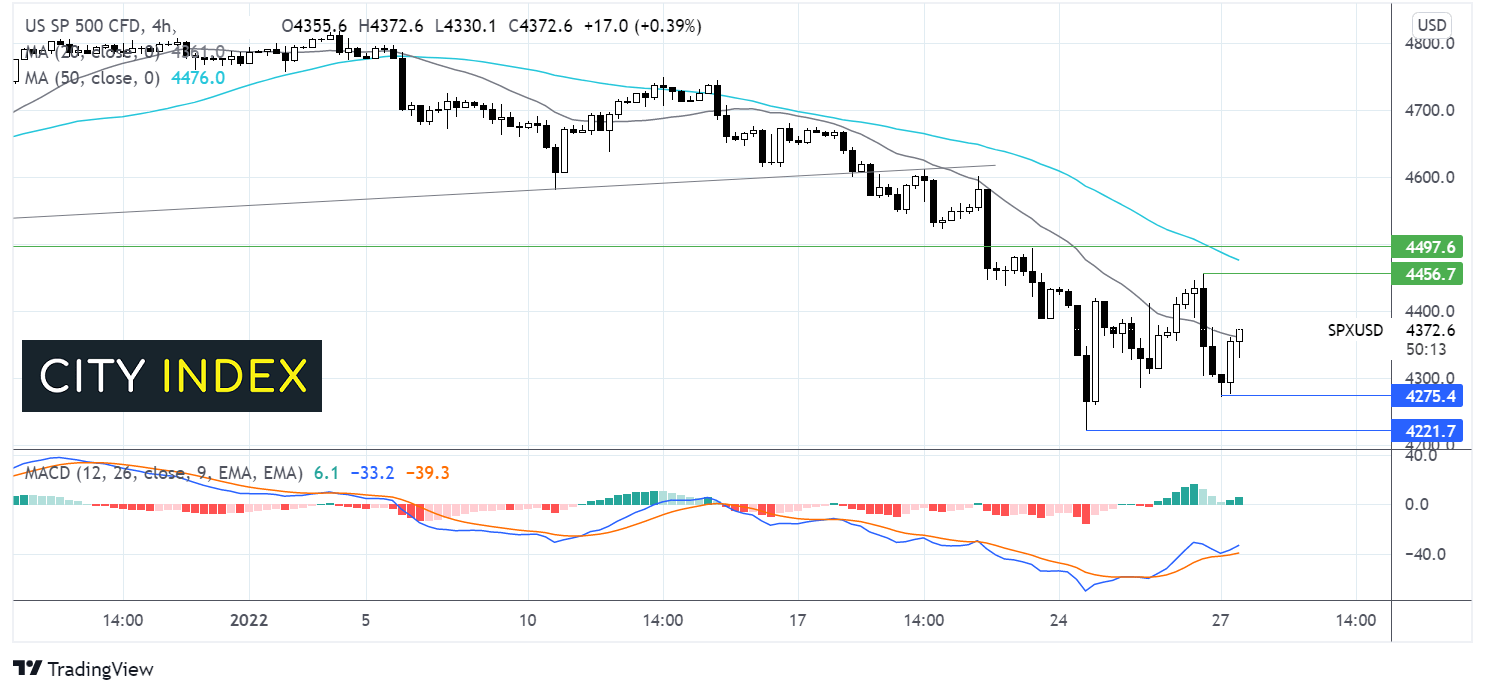

Where next for the S&P500?

S&P 500 is extending the rebound from 4221 struck at the start of the week. The retaking of the 20 sma, the bullish MACD and the hammer candle pattern are keeping buyers optimistic of further upside. Buyers will look for a move over 4450 yesterday’s high to change the bias to a bullish bias and attack 4500 the January 21 high. Sellers would look for a move below 4275 the daily low to target 4221.

FX markets USD rises to 19 month high

The USD has broken higher following the Fed meeting. The hawkish pivot from the Fed and expectations of up to 5 interest rate hikes across the years has sent the greenback to levels last seen in June 2020.

EUR/USD trades steeply lower on the back of the highly divergent central bank policies. Whilst the Fed is looking to hike rates around 4 if not 5 times a year, the ECB is not looking at hiking rates at all in 2022. German GFK consumer confidence unexpectedly improved looking out to February but remains depressed.

GBP/USD -0.51% at 1.3393

EUR/USD -0.7% at 1.1158

Oil hits fresh 7 year highs

Oil prices are extending gains as geopolitical concerns overshadow the stronger USD. Tensions in eastern Europe continue to rise prompting fears of an invasion by Russia into Ukraine and supply disruption in this crucial oil and gas transit hub.

These fears are overriding a stronger US dollar which makes this dollar denominated commodity more expensive for buyers with other currencies.

OPEC+ are due to meet next week. They are unlikely to raise the output quota given that the group of producers failed to reach production targets in December.

WTI crude trades +0.8% at $87.66

Brent trades +0.99% at $89.50

Learn more about trading oil here.

Looking ahead

15:00 US Pending home sales

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.