US futures

Dow futures -0.2% at 33342

S&P futures -0.2% at 34060

Nasdaq futures -0.02% at 13590

In Europe

FTSE +1.3% at 6817

Dax +1% at 15260

Euro Stoxx +0.7% at 3975

Learn more about trading indices

Futures slip but economic optimism remains

US futures are pointing to a slower start on Tuesday after rallying to record highs in the previous session. The S&P 500 closed 1.4% higher on Monday at a record 4076 whilst the Dow Jones rose 1.1% to close at an all time high of 33527.

The strong gains come amid on growing expectations of a strong US economic recovery. A blowout US jobs report on Friday, followed by a surging in service sector activity reported on Monday and an accelerating vaccine programme suggest that the US economic recovery is firmly on track.

Further evidence of the recovering US labour market is expected from the JOLTS job openings data at 13:00 UTC.

Stocks in focus

BP ADR - trades +3% pre-market after the oil giant said it will achieve its $35 billion net debt target about a year earlier than expected, which means that it can restart its share buyback programme.

Carnival – trades +0.5% pre-market after 5% gains in the previous session is due to report early in the session.

Snap- trades +2.6% pre-market after Atlantic Equities upgraded its rating to overweight from neutral.

Where next for Snap share price?

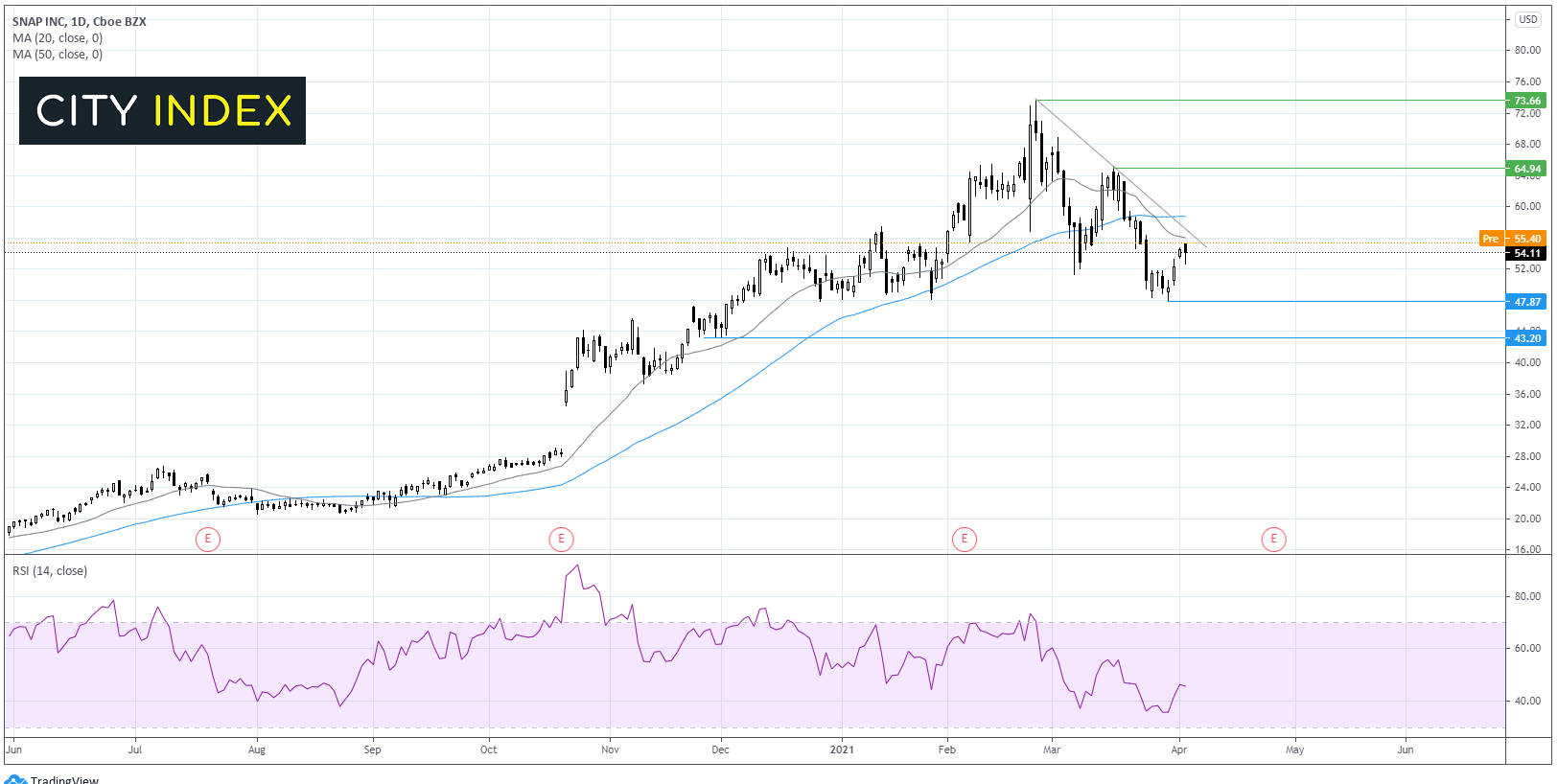

After trading steadily higher across the past year Snap hit an all time high of 73.60 in late February, before heading lower.

Price trades below its descending trendline dating back to late February. However, the jump higher pre-market is expected to see the price test resistance at the descending trendline and the 20 sma. A move above here could see the 50 sma tested at 59.00. should the bulls break above this level the move higher could gain momentum.

Failure to break above 56.50 the descending trendline and 20 sma could see the price rebound lower towards the March low and year to date low around 48.00. This is an important support level which has capped losses several times across the year. A break out below 48.00 could see a deeper selloff towards 43.20.

China asks for restrain in bank lending

China’s central bank has asked the country’s largest commercial banks to rein in their lending. The request comes after lending surged in the first two months of the year and is the latest effort by Beijing to rein in borrowing which surged through the pandemic to support the economic recovery.

The news hit demand for Chinese equities hard and the Shanghai Shenzhen 300 fell when the rest of the global markets were following wall street higher.

FX – EUR flat despite upbeat data, AUD lower post RBA

The US Dollar is attempting to recover after declining 0.4% in the previous session, its largest one -day decline in 3 weeks.

EUR/USD – trades unchanged at 1.18 despite upbeat Investor Sentiment Index. The index points to stronger morale in April, hitting 13.1, up from 5 in March and beating forecasts of 6.7.

AUD/USD – trades lower after the Reserve Bank of Australia left rates unchanged as expected. The central bank provided no clues over the future of its bond buying programme.

GBP/USD -0.5% at 1.3825

EUR/USD trades +0.03% at 1.1807

Oil rises ahead of OPEC+ meeting

After diving 4.5% in the previous session, oil prices are rebounding today. Optimism surrounding the global economic recovery is helping to lift oil ahead of API stock pile data later today. Upbeat Chinese data overnight, following on from much stronger than expected US ISM service sector PMI data has helped calm nerves of rising supply.

Concerns over supply sent oil prices tumbling on Monday as the OPEC + group are expected to start increasing supply as from May.

US crude trades +1.6% at $59.62

Brent trades +1.4% at $63.01

Learn more about trading oil here.

The complete guide to trading oil markets

Analyst Fiona Cincotta looks at the price action of WTI and levels to watch here.

Looking ahead

15:00 US JOLTS Job Openings (Feb)

21:00 API weekly crude oil stock piles