US futures

Dow futures +0.07% at 31985

S&P futures -0.3% at 3907

Nasdaq futures -0.9% at 13180

In Europe

FTSE +0.3% at 6680

Dax -0.18% at 13950

Euro Stoxx -0.1% at 3703

Learn more about trading indices

Risk on post Powell, commodities jump

Risk appetite has been reignited after Federal Reserve Chair Jerome Powell continued to sing from the dovish hymn sheet. He reiterated again to Congress on Wednesday that monetary policy would not be tightened for the foreseeable future.

The idea of low interest rates for longer and no signal of the tapering of bond buying, regardless of the improving economic outlook favours demand for riskier assets and currencies at the expense of the safe haven US Dollar.

The US Dollar Index dropped below 90.00 to a 7 week low despite US treasury yields pushing higher to 1.45%.

The weaker US Dollar is offering support to oil and commodity prices with copper futures rallying to a fresh 9.5 year high.

All you need to know about trading copper.

US data deluge

With durable goods orders, jobless claims and the 2nd estimate of Q4 GDP all set to be released, investors will be keen to see whether the data coincides with Powell’s assessment of the economy.

Jobless claims are expected to remain stubbornly elevated with just a very mild decline to 838k versus 861k last week.

US Q4 GDP is expected to be upwardly revised to 4.2%, up from 4% in the initial estimate.

Stock to open lower, Tech underperforms

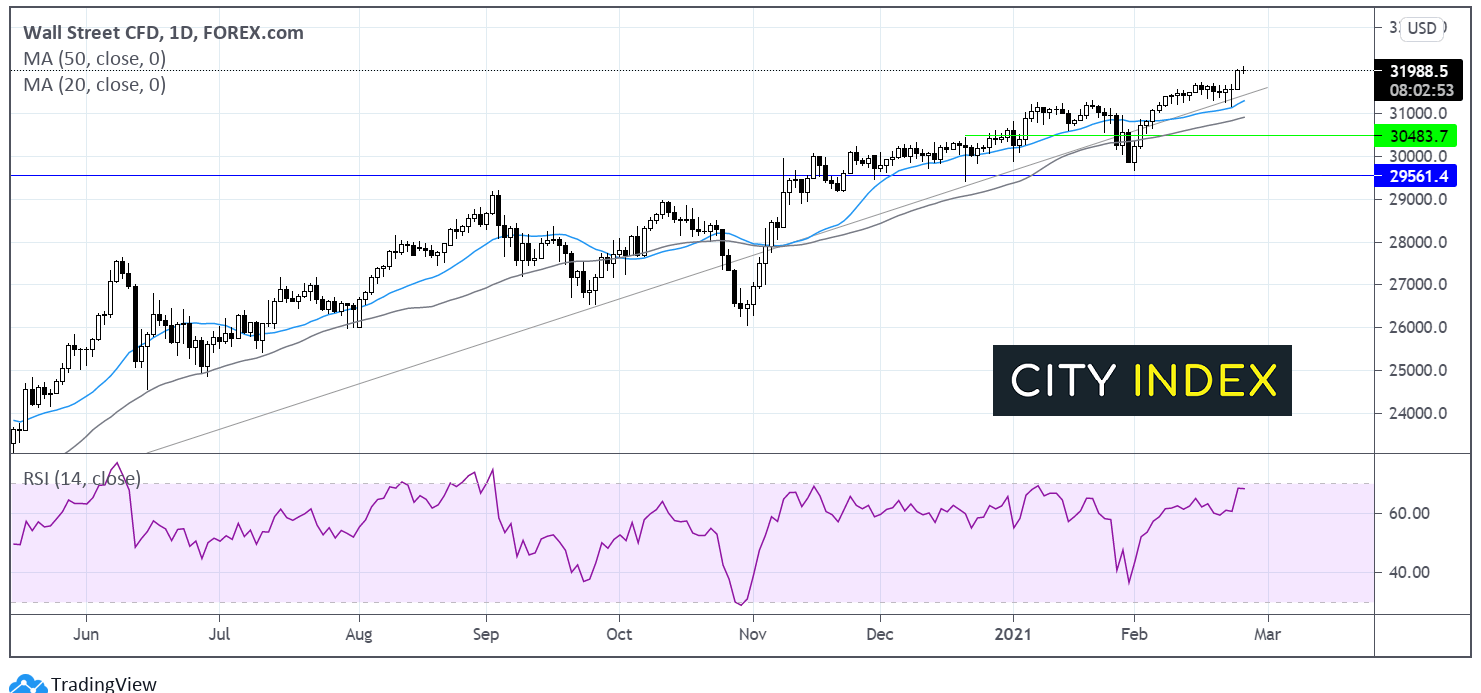

Whilst Asia and Europe saw a positive start Wall Street is looking to weaker start out of the blocks. The US tech sector is once again coming under heavy pressure as the bond market sell off resumes. The growth tech sector is particularly sensitive to interest rate expectations. The rotation out of growth and into value stocks continues benefitting the Dow which trades at its all time high.

.

GameStop & AMC Entertainment are two notable risers jumping 56% and 17% pre-market respectively. Given the recent short squeeze on the stock any big jumps look particularly conspicuous.

DoorDash & Airbnb to report after the close

Earnings continue to pour in with Salesforce, HP, AirBnB and DoorDash expected to report after the close. These will be DoorDash & Airbnb’s results since going public so will be closely watched to gauge the run up in the share price since the respective IPO.

Q4 numbers will provide insight into how the two firms are managing operations. However, investors will be really looking for comments and guidance regarding the outlook when covid restrictions ease and vaccines are more widespread. This will be a time when travel restrictions will have eased and people will be visiting more restaurants. Whilst Airbnb is set to benefit from the change in environment, DoorDash which has boomed in lockdown could face more headwinds going forwards.

FX – EUR hits 6 week high

The US Dollar is on the back foot in risk on trade after Fed Powell’s reiteration of a supportive stance.

EUR/USD trades at the highest level since mid-January on the upbeat market mood. German GFK consumer morale improved by more than expected heading into March as shoppers become more upbeat about the outlook despite the ongoing lockdown. The data comes following an upwardly revised German GDP reading in the previous session.

GBP/USD trades +0.08% at 1.4150

EUR/USD trades +0.5% at 1.2225

Analyst Fiona Cincotta look is at the price action of EUR/USD here and levels to watch.

Oil resumes its advance

Oil prices surged to a fresh 13 month high on the back of recovery optimism and the weaker US Dollar. However, the price has since eased back marginally as investors switch their attention to the OPEC meeting on 4th March and the rising probability that OPEC+ will lift some of its production cuts.

US crude trades +0.4% at $63.50

Brent trades +0.4% at $66.68

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

13:30 US Durable Goods Orders

13:30 Q4 GDP

13:30 initial jobless claims

15:00 Pending Home Sales