US futures

Dow futures +0.07% at 34250

S&P futures -0.07% at 4164

Nasdaq futures -0.1% at 13491

In Europe

FTSE +0.1% at 7048

Dax +0.02% at 15162

Euro Stoxx -0.1% at 3994

Learn more about trading indices

Rotation out of tech into value as economic recovery continues

US futures point to mixed start with the Dow Jones looking towards fresh highs, whilst the tech heavy Nasdaq remains out of favour once again. Amid signs that the US economic recovery is strengthening, investors are rotating out of tech into value.

Initial jobless claims

The number of American’s that signed up for unemployment benefit dropped to a new post pandemic low of 498k, down from the upwardly revised 540k and ahead of forecasts. Whilst the larger fall this week is offset by the unexpected upward revision to the previous week, the trend is still encouraging. In line with ADP numbers it is clear that the US labour market is on the right path to recovery and that the economic is gaining strength.

Earnings

Uber trades lower pre-market after posting encouraging results on Wednesday after the close but setting aside $600 million to cover costs to provide UK drivers with benefit.

Earnings will also be coming in from Beyond Meat, Viacoms & Kellogg among others.

Vaccine IP waiver

The European Commission has said that it too is willing to waiver vaccine intellectual property rights for covid vaccines whilst the pandemic lasts. The idea was first proposed yesterday by US Presidential trade adviser Katherine Tai sending Moderna sharply lower yesterday. BioNtech trades -17% in Germany.

Such a move would face a significant legal challenge from the pharma sector. However, broadly speaking a faster global vaccine programme should mean a quicker global economic recovery.

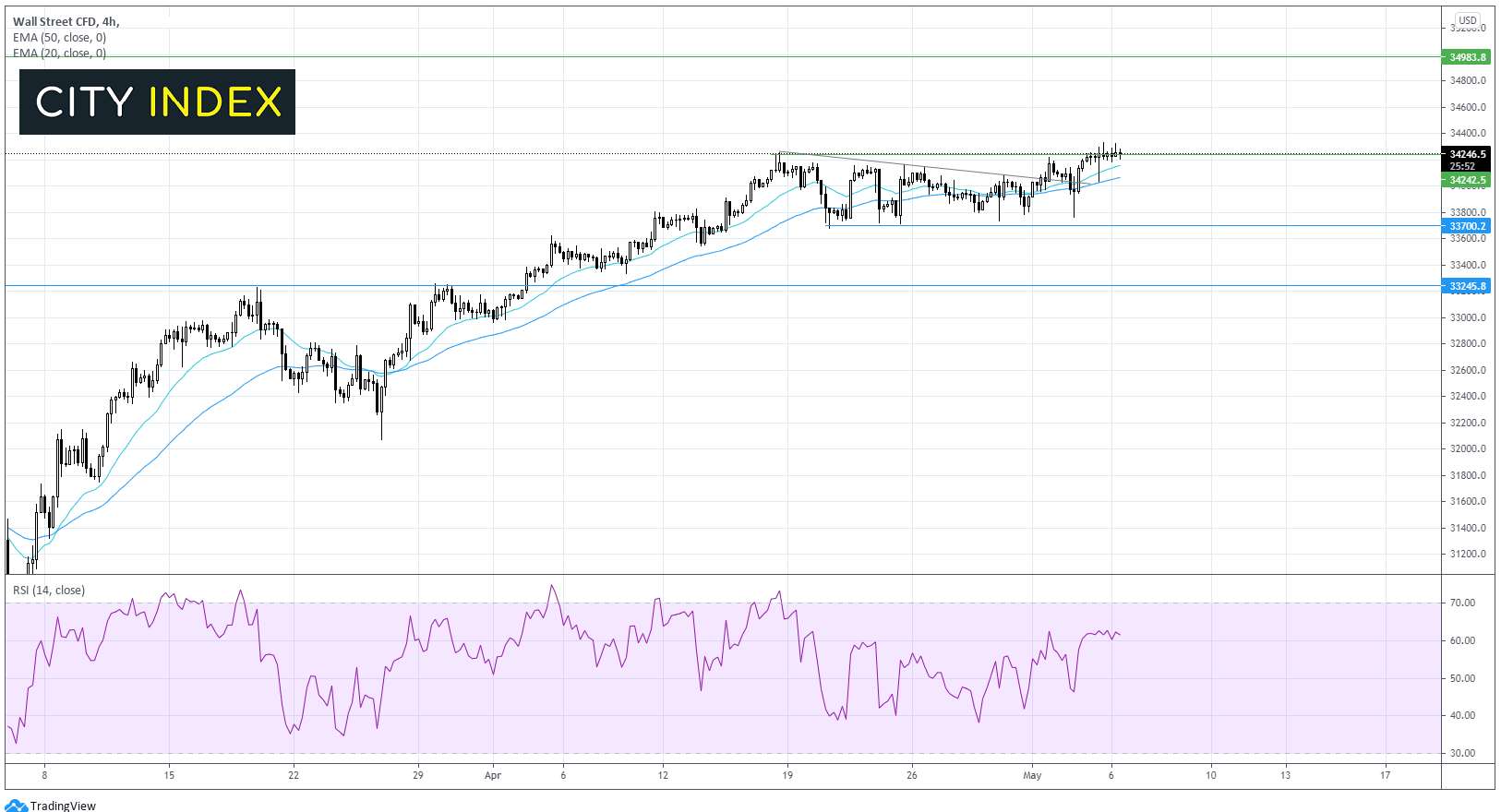

Where next for the Dow Jones?

The Dow Jones has been trading in a holding pattern since mid April, capped on the upside by 34245 and the downside by 33700. The Dow attempted to break out of the upper band of the channel in the previous session hitting a fresh all time high. The Dow will need to at least hold this level and the fact that it hasn’t immediately fallen away suggests that there is demand at this level. If it can hold then the outlook is for a bullish breakout. It would take a move below 33700 for the bears to gain traction.

FX – US Dollar weaker, EUR rallies, BoE hikes outlook

The US Dollar is edging lower despite strong recent data. This is most likely owing to its safe haven status. With the reopening optimism growing, investors are shunning the greenback for riskier currencies. Equally, the Fed’s insistence that policy won’t be tightened soon could also be keeping the greenback depressed.

EUR/USD trades higher after a stream of upbeat macro stats from the region. German factory orders rose 1.5% MoM in March. Orders surged by 3% double forecasts, highlighting the resilience of the country’s manufacturing sector even as covid cases rose. Eurozone retail sales rose 2.7% MoM ahead of the 1.5% forecast as lockdown restrictions eased. Data suggests thar the Eurozone economy has turned a corner.

GBP/USD trades higher after the BoE kept rates on hold as expected, but upwardly revises the growth outlook for the year. The BoE now expects the UK economy to expand by 7.25% this year, up from a previous expected 6.5%

GBP/USD +0.01% at 1.3910

EUR/USD +0.35% at 1.2047

Oil bulls pause for breath, Indian covid crisis deepens

Oil is slipping lower after hitting its highest level since mid-March on Wednesday on strong data and on Western reopening optimism. Surging covid cases in India continue to cap the upside.

US crude inventories fell by 8 million barrels in the most recent week, well ahead of the 2.2 million barrel draw expected. The data from the EIA additionally showed that exports and refining output were at the highest level in a year.

Demand is clearly picking up as Western economies reopen and this is underpinning a strong rally in oil across recent weeks. Today, oil bulls are pausing for breath, with one eye on the surging cases in Indian and Japan’s higher case load.

India, the third largest importer of out recorded 412,262 new daily covid cases crushing hope that the peak was hit yesterday as the government modelled.

US crude trades -0.6% at $65.17

Brent trades -0.6% at $68.40

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

14:15 BoE Governor Andrew Bailey speaks