US futures

Dow futures -0.06% at 35420

S&P futures +0.01% at 4534

Nasdaq futures -0.8% at 156011

In Europe

FTSE +0.07% at 7173

Dax +0.02% at 15845

Euro Stoxx -0.26% at 4220

Learn more about trading indices

Futures trade lower after NFP

US stocks are set for a weaker start following the US non-farm payroll report. The closely watched US Labour Department’s job report revealed that 253k new jobs were added in August well below than the 750k that were forecast. However, the July number was upwardly revised to over 1 million jobs to 1053k which has helped to offset some of the disappointment.

This was the smallest gain in job creation in 7 months. The fall in job creation comes as the delta variant has seen US covid cases rise but also amid difficulties filing positions.

The data supports the view that the Fed will hold off on tapering its bond purchases until later in the year. The Fed will still want to see more progress in the labour market recovery, as Powell said at the Jackson Hole Summit.

The unemployment rate declined to 5.2% this was in line with analysts’ forecasts and down from 5.4%. Average wages rose by more than expected to 4.3% YoY well ahead of the 4% forecast

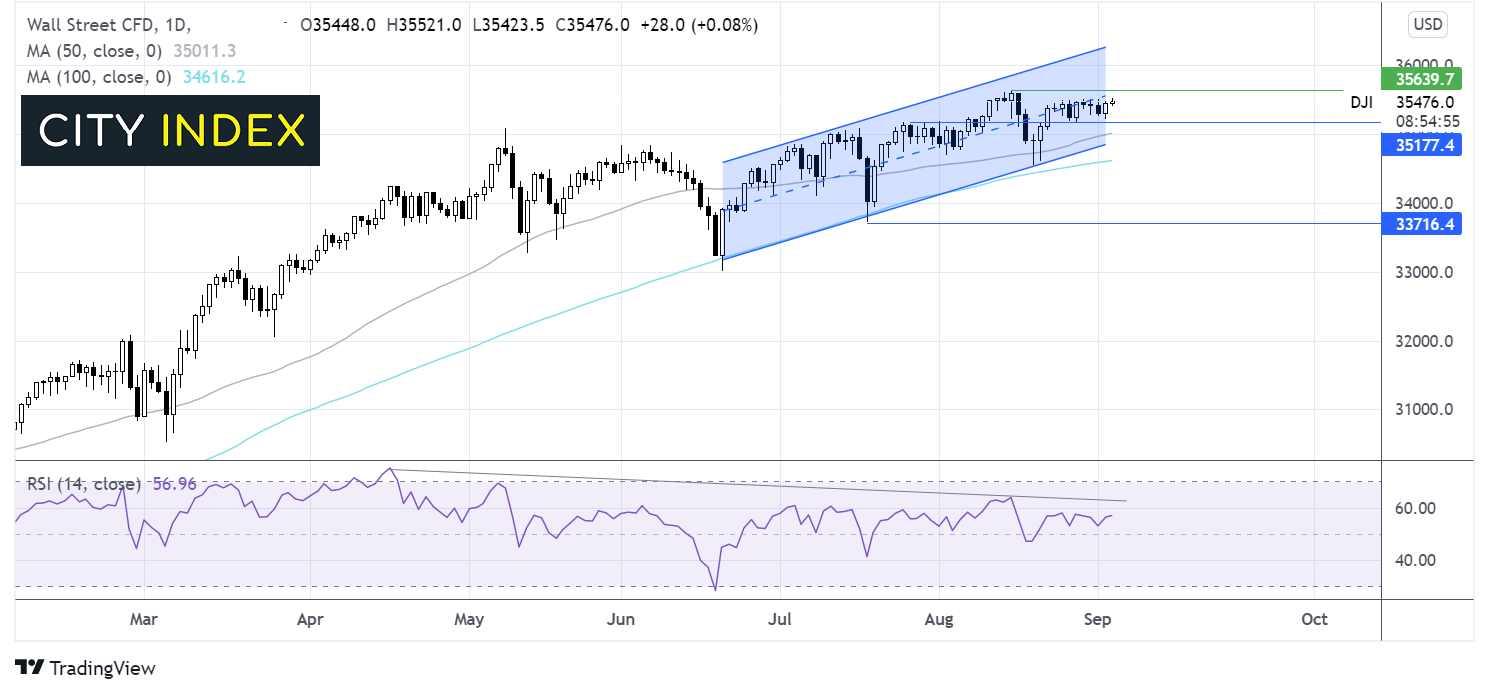

Where next for Dow Jones?

The Dow Jones trades within its acceding channel dating back to mid-June. However, the bearish reversal on the RSI suggests that momentum is slowing. The price has struggled around 35500 this week with a move above 35600 needed to reach fresh all-time highs. A move below 35150 could negate the near-term uptrend. A move below the 200 sma at 34600 could see the sellers gain traction.

FX – EUR shrugs off slowing growth and declining retail sales

The US Dollar is falling as bets cool over the Fed moving to tighten policy following huge miss in NFP. More evidence of the recover in the jobs market will be required by the Fed to before it starts tapering bond purchases,

EURUSD is treading water despite weak retail sales figures and as a supply shortage saps the strength of the economic recovery in the Eurozone. Business activity remained strong in August falling to 59 down from July’s 15 year high of 60.2. This was down from the flash 59.2 treading earlier in the month. Growth momentum is fading amid supply chain issues and amid the rise of delta covid cases.

Eurozone retail sales fell by 2.3% in July as the consumer driven bounce back slowed at the start of Q3. The figure comes after retail sales jumped in June by 1.5%. Sales have been volatile amid the reopening.

GBP/USD +0.12% at 1.3856

EUR/USD +0.17% at 1.1893

Oil edges higher ahead of OPEC+ announcement

Oil is edging higher for the third straight session. Oil is set to finish the week 2% higher amid easing fears over the demand outlook and expectations of a slow recovery for the US Gulf Coast export and refining hub from the hurricane that hit earlier this week. Oil prices have remained supported thanks to larger than forecast inventory draws, even as OPEC agreed to stick to the plan to add 400k barrels per day over the coming months.

Baker Hughes rig count data will be in focus later today.

US crude trades +0.29% at $70.06

Brent trades +0.59% at $73.36

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

14:45 US Markit Services PMI

15:00 ISM Services PMI

18:00 Baker Hughes Rig Count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.