US futures

Dow futures +0.1% at 35380

S&P futures +0.1% at 4484

Nasdaq futures +0.1% at 15336

In Europe

FTSE -0.4% at 7109

Dax +0.12% at 15888

Euro Stoxx -0.12% at 4170

Learn more about trading indices

Early rally eases

US stocks are heading for a mildly positive open as investors continue weighing up the risks of rising Delta covid cases and the chances of the Fed signaling the tightening of monetary policy at the Jackson Hole symposium later this week.

The positive sentiment after the FDA fully approved the Pfizer vaccine is seeing some follow through buying, although the upbeat mood is starting to wane. A decent bout of dip buying after last week’s sell off has lifted the Nasdaq to a fresh record high in the previous session.

Investors continue to position ahead of the Jackson Hole economic forum with investors weighing up the potential timing of the Federal Reserve’s next move. Bets have eased that the Fed will move towards tapering bond purchases. The weaker than forecast PMI data under pinned this belief in the previous session sending the US Dollar sharply lower and equities higher.

There is little on the economic calendar today to drive trading. Trading could become more subdued over the coming session with few looking to take out big positions ahead of such a potentially market moving event.

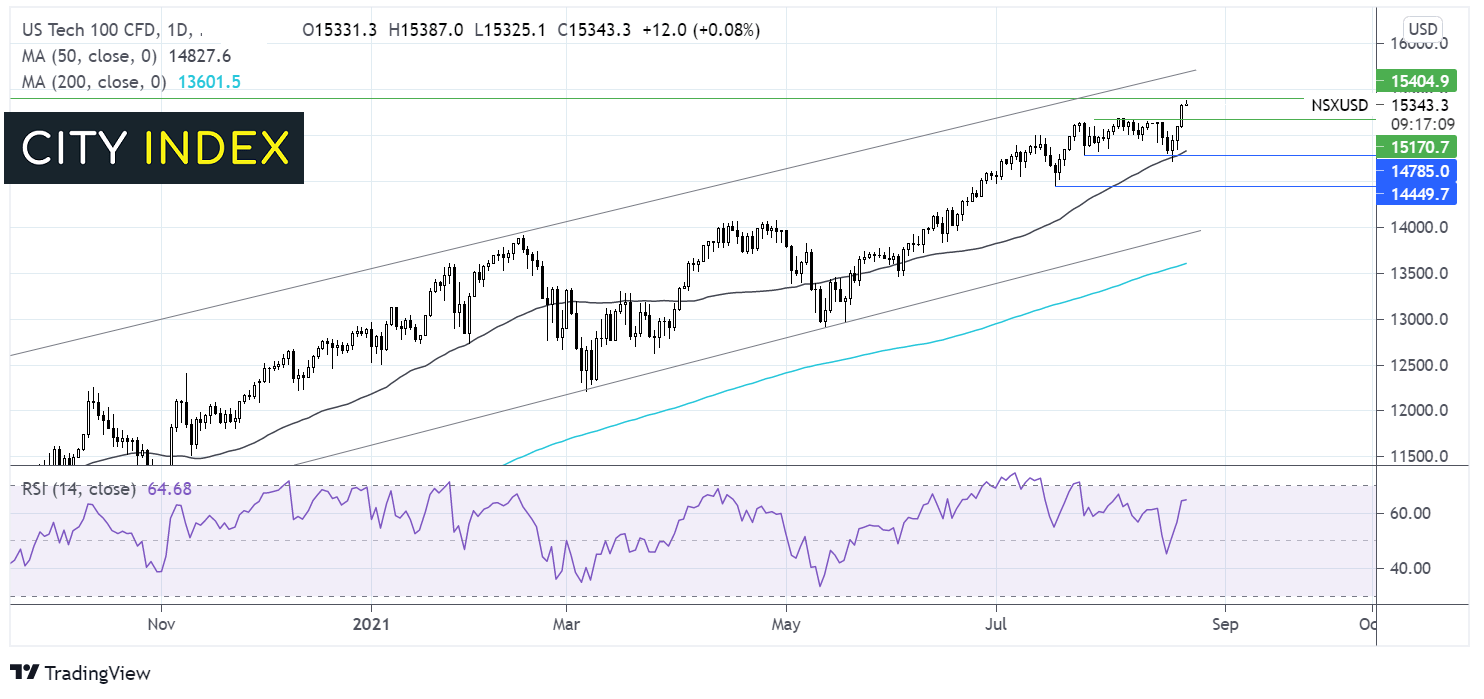

Where next for the Nasdaq?

The Nasdaq looks to fresh all-time highs. The index trades within its year long ascending channel. The index has broken out of its recent consolidation pattern in a bullish move bringing the upper band of the channel at 15700 into focus as a potential target. It would take a move below 15150 to negate the new bullish bias. A break below 14760 could open the door to 14450 the July low.

FX – USD steady after steep losses

The US Dollar is licking its wounds after steep losses in the previous session. The greenback fell sharply after the Jackson Hole Symposium was moved online due to rising covid cases. This prompted investors to ease off on bets that the Fed will tighten monetary policy sooner rather than later. Weaker than forecast PMI data further underpinned the theory.

EUR/USD holds steady in quiet trade despite German economic growth being upwardly revised. German GDP for Q2 came in at 1.6% QoQ, up from the previous estimate of 1.5%. On an annual basis GBP rose to 9.4%, up from 9.2%.

GBP/USD -0.02% at 1.3712

EUR/USD -0.06% at 1.1737

Oil extends gains on vaccine optimism

Oil prices are extending yesterday’s bounce. Oil rallied 5% in the previous session following news that the FDA gave full approval to the Pfizer covid vaccine. The move boosted optimism that more people will take the vaccine, boosting mobility and reducing the chances of further lockdowns even as covid cases rise.

China singing victory over its latest covid wave is also boosting the demand outlook.

API crude oil inventory data is due later today.

US crude trades +1.7% at $66.72

Brent trades +1.8% at $69.65

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 New Home Sales

21:30 API Crude Oil Inventories

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.