US futures

Dow futures -0.5% at 32919

S&P futures -0.4% at 3959

Nasdaq futures -0.1% at 12967

In Europe

FTSE -0.2% at 6728

Dax +0.5% at 14818

Euro Stoxx +0.5% at 3887

Learn more about trading indices

Stocks point lower as banks warn of big losses

US stocks point to a weaker start as traders brace themselves for the repercussions of a US based family hedge fund defaulting on margin.

Over-leveraged Archegos Capital Management was behind a fire sale of $20 billion in stock including Viacom, Discovery & Baidu. The move left numerous banks exposed. Credit Suisse was one of the hardest hit, and trades -13% in the European session, whilst Nomura closed -16% warning that it could face a hit of $2 billion. Both banks experienced major losses and warned of a significant hit to profits.

The Dow Jones is set to under perform the Nasdaq on the open, with the tech heavy index futures picking up off session lows.

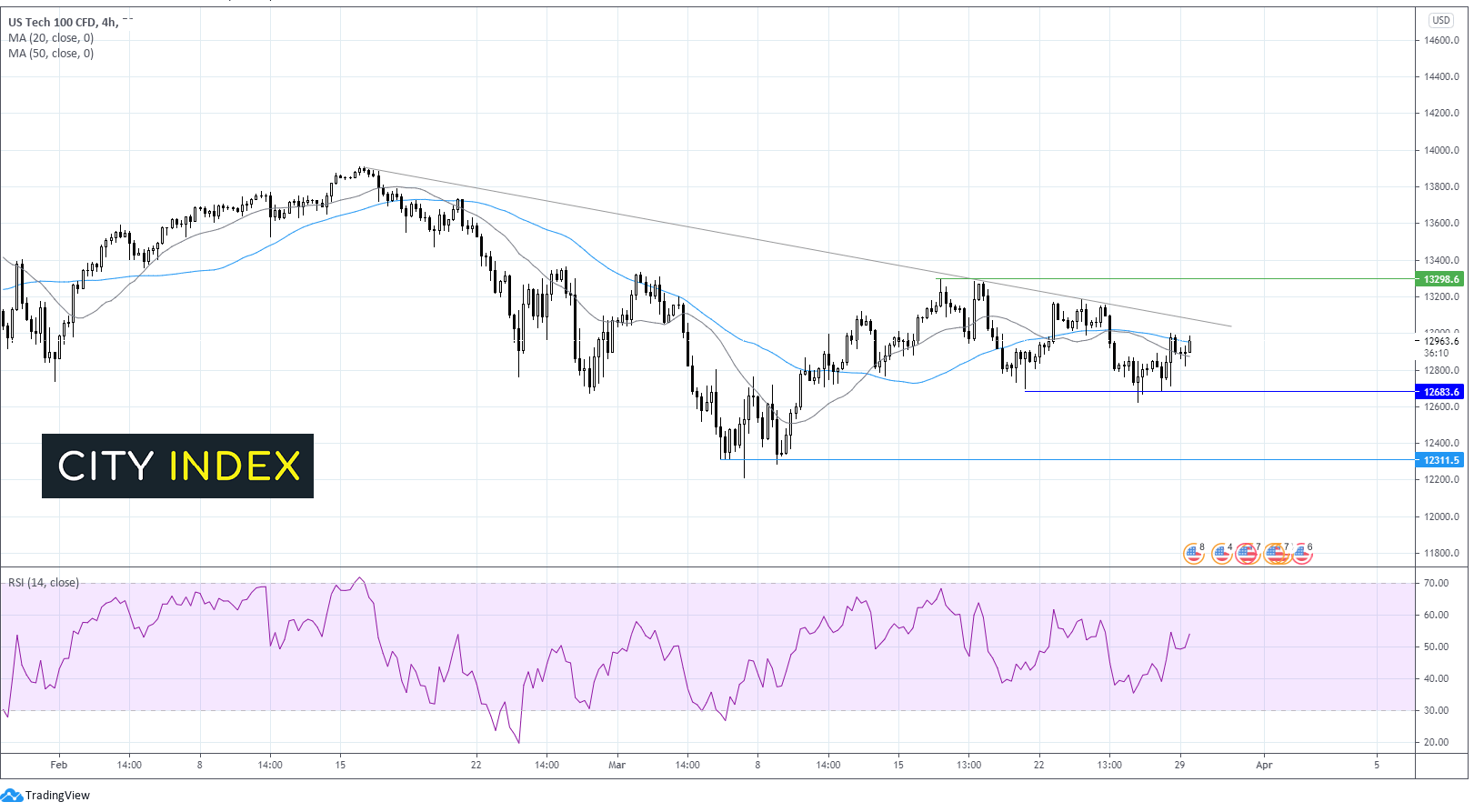

Where next for the Nasdaq?

The Nasdaq trades below its descending trend line dating back to mid February. However, it has picked up from last week’s lows around 12600. The recent long tails on the candles point to a show of strength in the price.

The price is currently testing its 50 sma resistance as 12950. A move beyond here and the descending trendline at 13000 is needed to convince more buyers in . Beyond the key resistance at 13000 bulls will look for 13300 high March 16.

On the flip side, failure to retake the 50 sma could see support tested at 12680 ahead of 12600. A move below this level could see the seller gain momentum.

Biden’s infrastructure spend

President Joe Biden is set to lay out huge new spending plans this week. Hot on the heels of the $1.9 trillion stimulus package, the Biden administration is set to reveal plans for infrastructure spending worth over $3 trillion to be split in two initiatives. The first, to be laid out this week, will focus on green energy transition, whilst the second will focus on health care and child care.

Covid cases rise in Europe, South America, India

Concerns over covid are still weighing on sentiment. Whilst the US appears to be on the right road to recovery the same can’t be said for Europe, South America or India where cases are surging. India recorded over 60,000 new daily cases, its highest level of covid cases since October last year. Meanwhile in Germany, Angela Merkel is threatening stricter lockdown conditions.

Visa to start settling with crypto

Bitcoin trades + 3% after Visa announced that it is piloting a scheme which will allow the use of USD Coin, a crypto currency to settle payment transactions in its network. USD Coin is pegged to the US Dollar in form 1:1. The move, which comes shortly after Tesla announced last week that it would accept payment in Bitcoin and adds legitimacy to cryptocurrencies.

FX – US Dollar trades at 4 month highs

The US Dollar is hovering around its 4 month high, supported by a strong US vaccine rollout and optimism surrounding the US economic recovery.

EUR/USD – trades lower sub 1.18 and is set for its worst monthly performance since July 2019 as the divergence between the US’s economic outlook and that of the Eurozone widens. Europe is experiencing a rise in covid cases, tighter lockdown restrictions and a sluggish vaccine rollout hitting demand for the common currency.

GBP/USD +0.25% at 1.3726

EUR/USD trades -0.21% at 1.1770

Oil rises, Suez Canal to re-open soon

Oil started the week on the back foot, although has since moved higher as investors continue to digest the latest developments from the Suez Canal, rising covid cases in Europe, India and South America whilst also looking ahead to the OPEC+ meeting later this week.

The container vessel which had blocked the Suez Canal for almost a week is now around 80% free. Reports that the ship has been partially freed has raised hopes that traffic, including oil supplies can resume within hours.

The news pulled oil lower in early trade. However, attention is now moving to the OPEC + meeting later this week, with the group broadly expected to keep production cuts in place.

US crude trades +1.06% at $61.66

Brent trades +1.2% at $65.25

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

There are no US macro releases today.