US futures

Dow futures -0.17% at 34237

S&P futures -0.13% at 4286

Nasdaq futures -0.09% at 14562

In Europe

FTSE -0.5% at 7050

Dax -1.25% at 15531

Euro Stoxx -0.9% at 4071

Stocks ease back from record highs

US futures trade mildly lower, consolidating at record levels in the wake of stronger than expected ADP payroll data.

The private payroll report revealed that 692k new jobs were created in June, ahead of the 600k forecast. This was down from the almost 1 million private sector jobs created in May but is still a very solid print. Businesses are still scrambling to find workers as the economy continues to re-open.

Whilst inflation remains elevated, the Fed is looking for more progress in the US labour market recovery before tightening monetary policy. So far strong ADP data hasn’t been translating into strong US non-farm payroll numbers. Usually, the two reports are positively correlated. However, that hasn’t been the case recently.

Yesterday Moderna announced that its covid vaccine was effective against the highly infectious delta variant.

Despite the good news, the market is struggling to move higher ahead of Friday’s non farm payroll report. Few are prepared to take on large bullish bets when the market hovers at all time highs ahead of Friday’s jobs report.

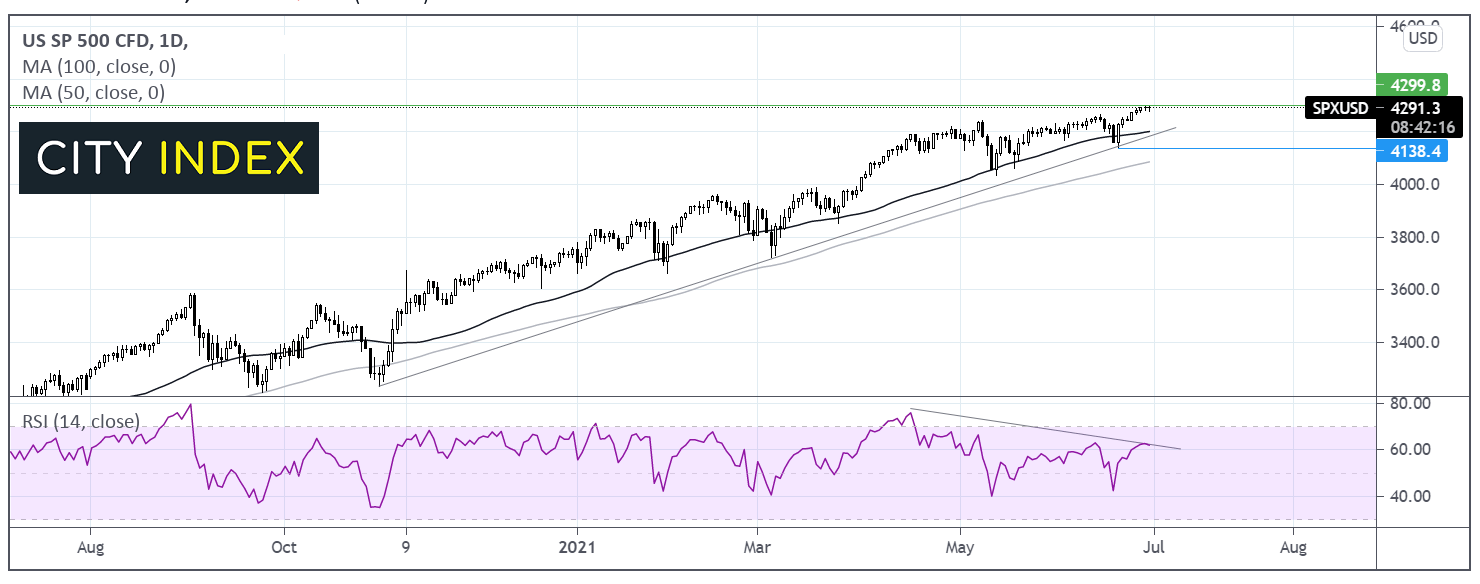

Where next for the S&P 500?

The S&P keeps grinding higher, hitting a fresh all time high of 4300 in the previous session. The index is ticking lower heading towards the open and the bearish divergence in the RSI suggests that momentum is slowing. It would take a move below 4200 the confluence of the multi-month ascending trendline, the 50 dma and horizontal support to negate the near term uptrend. Sellers could gain traction below 4138 the June 21 low. For the buyers 4300 is the target before looking for fresh all-time highs.

FX – USD holds gains, GBP rises

The US Dollar is edging higher for a sixth straight session and holding onto strong gains from the previous session. Strong US consumer sentiment numbers sent the US Dollar sharply higher.

GBP/USD has rebounded after hawkish comments from BoE’s Andy Haldane. The departing policymaker called for the unwinding of QE amid risks of surging inflation. Haldane sees inflation to be closer to 4% than 3% by the end of the year. His comments lifted the Pound, which had struggled for traction earlier in the session after the UK Q1 GDP final reading was downwardly revised to -1.6% quarter on quarter, from -1.5%.

GBP/USD +0.23% at 1.3868

EUR/USD -0.07% at 1.1888

Oil hits $75 after large inventory draw

Oil prices are bounding higher on Wednesday, extending gains for a second straight session. Both benchmarks continue to hover around two and a half year highs with Brent over $75 and WTI crude over $74.

The highly contagious Delta variant is spreading rapidly in some countries, promoting new lockdown restrictions. However, optimism surrounding a broader recovery in demand is keeping the bulls in control.

API reported a larger than expected draw on crude oil crude oil inventories of 8.2 million barrels. Attention will now turm to EIA data which is expected to show a -4.4-million-barrel draw.

Tomorrow the OPEC+ meeting begins. Expectations are growing that the group will raise production by 500,000 barrels per day, which could be comfortably absorbed into the market given the demand outlook. The OPEC sees demand rising by 6 million barrels per day in 2021, with 5 million of that coming in H2.

US crude trades +1.1% at $73.63

Brent trades +0.94% at $75.04

Looking ahead

15:00 Pending Home Sales

15:30 EIA Crude Oil Stocks