US futures

Dow futures +0.25% at 34990

S&P futures +0.4% at 4387

Nasdaq futures +0.61% at 14971

In Europe

FTSE -0.3% at 7081

Dax +0.04% at 15791

Euro Stoxx 0.11% at 4098

Learn more about trading indices

Powell in no rush to taper

US futures are heading higher following soothing words from Fed Chair Powell in his pre-prepared statement for congress later today.

Fed chair Powell insists that the economy is still a way off in terms of the progress that the Fed wants to see in order to reduce its support for the US economy. Blowout consumer and factory gate inflation are not steering the Fed off its well-rehearsed dovish path just yet.

Producer price index surged to 7.3% YoY in June, up from 6.6% in May and well ahead of the 6.8% forecast. On a monthly basis PPI rose 1%, smashing the 0.6% expected.

The surging PPI numbers came after CPI yesterday rose at the fastest clip since 2008.

Even so, Fed Powell’s words are tonic for the market, with Wall Street’s three main indices set to open higher. Despite persistently rising inflation, the market is prepared to take the Fed at its word.

Attention will remain on Fed Powell who is due to testify before Congress later today. Any hint that the Fed is getting nervous about surging inflation could quickly send stocks lower.

For now, a patient Fed and earning season kicking off has all-time highs back on the radar.

Where next for the Dow Jones?

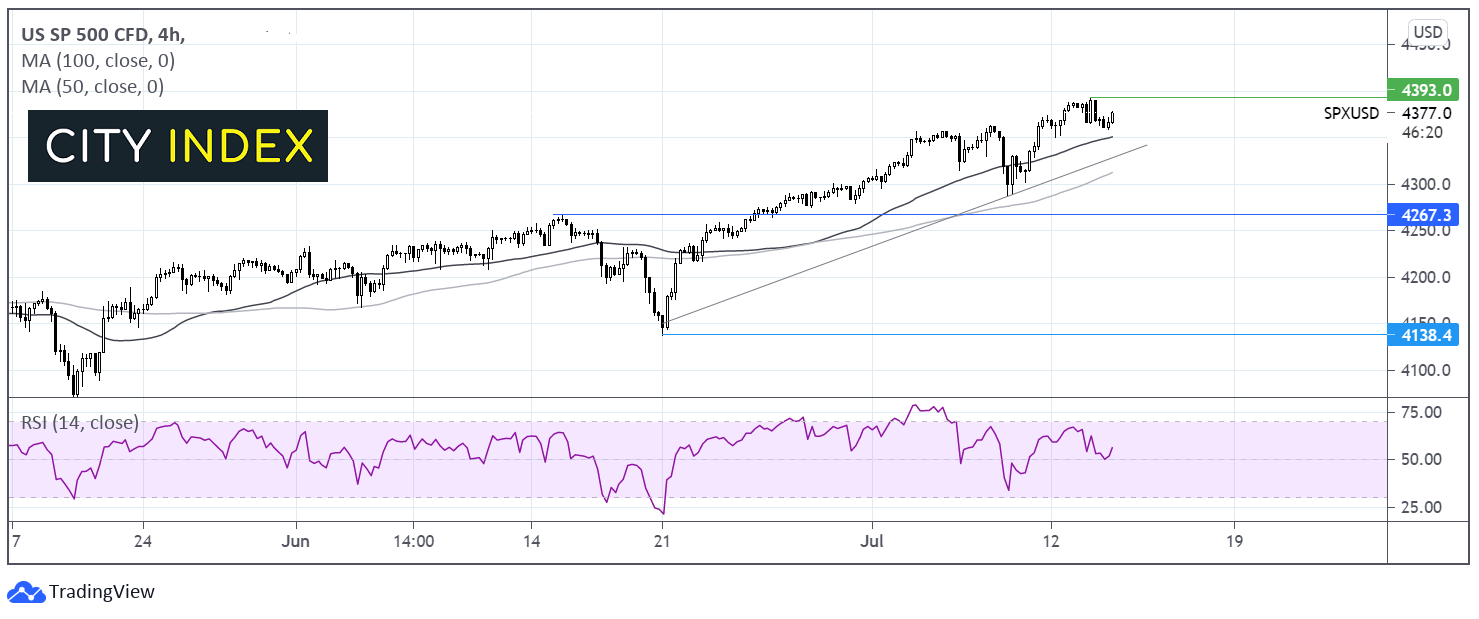

The s&p500 trades above its month old ascending trendline and above its 50 & 100 sma on the 4 hour chart ion a bullish trend. The RSI is over 50 but below 70 and pointing higher suggesting there is more upside to come. The prices need to retake 4393 in order to reach fresh all-time highs. Support can be seen at 4350 the 50 sma. A break below here could open the door to 4330 the ascending trendline support. A breakdown of this level could negate the near-term uptrend.

FX – USD eases, GBP jumps on higher CPI

The US Dollar is edging lower after hitting a 3 month in the previous session after US inflation jumped higher. Persistently high inflation raises the prospect of the Fed moving sooner to raise interest rates.

GBP/USD – The Pound is outperforming its major peers after UK CPI shot higher to 2.5% YoY in June, up from 2.1% in May. This was ahead of the 2.2% level forecast and remains above the BoE’s 2% target. The jump in inflation is boosting bets that the BoE could consider tightening monetary policy sooner.

GBP/USD +0.4% at 1.3870

EUR/USD +0.28% at 1.1809

Oil eases EIA data due

Oil prices are slipping lower after data revealed that Chinese crude imports for the first half of the year fell by 3% compared to last year. This is the first contraction since 2008 and raises concerns that surging oil prices are eroding demand.

Separately the API report revealed that crude stockpiles fell by 4.1 million barrels, slightly missing the 4.8 million draw forecast. However, this did mark the 8th straight week of falling stockpiles. Even so, oil is unlikely to push back towards multi year highs of 77.00 reached at the start of the month whilst OPEC+ are yet to agree on an output increase.

Attention will now turn to EIA stockpile data.

US crude trades -0.4% at $74.35

Brent trades -0.3% at $75.84

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 BoC Rate Decision

15:30 EIA Crude Oil Stock Piles

17:00 Federal Reserve Powell Testifies

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.