US futures

Dow futures +0.37% at 35965

S&P futures +0.36% at 4621

Nasdaq futures +0.3% at 15900

In Europe

FTSE +0.2% at 7261

Dax -0.62% at 15588

Euro Stoxx -0.47% at 4211

Learn more about trading indices

Encouraging earnings overshadow headwinds

US stocks are set to rise on the open amid optimism surrounding the economic recovery as global earnings continue to impress and European stocks hit record highs. Of the 280 S&P 500 companies that have reported 82% have exceeded expectations. Strong earnings are supporting the belief that the economy will be OK despite headwinds from rising prices, labour shortages and supply chain issues.

Stocks are looking to power higher even as inflation expectations remain high and the bets are rising that the Fed could move to hike rates sooner. Comments by US treasury secretary Janet Yellen, who expressed confidence in the economic recovery from the pandemic is also helping sentiment.

Attention will now turn to US manufacturing PMI which is expected to ease slightly in October but remain firm at 60.5.

Separately Biden’s economic agenda appears to be on track as Democratic law makers look to overcome difference and head for a vote on Tuesday on both the $1 trillion bipartisan infrastructure bill and the $1.85 trillion social safety net and climate bill.

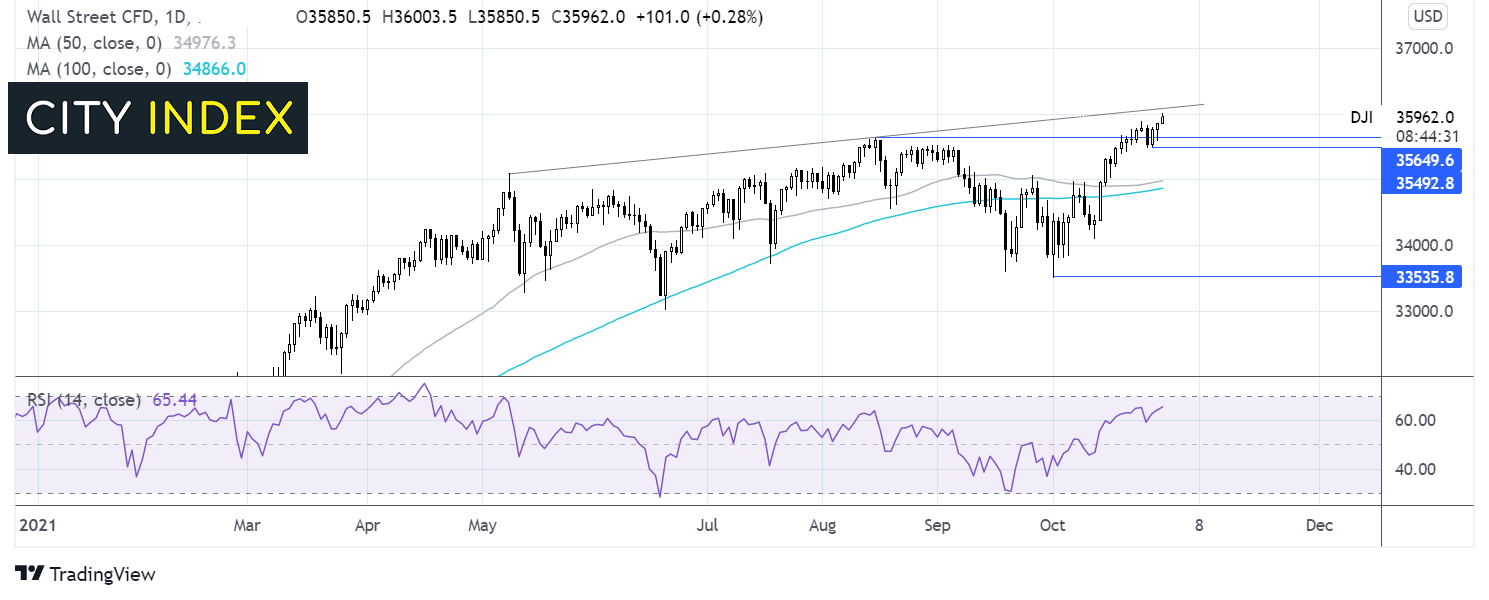

Where next for Dow Jones?

The Dow Jones is extending its rebound from 33500 to fresh all-time highs. The price continues to hold above the previous all time high of 35630 and the RSI points to further gains whilst it remains out of overbought territory keeping buyers optimistic. Possible resistance could bee seen around 36150 the rising trendline. A fall below 35630 could see 35500 tested. A fal below here would negate the near term up trend. A fall below 35000 the 50 sma could see sellers gain traction.

FX – USD hold gains, GBP hit by Brexit

The US Dollar is edging a few pips lower but holds on to most of Friday’s gains. The USD jumped higher following the release of core PCE data on Friday which hit a 30 year high at 3.6%. The data prompted a sooner move by the Fed to hike rates.

GBP/USD is underperforming amid rising Brexit tensions, with headlines going from bad to worse. As the UK – French fishing row escalates. UK manufacturing PMI was revised higher to 57.8 from the flash reading of 57.7, prices rocketed higher.

GBP/USD -0.22% at 1.3663

EUR/USD +0.12% at 1.1576

Oil resumes uptrend

Oil prices are resuming their uptrend after losing ground last week for the first time in 9 weeks. Whilst WTI dipped just 0.2%, last week, those losses have already been pared.

The demand outlook remains strong for oil ahead of the OPEC + meeting later this week. The oil cartel is not expected to raise output further despite pressure rising from leaders such as Joe Biden to do so. Members Kuwait and Iran have voiced their support to keep output as it is.

Gains in oil are being capped by news that China has released gasoline and diesel reserves to increase market supply.

WTI crude trades +0.1% at $82.99

Brent trades +0.47% at $84.01

Learn more about trading oil here.

Looking ahead

14:00 ISM Manufacturing PMI

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.