US futures

Dow futures +0.7% at 34667

S&P futures +0.4% at 4340

Nasdaq futures 0.01% at 14725

In Europe

FTSE +0.7% at 7081

Dax 1.% at 15566

Euro Stoxx +1.3% at 4045

Learn more about trading indices

Dow leads recovery, Nasdaq lags

US stocks are set to rebound on the open after steep losses in the previous session. The overall outlook remains upbeat, particularly with regards to corporate earnings which are drawing into focus as the US banks kick off earnings season next week.

Covid cases are on the rise, particularly in Asia, but for now that is not going to derail the rally. Yesterday’s selloff looks to be more of a technical pullback rather than owing to serious fundamental changes to the outlook.

On the virus front, Pfizer plans to request emergency authorization for a third booster dose of its covid vaccine, which is believes will be more effective against the Delta strain.

The Nasdaq set to lag behind its peers, with futures just breaking even. Big tech are coming under pressure after reports emerged that President Biden is encouraging regulators to re-instate Obama era rules on net-neutrality. This would encourage competition within certain sectors of the US -economy.

There is little in the way of data for investors to sink their teeth into. The Fed’s monetary policy report could attract some attention.

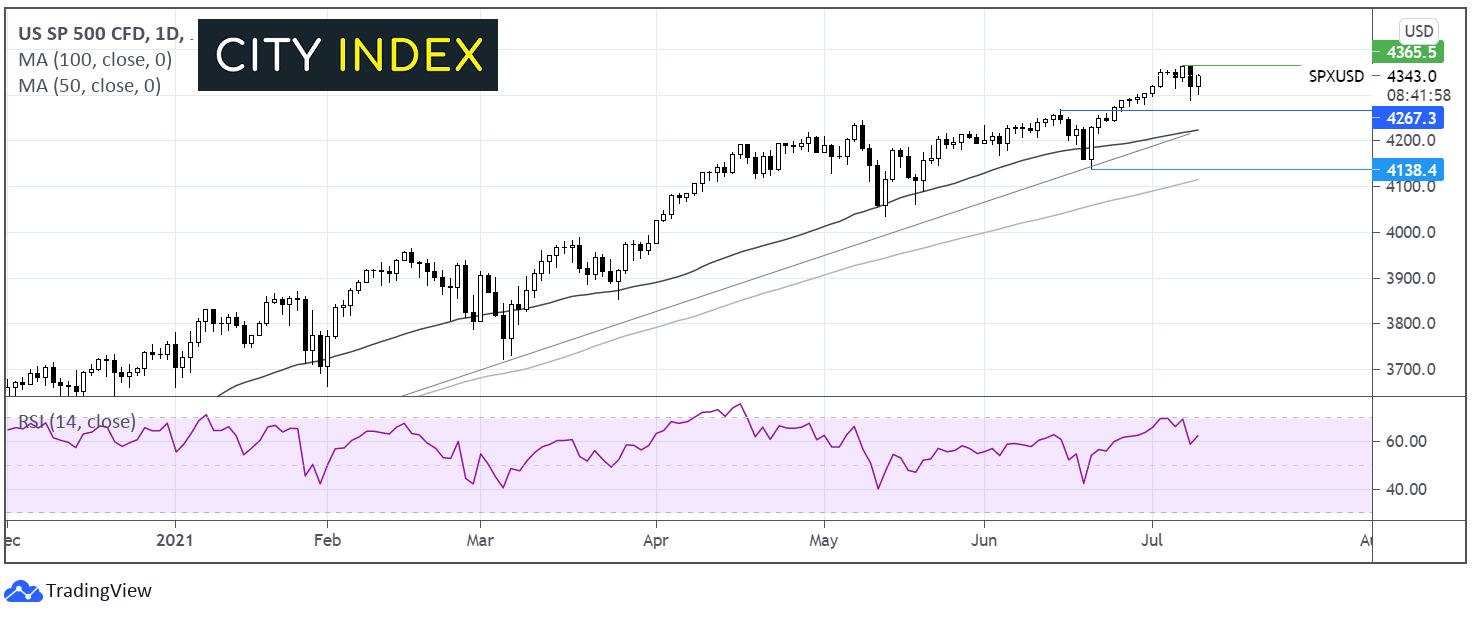

Where next for the S&P500?

The S&P500 is once again on the rise, yesterday’s selloff hasn’t even hit the sides of the rally. The pullback to a low of 4288 didn’t even bring the 50 sma into play. The RSI is in positive territory and pointing higher, suggesting that there could be more upside to come. Buyers need to break above 4360 to reach fresh all time highs. Sellers need a move below 4270 to negate the near term up trend. A fall below 4210 could see the sellers gai traction.

FX – GBP shrugs off weak GDP data

The US Dollar is edging lower despite both treasury yields and stocks rising.

EUR/USD -The pair is capitalizing on the weaker US Dollar. ECB president Christine Lagarde didn’t rock the boat in a speech today and there were no surprises in the minutes from the ECB meeting.

GBP/USD is rebounding from a deep selloff in the previous session shrugging off weak GDP data. UK GDP MoM in May rose 0.8% short of the 1.5% forecast. This was also down from April’s 2% GDP growth suggesting that growth was starting to slow even as the reopening was in full swing.

GBP/USD +0.24% at 1.3820

EUR/USD +0.1% at 1.1856

Oil extends rebound

Oil prices are rebounding for a second straight session following crude stockpile data. The data revealed that stock piles declined by 6.69 million barrels in the week ending 2 July, taking inventories to the lowest level since February last year, before the pandemic.

This is the seventh straight week of declining inventories and adds to evidence that demand is rising economies and the US driving season ramps up.

That said oil prices could struggle to retake recent multi year highs whilst the OPEC+ disagreement persists. With Saudi Arabia and UAE failing to see eye to eye over output increases the prospect of a price war for market share still exists.

Oil is set to decline 2.5% across the week

US crude trades +0.1% at $73.26

Brent trades +0.8% at $74.51

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 US Whole sales inventories

17:00 Fed Monetary Policy Report

18:00 Baker Hughes Rig Count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.