US futures

Dow futures +0.23% at 35677

S&P futures +0.1% at 4554

Nasdaq futures -0.22% at 15453

In Europe

FTSE +0.65% at 7233

Dax +0.8% at 15600

Euro Stoxx +1.00% at 4199

Learn more about trading indices

Nasdaq slips as Snap & Intel disappoint

US stocks are set to open mixed with the tech sector under pressure and the tech heavy Nasdaq under performing its peers.

The Dow Jones has extended its rebound off the 200 day moving average at the start of the month and powered to fresh all time highs. The Nasdaq on the other hand, trades 1.5% off that record level. A double whammy of bad news for the tech sector could well mean that record highs are out of reach for now.

Intel have tumbled 10% pre-market after disappointing Q3 sales. Component shortages are hampering sales of the semiconductor’s flagship chip processor. Adding to the bad new the chipmaker predicts lower margins for years to come. The depressing update left investor little choice but to jump ship.

Separately big names such as Facebook and Alphabet were also tanking lower following earnings from SNAP. Whilst EPS beat forecasts at 17c vs 8c expected, revenue fell short of expectations at $1.07 billion vs $1.10 billion forecast. SNAP blamed the impact from Apple’s privacy changes. Few companies were willing to spend big on advertising without the comfort of underlying analytics.

Despite weakness in tech, overall earnings have been upbeat contributing to the risk on mood in the market.

Looking ahead Federal Chair Jerome Powell is due to speak and investors will be watching closely for clues on when the Fed might start raising monetary policy. October PMI data will also be under the spotlight.

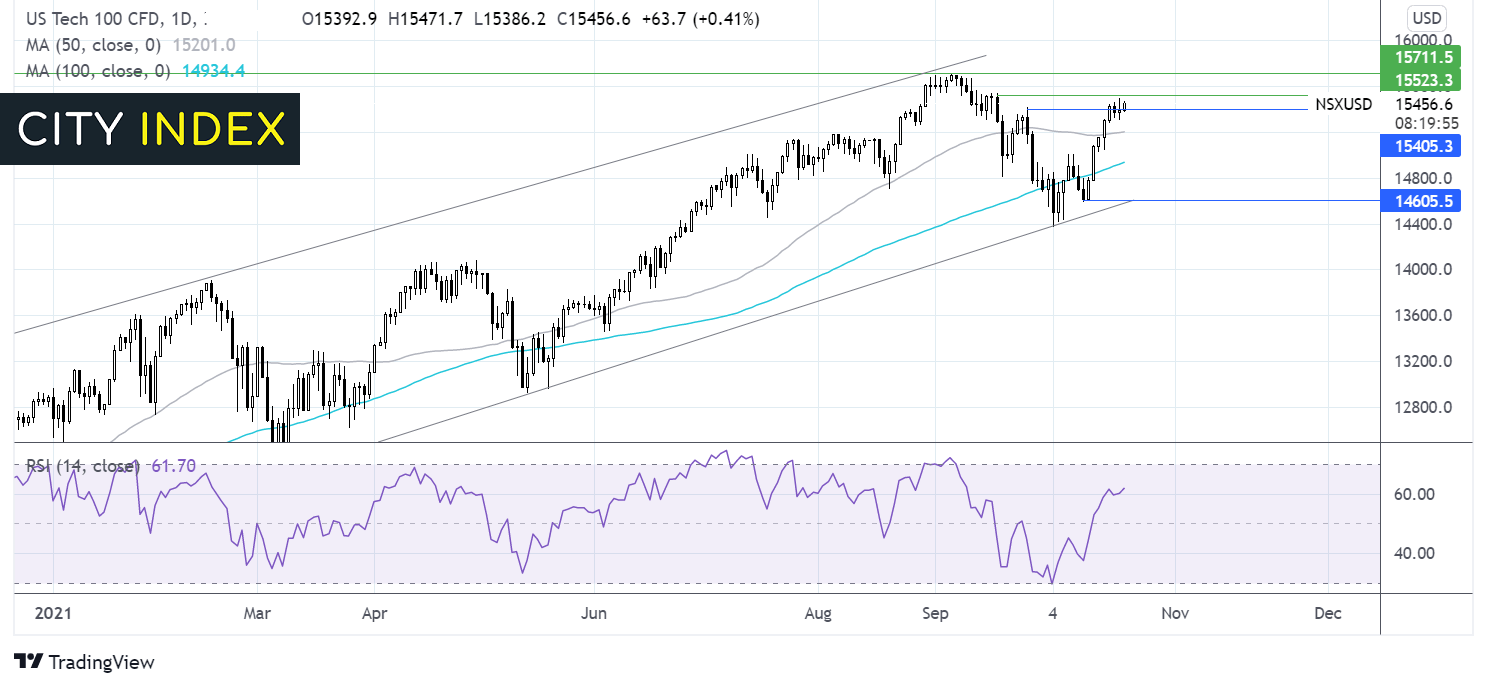

Where next for the Nasdaq?

The Nasdaq extended its rebound from the rising trendline support pushing back over its 100 sma and 50 sma. The retaking of resistance at 15400 and the bullish RSI keeps the buyer optimistic of further upside toward 15500 the weekly high and on to 15700 and fresh all time high. A fall below the 50 sma at 15200 could negate the near term uptrend. A move below 14600 could see sellers gain traction.

FX – EUR capitalizes on weaker USD

The US Dollar is falling on safe haven outflows. The upbeat mood in the market after solid PMIs in Europe and Evergrande narrowly missing default are dragging on demand for the greenback.

GBP/USD is struggling to gain ground after retail sales disappointed, unexpectedly declining -0.2% MoM, analysts had forecast a 0.5% rise. However, both services and manufacturing PMI data beat forecasts in September, despite supply chain issues.

EUR/USD is gaining, capitalizing on the weaker USD and finding support from better than forecast composite PMI data which only ticked mildly lower in October to 58.5, from 58.6 in September. German industrial production was encouraging strong.

GBP/USD -0.02% at 1.3800

EUR/USD -0.14% at 1.1640

Oil set for 9th straight week of gains

Oil prices are paring earlier losses and pushing higher on Friday. Oil trades around multi-month highs and is set to book its 9th straight week of gains.

Prices remain well supported by concerns over high coal nd has prices and shortages of these commodities in China, India and Europe which have prompted some power generators to switch to using oil.

However, winter is expected to be warmer than usual in the US and China is planning on intervening in the coal market to bring down prices, which is keeping a lid on gains in oil.

Looking ahead US Baker Hughes rig count data is due to be released.

WTI crude trades +0.67% at $82.93

Brent trades +0.6% at $84.70

Learn more about trading oil here.

Looking ahead

14:45 US manufacturing & services PMI

17:00 Baker Hughes rig count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.