US futures

Dow futures -0.4% at 33943

S&P futures -0.4% at 4140

Nasdaq futures -0.3% at 13863

In Europe

FTSE -1.3% at 6911

Dax -1% at 15223

Euro Stoxx -1.13% at 3970

Learn more about trading indices

US stocks ease lower after record gains on covid concerns

US futures are pointing to a weaker start for a second straight session following a series of record highs across the previous week.

Concerns are rising that the spread of covid outside of the US could hinder the global economic recovery and drag on guidance from US companies as they report – particularly multi-nationals.

Even with these mild loses, stocks are still hovering around record highs. Investors will want to see strong number but also solid guidance to validate these levels. Any sense that the outlook isn’t as rosy could hit sentiment.

Stocks in focus this session will include IBM whose revenue grew for the first time in 11 quarters. In addition to Tesla and Peloton which continue to face questions over safety issues.

Earnings from Johnson & Johnson, Procter and gamble are due. Netflix will report after the close where investors will want to see whether the streaming giant can keep new subscribers rolling in.

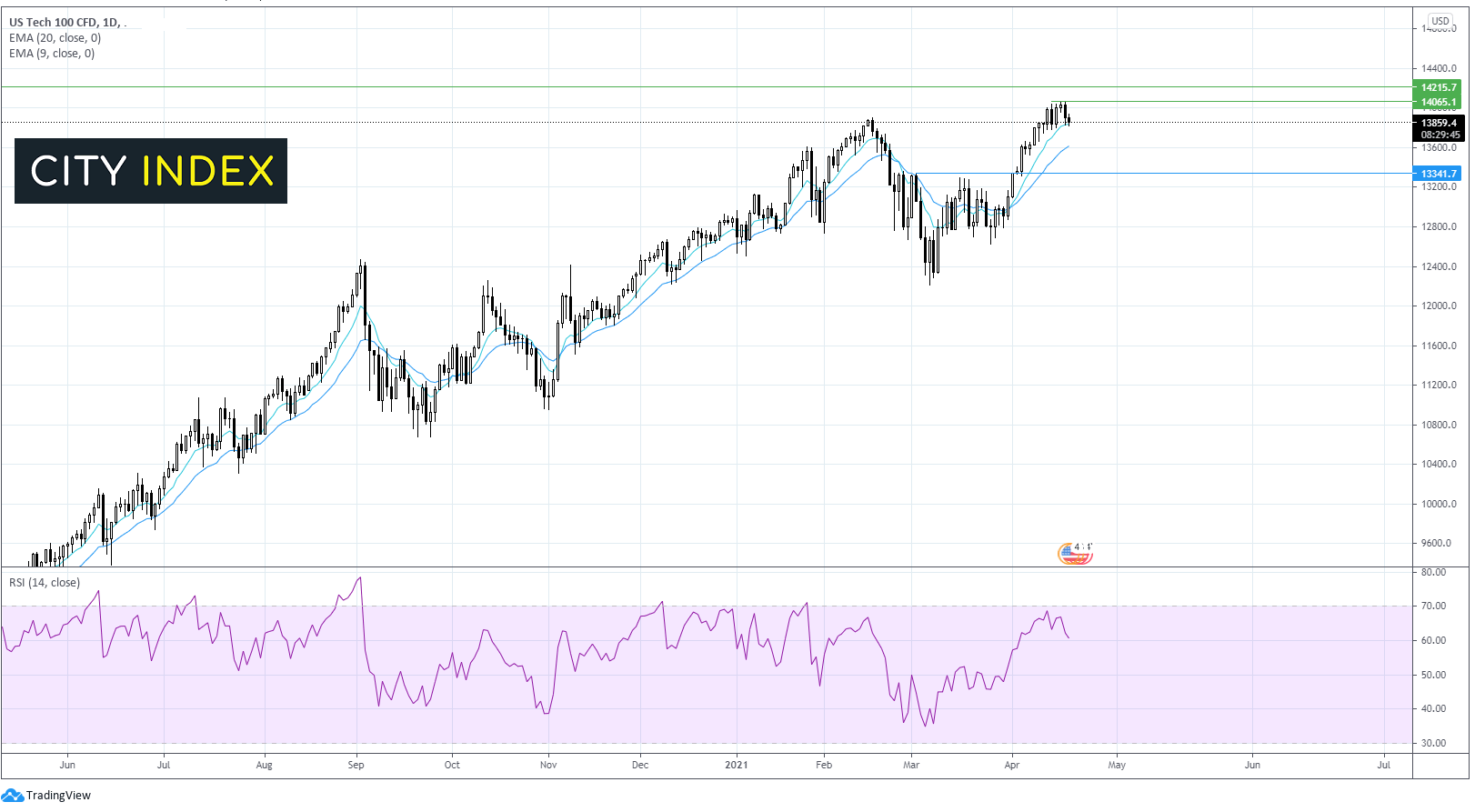

Where next for the Nasdaq?

The tech heavy Nasdaq, like its US peers looking overextended at the end of last week. The RSI almost tipped into overbought territory, but the bearish divergence suggests that the rally had run its course.

Today’s slight pull back sees the price testing the 9 EMA on the daily chart at 13840, the support is holding for now with the Nasdaq futures at 13870. A break through this support could open the door to 13590 the 50 EMA and 13340 resistance turned support from late February.

On the flip side, should 13840 hold, any recovery would look to taget 14060 the recent all time high.

FX – US Dollar rebounds

US Dollar is rebounding as treasury yields fall in a reverse of the relationship that was seen over the first three months of the year.

GBPUSD trades under pressure after a mixed labour report. Unemployment unexpectedly dipped lower to 4.9% in the three months to February, down from 5% in January. Analysts had expected unemployment to rise to 5.1%. The drop in unemployment rate is more likely due to a rise in the number of people who had exited the jobs market altogether as the inactivity rate rose by 0.2%.

EURUSD the euro is holding up well as the outlook for the EU vaccine programme pick after the EU secured 100 million additional Pfizer vaccine doses.

GBP/USD -0.03% at 1.3981

EUR/USD +0.16% at 1.2056

Oil pauses as covid concerns return

Oil prices continue to trade in positive territory, although have slipped back from session highs of $64.37 as the US Dollar has rebounded. The falling USD has offered support to oil prices, making it cheaper for buyers with other currencies.

Oil prices also remain supported by the expectation of falling crude inventories as the US demand grows amid the reopening of the economy. However, risks are also growing relating to rising covid cases in India, the third largest oil importer in the world. Tighter lockdown restrictions could see demand drop off rapidly.

US crude trades +0.33% at $63.63

Brent trades +0.45% at $66.88

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

21:30 API weekly crude stockpiles

02:30 Australia retail sales