US open: All eyes on Biden’s infrastructure proposal

US index futures:

- Dow futures -0.1% to 32,909

- S&P 500 futures +0.1% to 3,953

- Nasdaq 100 futures +0.6% to 12,957

European indices:

- FTSE -0.1% to 6,762

- Dax +0.0% to 15,009

- Euro Stoxx 600 +0.2% to 432

US indices pointing to a tepid open

US stocks are pointing to a mixed start as traders weight the continued strength in treasury bond yields (a close near the current 1.73% level in the benchmark 10-year yield would mark the highest since January 2020) against better-than-expected Chinese manufacturing data overnight (51.9 vs. 51.3 expected).

As of writing, the US ADP employment report has just been released, showing 517k jobs were created, a tick below expectations of a 552k reading after last month’s upwardly-revised 176k figure. This report paints a potentially bullish picture ahead of Friday’s highly-anticipated NFP report.

Biden’s stimulus plan

The biggest development to watch today will be high-level proposals in US President Biden’s infrastructure plan. The proposal is expected to come with a $2T price tag to revitalize U.S. transportation infrastructure, water systems, broadband and manufacturing, among other goals. This represents just the first of two infrastructure bills, with a second, more partisan proposal focused on “human infrastructure” (read: education and health care reforms) expected in the coming weeks.

Of course, politicians try to avoid outright deficit spending, so the bill is expected to come with an increase in the corporate tax rate and attempts to close loopholes around “offshoring” corporate profits, a development that may hurt technology companies more than other firms if passed.

US stocks in focus

Chewy (CHWY) earned a surprise profit of $0.05 per share, well above expectations of a $0.10 loss, with revenue surging 47% y/y. The stock is trading up more than 13% in pre-market trade.

Marijuana stocks like Tilray (TLRY), Canopy Growth (CGC), Aphria (APHA), and Aurora Cannabis (ACG) are all on the rise in pre-market trade on news that New York State would become the 15th state to legalize recreation use of the drug.

Apple (AAPL) was upgraded to “buy” at UBS on expectations of more stable long-term iPhone demand. The stock is trading up nearly 2% in pre-market trade.

Where next for Chewy share price?

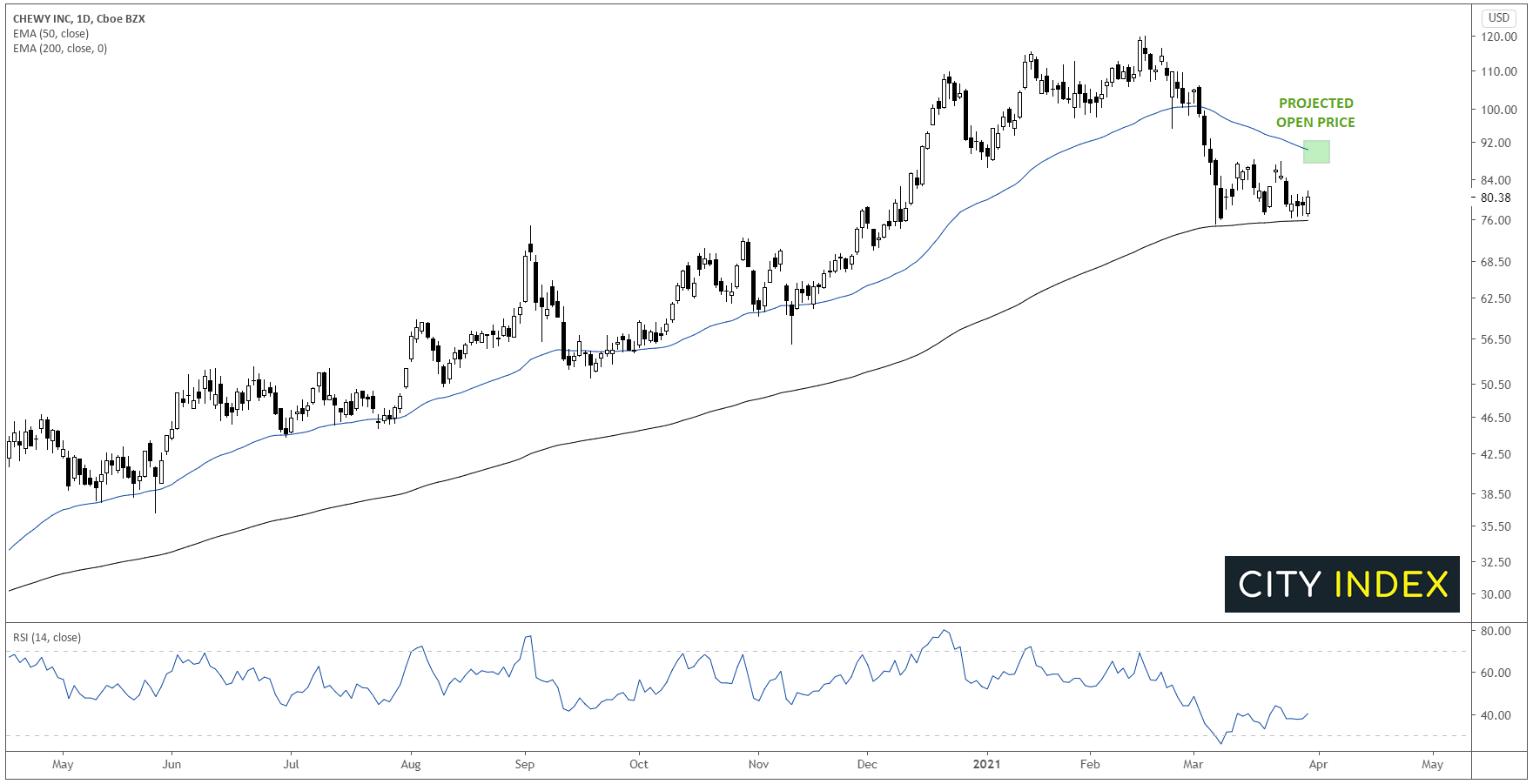

After seeing a sharp drop in February to test its 200-day EMA, Chewy (CHWY) is poised to open near its 50-day EMA near $91.00. The stock’s RSI indicator has been showing a bullish divergence over the last couple of weeks, signaling that selling pressure was waning even before yesterday’s strong earnings report, so bulls will want to see if the stock can re-establish a foothold above 91.00 to open the door for a potential continuation back into triple-digit territory in the coming weeks:

Source: StoneX, TradingView

FX – Quiet with a dash of yen weakness

The FX market is seeing a relatively quiet end to the quarter, with the day’s most notable development being the slight weakness in the Japanese yen.

EUR/USD is stabilizing above its nearly 6-month low at 1.1700, though market’s bias remains to sell any near-term bounces in the pair for now.

GBP/USD is in the middle of this week’s range at 1.3766.

USD/JPY is extending its rally for a 6th straight day to approach the 111.00 handle.

Learn more about forex trading opportunities.

Oil steady ahead of tomorrow’s big OPEC+ meeting

Oil is ticking up in slow trade ahead of tomorrow’s highly-anticipated OPEC+ meeting. The group is expected to leave production unchanged as COVID variants force lockdowns in a number of major markets, but there is risk of increasing production if the different blocs within the cartel are unable to reach an agreement, as we saw at this time last year.

Attention will now turn towards the API stockpiles data due later today.

- US crude trades +0.3% to $60.55

- Brent trades +0.2% at $64.04

Looking ahead

14:00 GMT – US Pending Home Sales

14:30 GMT – Crude Oil Inventories