US Listed Chinese Concept Stocks: The Two Struggling

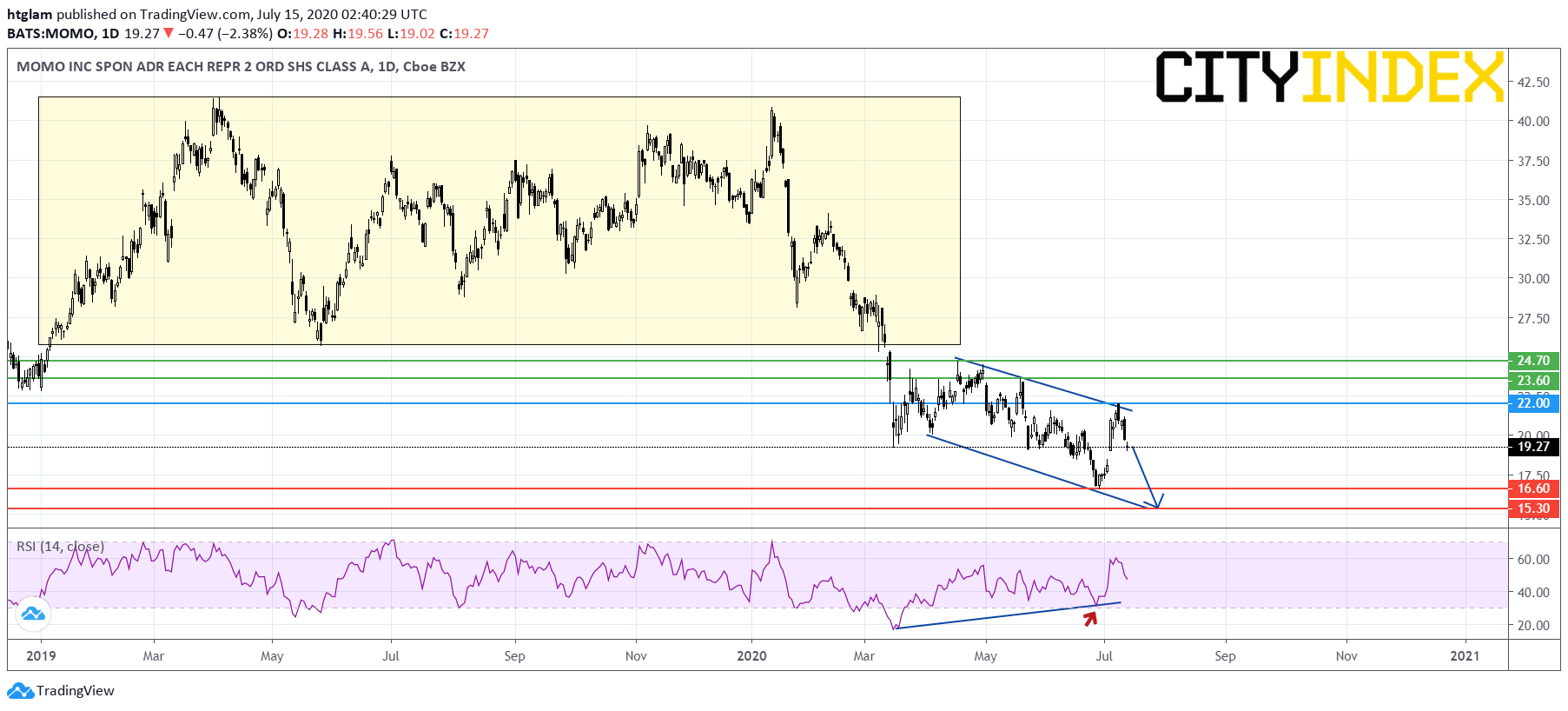

Weibo (WB): Downtrend Intact

Source: TradingView, Gain Capital

Weibo (WB), a Chinese microblogging website, remains on the downside as shown on the daily chart. Despite a recent rally, it is capped by a bearish trend line drawn from April last year. The level at $40.40 might be considered as the nearest resistance, with prices likely to retreat to the 1st and 2nd support at $32.50 and $28.90 respectively. Alternatively, a break above $40.40 would suggest an upturn and trigger an advance to the next resistance at $45.80.

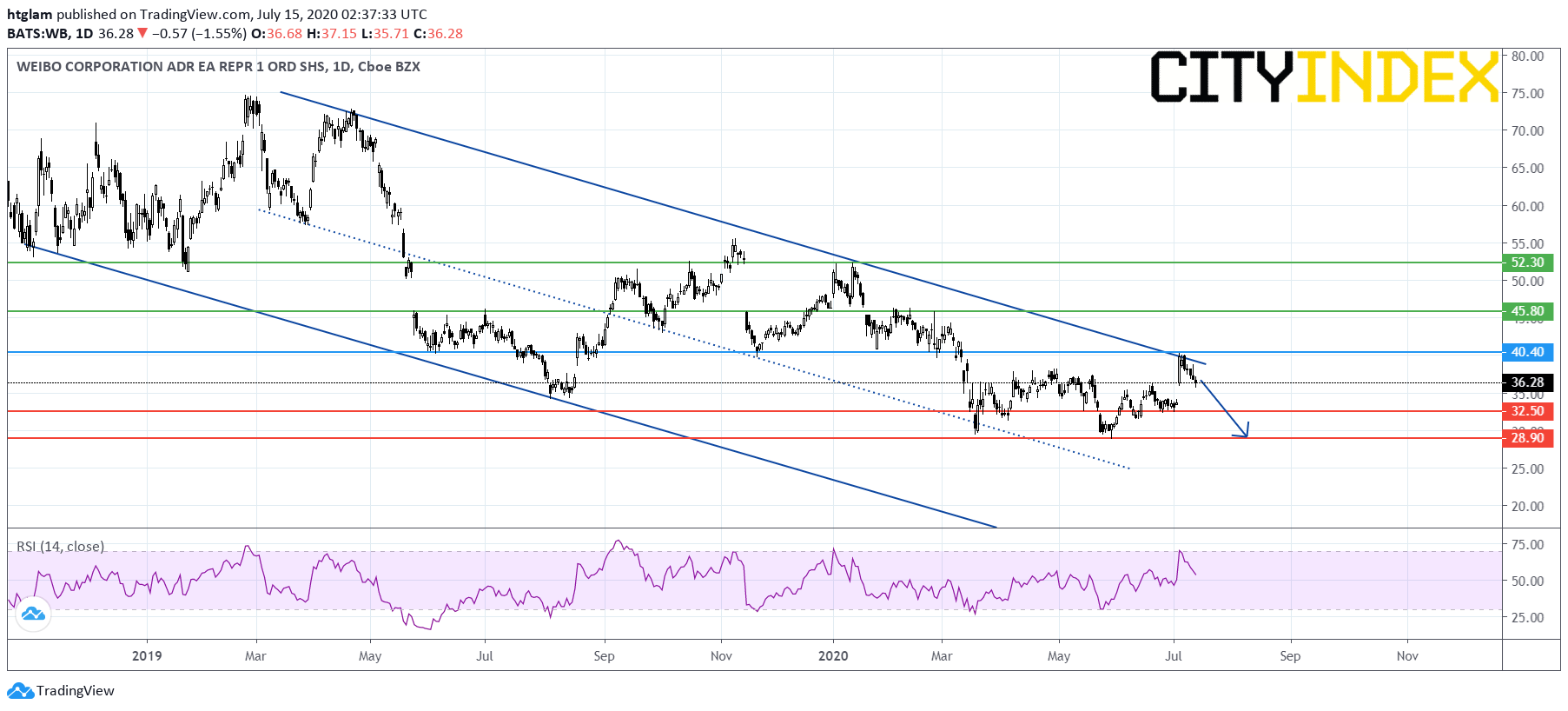

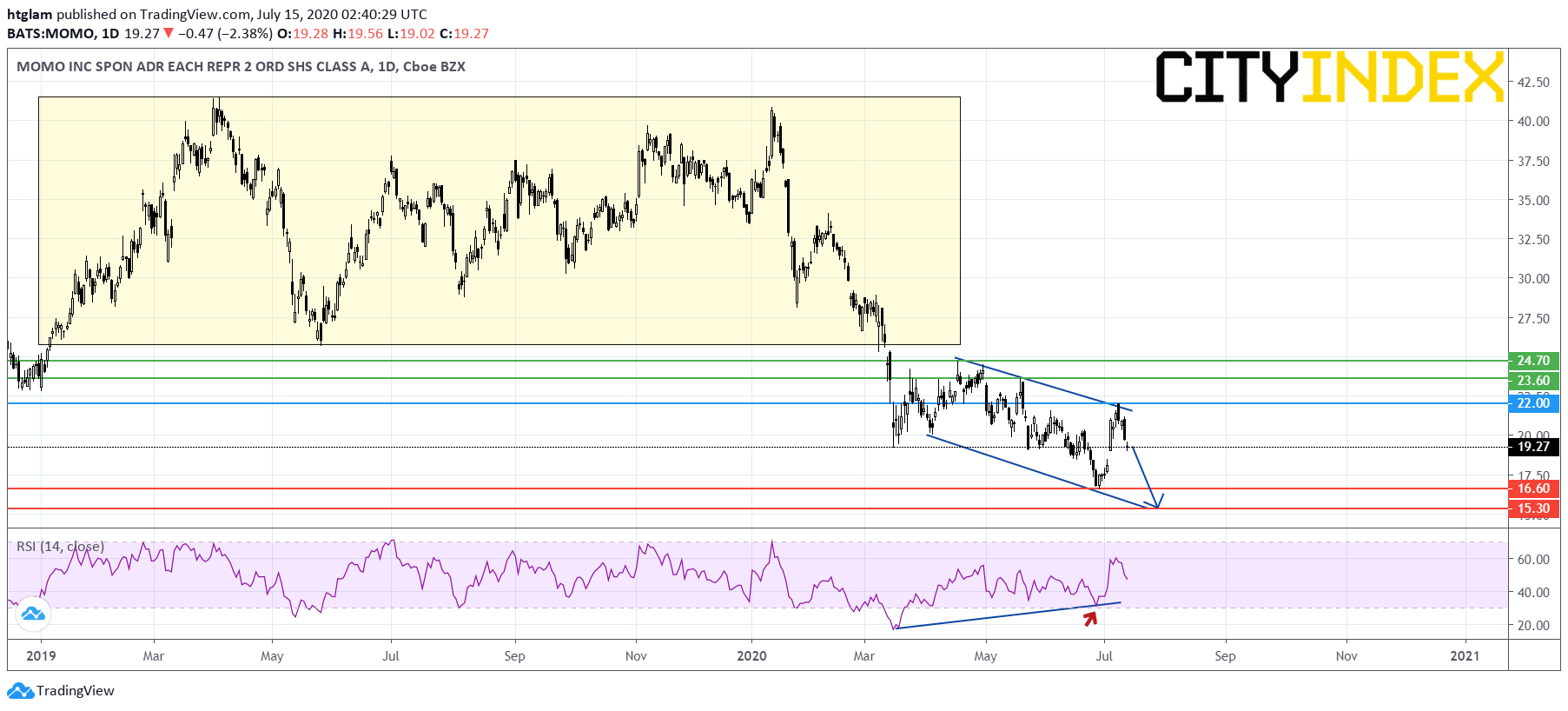

Momo (MOMO): Lack of Strong Bullish Reversal Signals

Source: TradingView, Gain Capital

Momo (MOMO), a mobile-based social networking platform, has yet to show a strong enough bullish reversal pattern. Despite the fact that there is a daily RSI bullish divergence, it remains capped by a declining trend line drawn from April. Unless the key resistance at $22.00 is surpassed, prices risk breaking the nearest support at $16.60 and drop further to test the next support at $15.30. Alternatively, a break above $22.00 might trigger a further rebound to the next resistance at $23.60.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM