Headlines

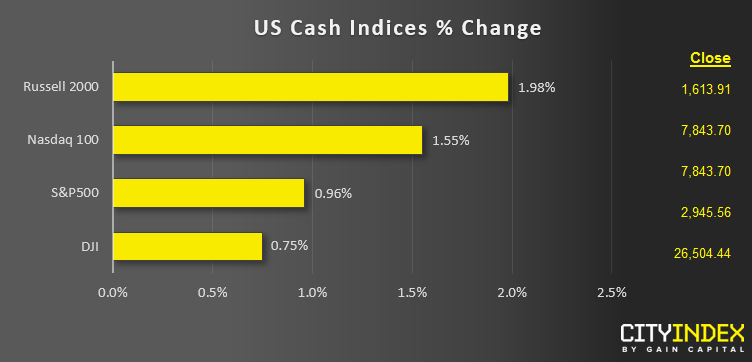

- US indices rallied across the board to unwind Wednesday’s Fed-driven losses, with most US indices gaining around 1%.

- All eleven major sectors rallied on the day, led by energy (XLE) stocks. Health care (XLV) was the weakest sector today but nonetheless gained 0.6%.

- US Non-Farm Payrolls (April) printed at 263k, well above estimates of 181k, and the unemployment rate dropped to 3.6%, its lowest level since 1969. However, average hourly earnings rose at only 0.2% m/m (3.2% y/y), a tick below consensus estimates.

- In corporate news, newly-public Lyft (LYFT) and Disney (DIS) report earnings next week. BYND managed to eek out a small gain after exploding higher by 160% on its IPO yesterday.

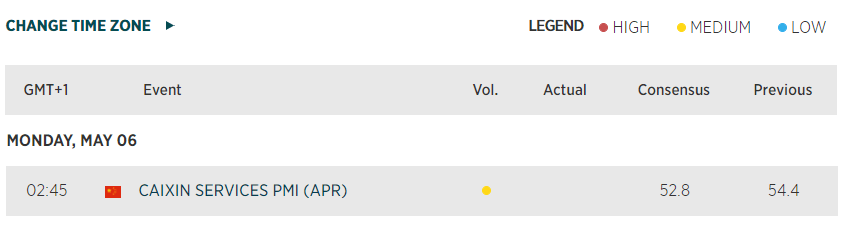

- Japan will remain on holiday Monday for Children’s Day, likely leading to more low liquidity trade in the Asian session to start next week.

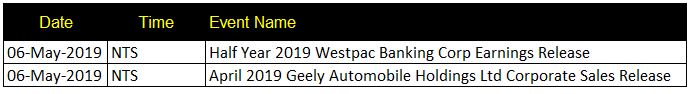

Corporate Event Calendar (Asia)

NTS = No Time Specified

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM