Headlines

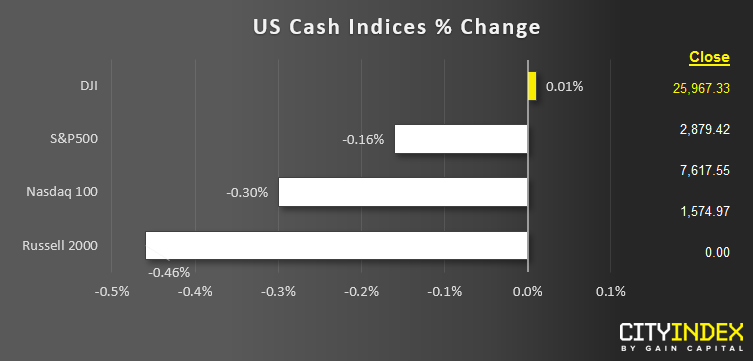

- US indices closed mixed on the day as traders remained cautious ahead of US-China trade talks in Washington DC over the next two days, with the potential for some crazy-looking tariffs on looming.

- Among the major sectors, health care stocks (XLV) were able to grind out a small gain, while utilities (XLU) were the weakest major sector.

- Trump tweets that China’s Vice Premier Liu He is coming to the US “to make a deal,” boosting hopes of a potential trade deal this week (and by extension, risk assets). That said, traders are cautious after a Reuters report that China backtracked on all of its previous trade commitments.

- Walt Disney Company (DIS) beat earnings at $1.61 vs. $1.58 eyed, as well as reporting stronger-than-expected revenues ($14.92B vs. $14.36B eyed).

- Beyond Meat experienced its first down day since Thursday’s IPO, closing lower by nearly 9% today.

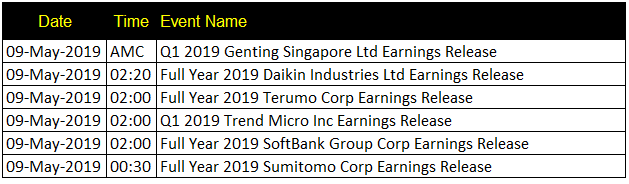

Corporate Calendar

AMC = After market close

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM