Headlines

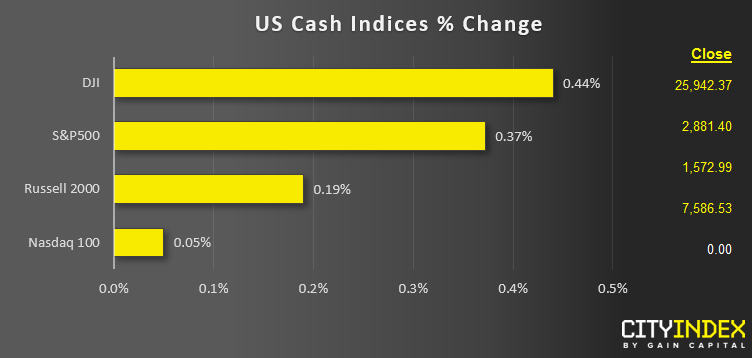

- US indices shrugged off morning losses to close higher on the day.

- All eleven major sectors closed higher. Utilities (XLU) led the way with a nearly 2% gain while health care stocks were the laggards, finishing essentially flat on the day.

- US-China trade talks dissolved with no deal, though parties described the discussions as “constructive” and having went “fairly well.” Chinese media reports that the two sides will meet again in Beijing in the coming weeks.

- The US reported slightly softer-than-expected CPI figures (2.0% y/y), but “core” CPI, which filters out more volatile food and energy prices, rose 2.1% as expected.

- Uber (UBER) stumbled out of the gate on its IPO, closing at 41.40, below even its (subdued) initial offering price. Rival LYFT dumped over 7%.

- Real estate database Zillow (ZG) rallied 5.5% after reporting “triple play” earnings (beat earnings estimates, beat revenue estimates, and raised guidance) yesterday

Corporate Calendar

NTS = No Time Specified

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.