US Equity Handover: Stocks Close Flat as BYND Dumps on Downgrade

Headlines

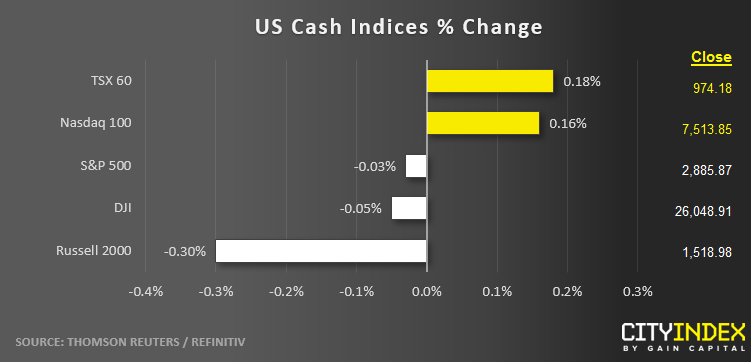

- US indices oscillated in and out of positive territory today, ultimately closing essentially flat across the board.

- The Nasdaq 100 may stand to benefit from a possible thaw in US-China trade talks.

- Communication Services (XLC) was the strongest sector on the day; Utility stocks (XLU) were the weakest group.

- US PPI came in at +0.1% m/m (+1.8% y/y), a tick below expectations. Tomorrow’s US CPI report will be a key release in setting expectations for whether the Fed may cut interest rates either next week or at its July meeting.

- Beyond Meat (BYND) was downgraded by JP Morgan, taking the high-flying stock down 25%. At $126, it’s still up 400% from last month’s IPO price of $25.

*There are no high-impact corporate announcements expected during tomorrow’s Asian session.*

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM