Headlines

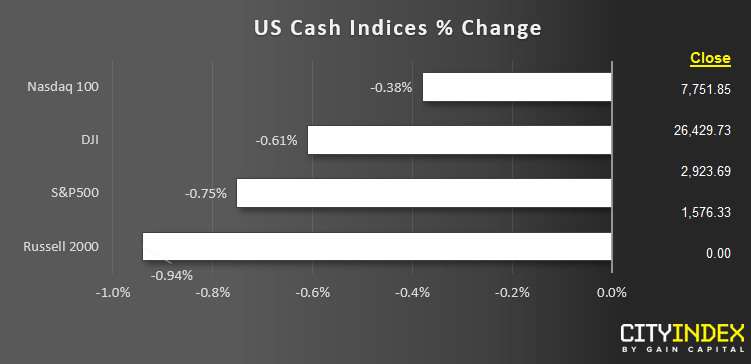

- US indices pulled a U-turn in the afternoon, with most indices closing more than 0.5% lower despite better-than-expected earnings out of Apple (AAPL).

- Among the major sectors, technology (XLK) edged higher, while materials (XLB) and energy (XLE) stocks shed more than 1% on the day.

- The Federal Reserve left interest rates unchanged, tweaked its IOER, and made modest changes to its monetary policy statement.

- In his press conference, Fed Chairman Powell characterized low inflation as “transitory” and noted that the central bank does not “see a strong case for moving in either direction.”

- In other US news, the ADP non-farm employment report beat expectations at 275k but the ISM Manufacturing PMI report came in soft at 52.8.

- Trading in Asian markets will likely be thin with Japanese traders still on break for Golden Week.

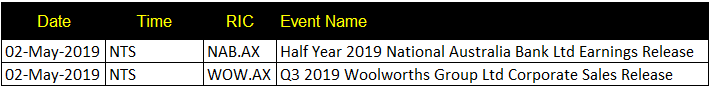

Corporate Event Calendar (Asia)

NTS = No Time Specified

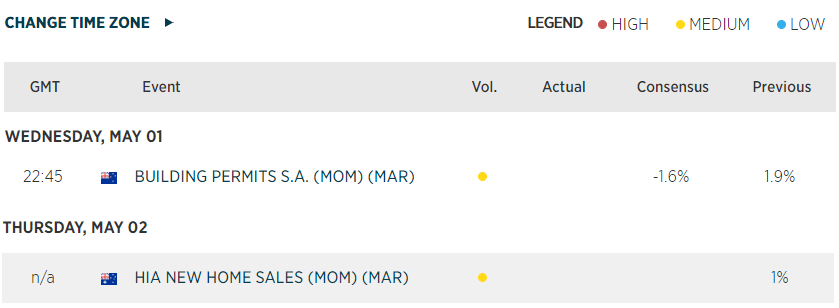

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM