Headlines

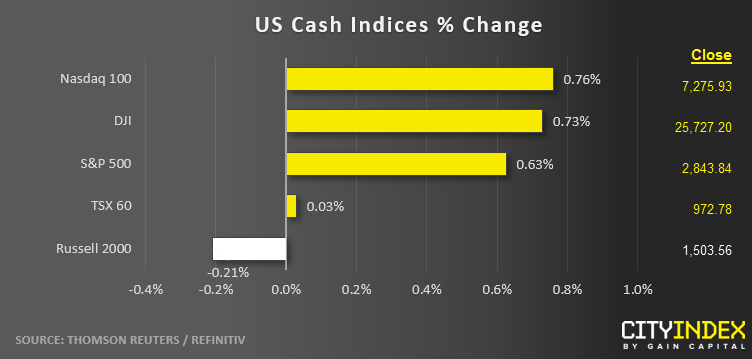

- US indices closed higher for the third consecutive day to hit a 2-week high.

- All eleven major sectors closed higher, led by energy (XLE) stocks.

- Headlines on US-Mexico immigration/tariff negotiations were hot and heavy today: The Trump Administration initially indicated that Mexico was not offering enough to avert tariffs, though the Washington Post reported late in the trading day that the two sides were considering a deal to boost immigration enforcement that may avert the tariffs.

- Tech giants generally shook off regulatory concerns from the start of the week, though worries about Facebook (FB) remain.

- Gold prices are testing their 2019 highs near $1340 on rate cut hopes.

- Recent IPOs Beyond Meat (BYND) and Zoom Video (ZM) are poised to report earnings for the first time shortly after we go to press.

*There are no high-impact corporate announcements expected during tomorrow’s Asian session.*

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM