Headlines

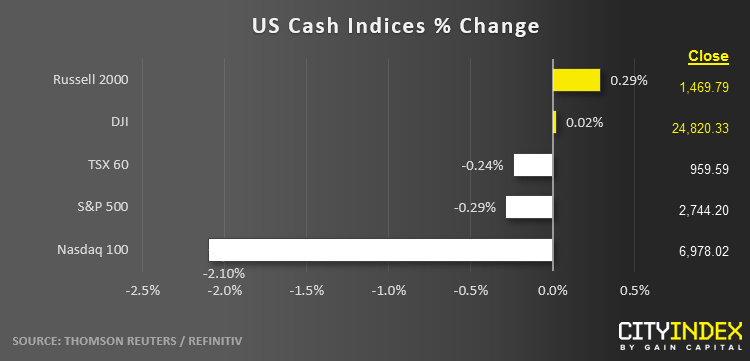

- US indices closed lower on the day, with the tech-heavy Nasdaq 100 leading the way to the downside.

- Communication service (XLC) and technology (XLK) led the way lower, each falling more than 2% on the day. Materials (XLB) stocks were the strongest sector, gaining nearly 2.5% today.

- A series of reports over the weekend suggest that the federal government is either investigating or looking into tech giants Alphabet (GOOG, -6%), Amazon (AMZN, -5%), Facebook (FB, -8%), and Apple (AAPL -1%). Separately, Apple announced it would break its iTunes platform into three separate apps.

- US data: Both the ISM and Markit manufacturing PMI readings came in lower than expected. ISM Manufacturing PMI fell to a 2.5-year low at just 52.1, though the employment figure held up relatively well at 53.7.

- Gold rose over 1.5% while oil (WTI) edged nearly 1.5% lower on the day.

- Front-end US yields continued their freefall as traders increased bets on multiple Fed rate cuts this year; the 2-year treasury now yields just 1.83%, down nearly 30bps in the last three sessions alone!

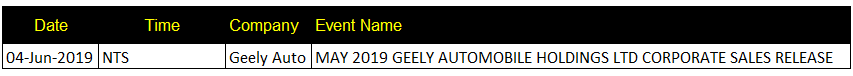

Corporate Calendar (Asia)

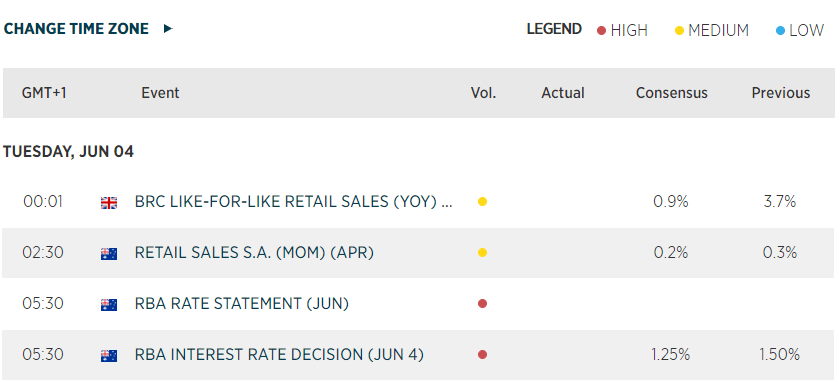

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM