Headlines

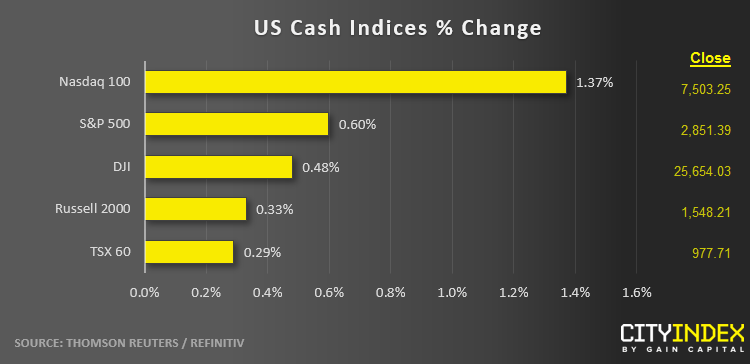

- US indices gained ground for the second straight day, with the DJIA regaining its 200-day moving average and the VIX dropping back below 20.

- Ten of the eleven major sectors rose on the day again, led by communication service stocks (XLC). Financials (XLF) were the laggard, falling fractionally from yesterday’s close.

- Uber rallied back toward 42.00 today to retest its IPO price.

- Trade headlines dominate once again: President Trump decided to postpone his decision on EU automobile tariffs for six months, while Treasury Secretary Mnuchin noted that the US was close to a deal with Mexico and Canada on steel tariffs.

- The WSJ suggested that a US delegation may head to China for trade talks next week, though that hasn’t been confirmed. See “What Trump’s up to and how it might end” for more.

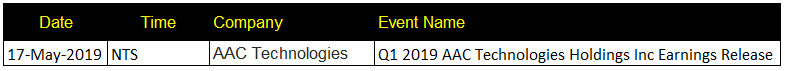

Corporate Calendar

NTS = No Time Specified

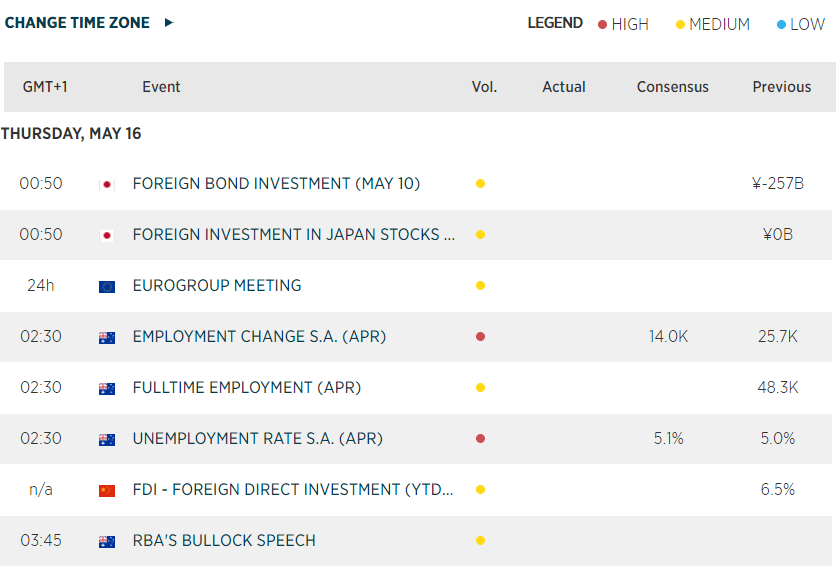

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM