Headlines

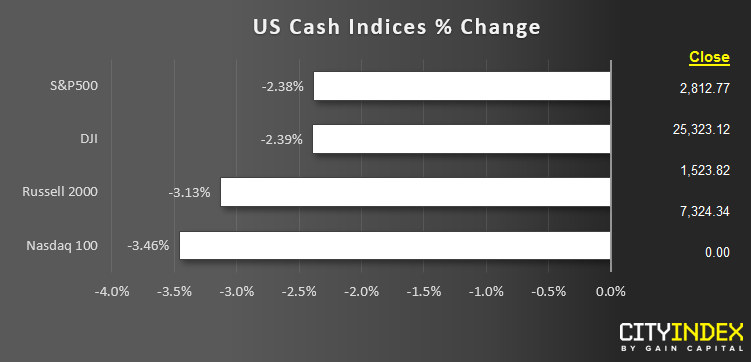

- US indices got dumped, with major US indices closing roughly 2-4% lower in the worst day of the year for global equities (ACWI).

- For the second day in a row, utilities (XLU) led the way by eking out a small gain. Technology stocks (XLK) were the worst performers, losing more than 3% on the day.

- Risk aversion dominated today’s trade as China vowed to raise tariffs on US imports. State-run media suggested that China was considering even more extreme measures such as banning US agricultural imports or dumping US treasury holdings.

- Uber (UBER) shed another 12% on the day after Friday’s IPO while rival LYFT shed 6% of its own. LYFT now trades 33% below March’s IPO price

Corporate Calendar (Asian session)

BOM = Before Market Open

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 08:15 AM