Headlines

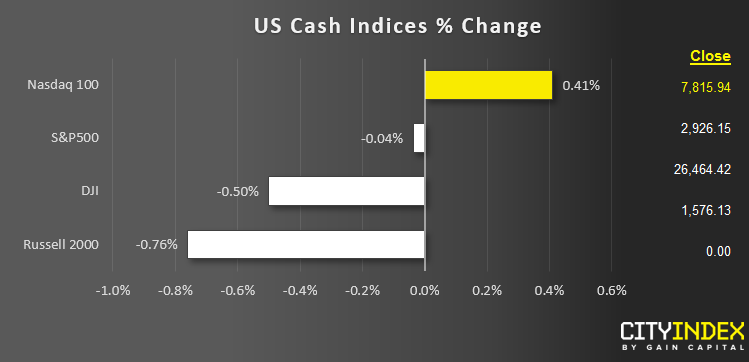

- US indices finished mixed on the day, with the Dow weighed down by disappointing earnings from MMM and UPS, while the Nasdaq edged higher.

- Among the major sectors, communication services (XLC) led the way followed by health care (XLV), with both tacking on 1%+. Industrials (XLI) and materials (XLB) brought up the rear with 1%+ losses.

- In individual corporate news, Amazon (AMZN) crushed analysts’ earnings estimates and reported slightly better than expected revenues. Microsoft (MSFT) flirted with $1 trillion in market cap after beating earnings & revenue estimates yesterday. Tesla (TSLA) closed at a two-year low after disappointing earnings.

- Asian stock indices are pointing to generally lower opens as we go to press.

Corporate Event Calendar (Asia)

BMO: before market open AMC: after market close NTS: no time specific

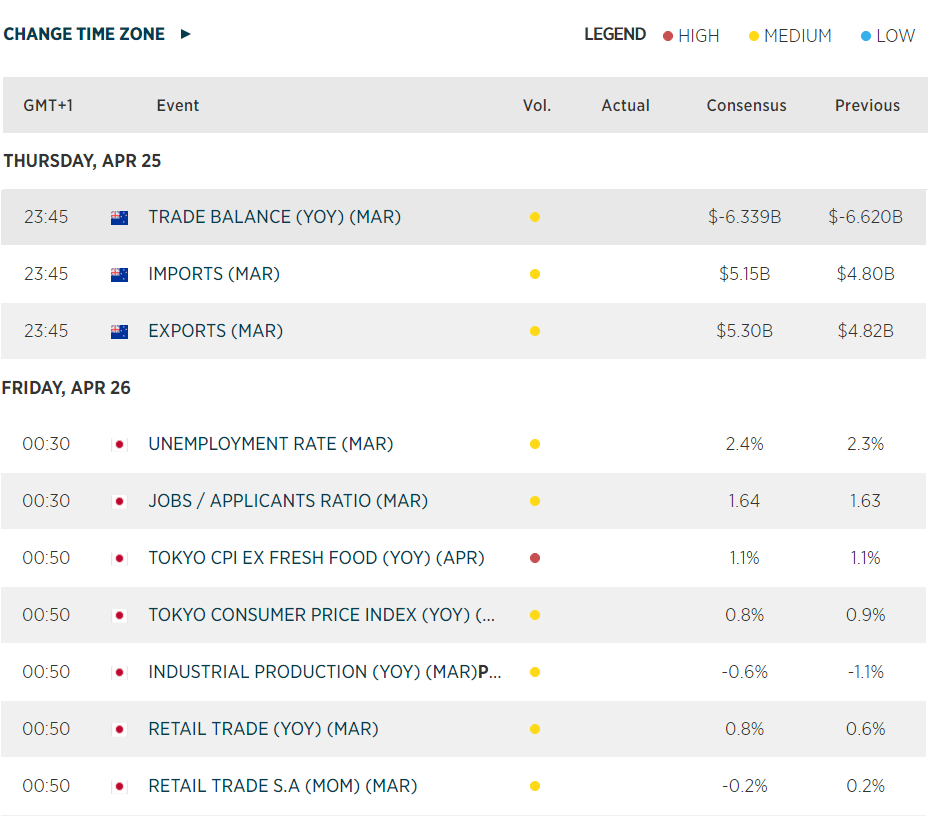

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 11:48 PM

Yesterday 11:16 PM

Yesterday 05:00 PM