US Election ALMOST Over: DXY, AUD/USD, EUR/GBP

Although many of the pollsters were wrong, or inaccurate, regarding some of the Presidential state outcomes, it appears that Biden may end of winning after all. But Trump has already laid the groundwork for contesting the results. The big question now is: If Biden wins, will the markets care about Trump’s court drama or will it just be a side show? We don’t know for sure, but we do know price action!

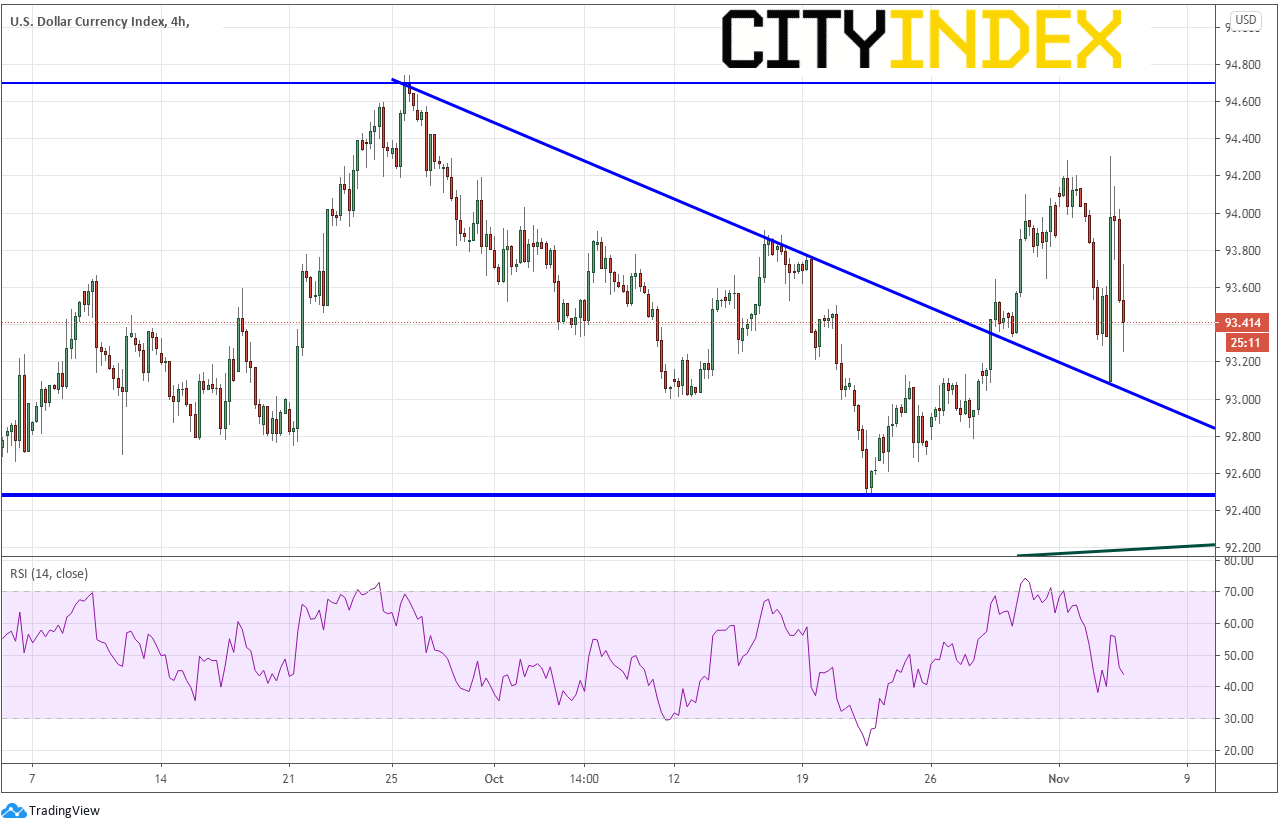

DXY

The US Dollar Index is moving lower. A Biden victory would mean more stimulus, more supply of US dollars in the system, and therefore, a lower price. After a break higher out of the descending triangle, price gapped open lower last night as the results began coming in and tested the downward sloping trendline of the triangle. However, price bounced as it appeared Trump may win. Price has since moved lower, but is still respecting the trendline. First support is yesterday’s lows and the intersecting downward trendline near 93.00. Below that is horizontal support near 92.50. Resistance is at overnight highs near 94.30.

Source: Tradingview, City Index

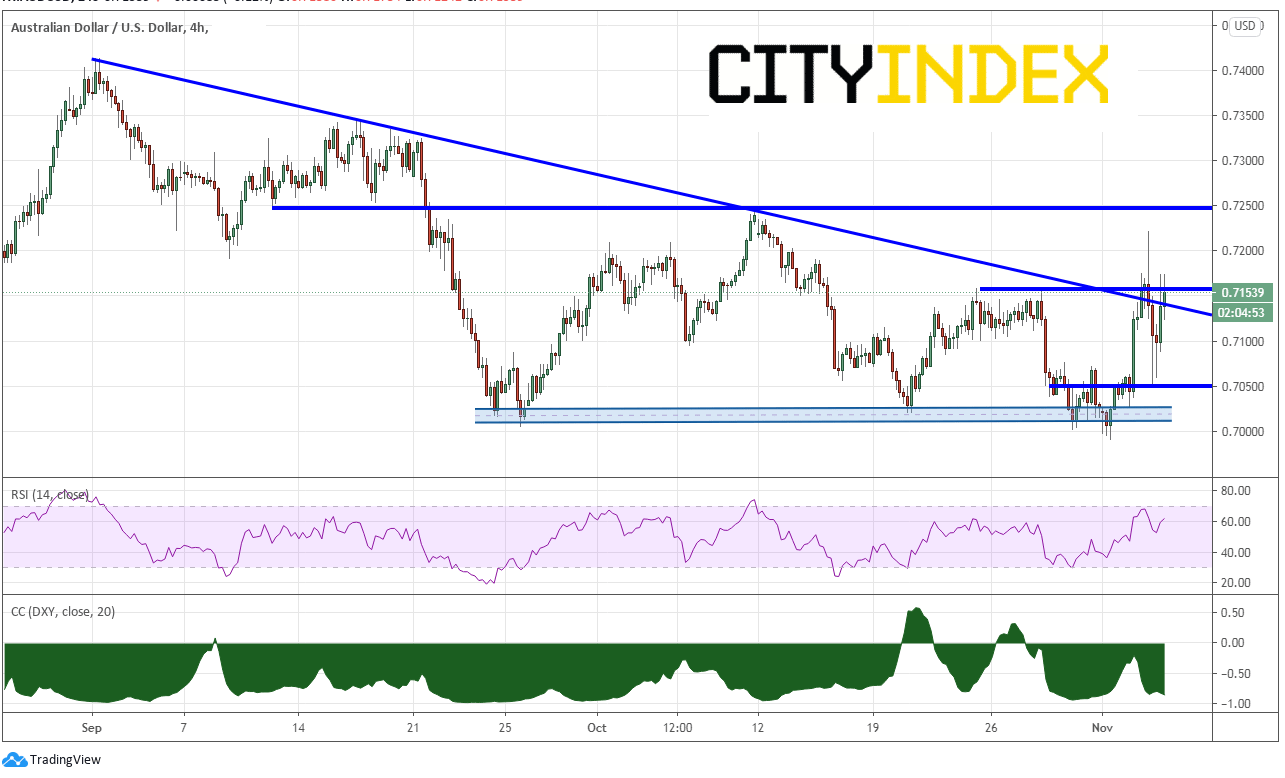

AUD/USD

AUD/USD is currently trading at a -.85 correlation to the US Dollar Index (DXY). A correlation coefficient of -1.00 means that the 2 instruments are trading on a 1 for 1 opposite basis. So, a tick higher in DXY would mean a tick lower in AUD/USD. Therefore, Aussie traders may want to watch the DXY to give them for confidence in their decision on entering and exiting positions. Resistance above is at overnight highs near .7220 and then horizontal resistance near .7250. Support is at overnight lows near .7050.

Source: Tradingview, City Index

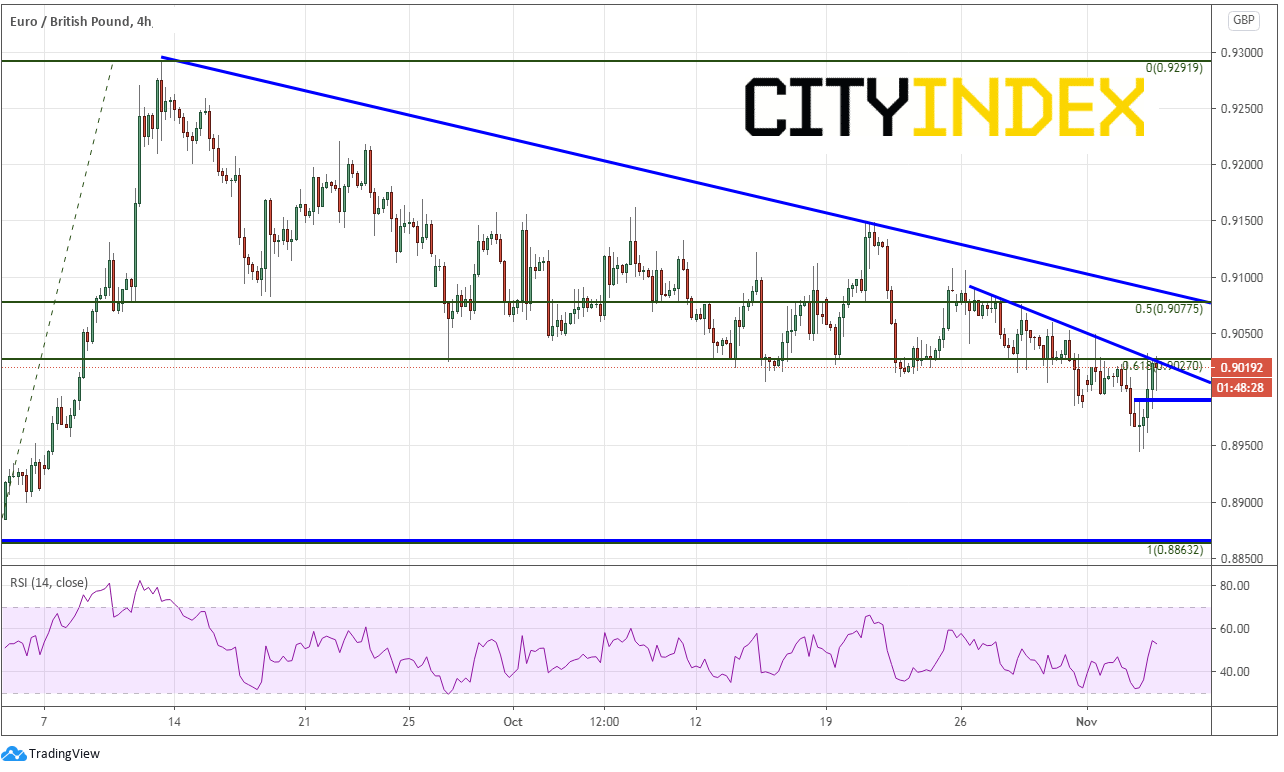

EUR/GBP

If one is searching for a trade that is away from all the drama of the US, that trader can turn attention to back to Brexit! EUR/GBP is currently up against trendline resistance, horizontal resistance and the previous 61.8% Fibonacci retracement form the lows of September 3rd to the highs of September 11th (previous support acts as resistance), near .9025. There is some short-term support below near .8990 and the overnight lows just below .8950. If price drops below, it can quickly accelerate to the September lows near .8860. Resistance is at .9030, then the downward sloping trendline from triangle on the 240-minute chart near .9075.

Source: Tradingview, City Index

If one is looking for volatility to trade, the US Dollar has provided plenty of it over the last 18 hours. However, there with an update due today on Brexit negotiations, so there is potential for volatility there as well!