US Dollar Screaming Higher as Month End Flows Dominate

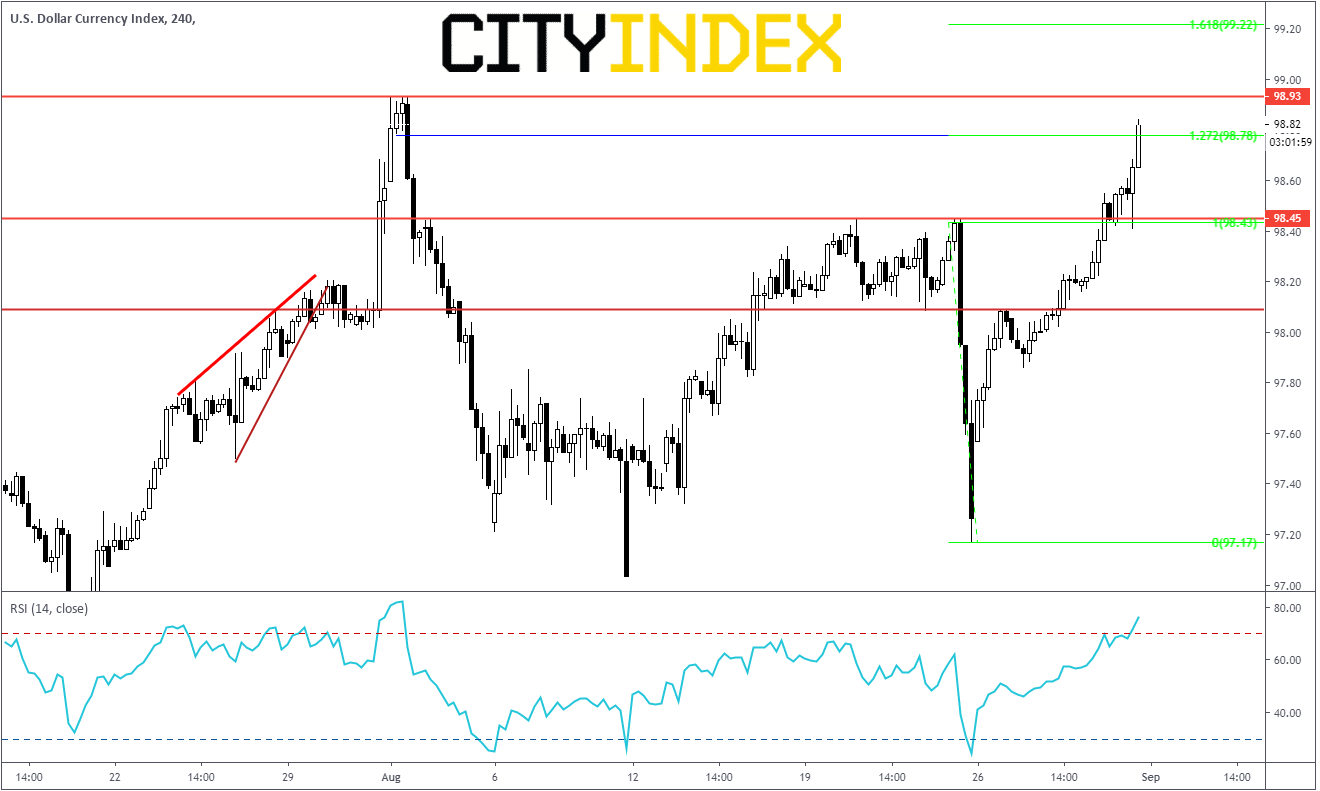

As we wrote about earlier in the week, sometimes month end flows can come out of nowhere and lead to large, sometimes even exaggerated moves in the market. Today is the last trading day of the month and that could be what we are seeing today as the DXY heads higher.

DXY broke through horizontal resistance at 98.45 earlier and moved right up to the 127% extension level at 98.78, which is the move from the daily highs on august 23rd to the lows of the same day. Next target on the upside is the recent high from August 1st at 98.93. Short term support comes in at the daily low of 98.41.

Source: Tradingview, City Index

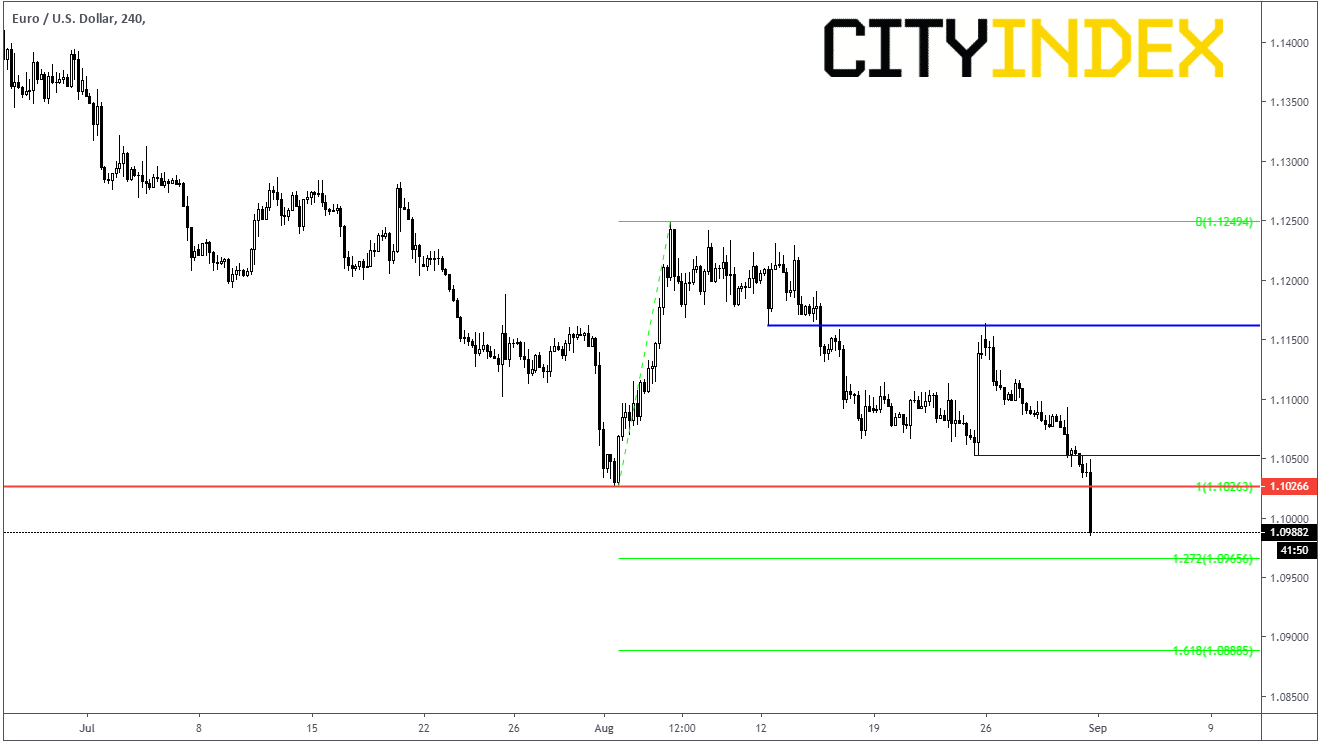

As a result of the move higher in DXY, EUR/USD has taken a nose dive, breaking through the August 1st low at 1.1026. EUR/USD has traded the whole month of August in a 225 pips range, between the August 1st low and the August 6th high at 1.1250. Next support comes in at 1.0965, which is the 127% extension from the previously mentioned period.

Source: Tradingview, City Index

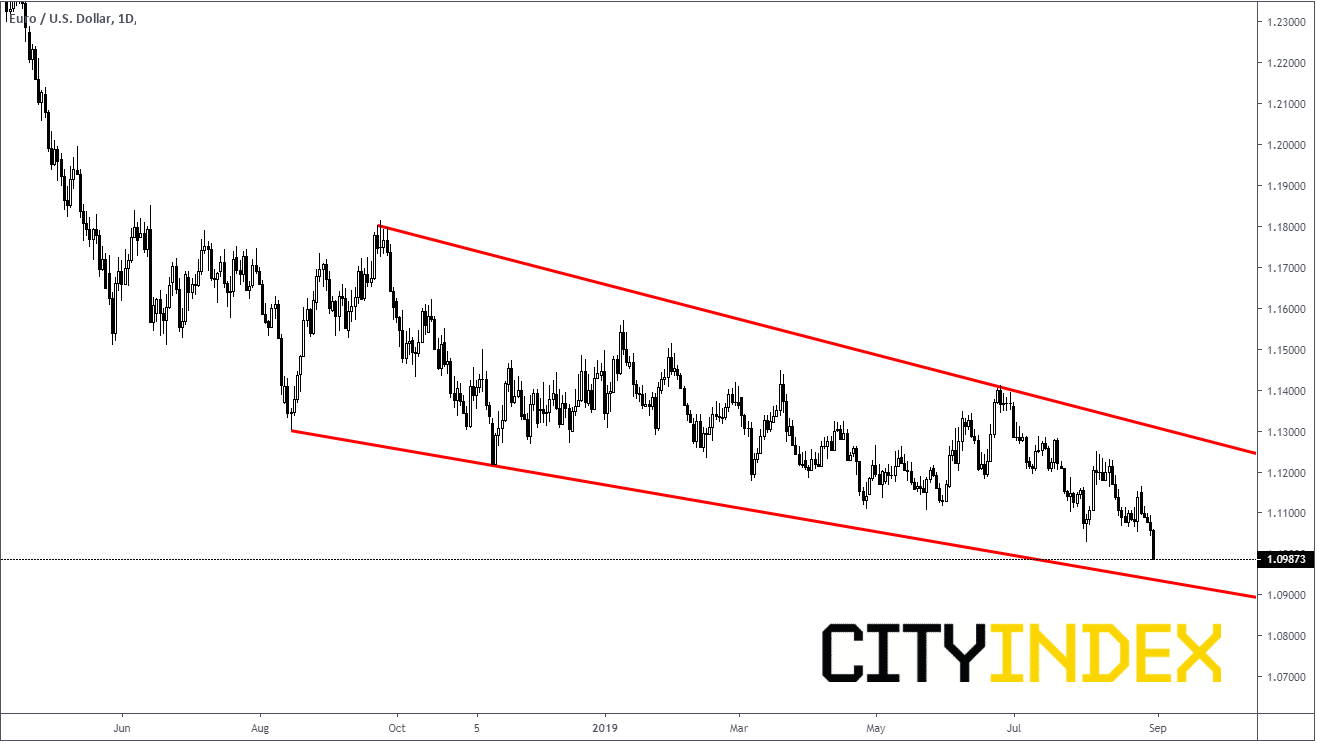

Below that is daily trendline support at 1.0940.

Source: Tradingview, City Index

The old support level at 1.1026 now acts as resistance above. Second resistance level is the August 23rd lows at 1.1050.

Be careful the rest of the day and more and more people leave for the long holiday weekend in the US. As liquidity thins out, volatility could remain.