US Dollar profit taking before the FOMC..where to next?: DXY, EUR/USD, NZD/USD

The FOMC meets later today and it appears that some traders are booking profits ahead of the meeting, as the US Dollar is off its lows. In addition to the interest rate decision, staff members will provide their updated economic projections, including their outlook for GDP and inflation. Although expectations are for more upbeat projections due to the release of the coronavirus vaccine, if the FOMC is too optimistic, the US dollar could move higher and stocks could reverse lower. Better outlook means less stimulus. Less stimulus means less supply of US Dollars. Less supply of US Dollars means higher price of DXY and lower prices of US stocks.

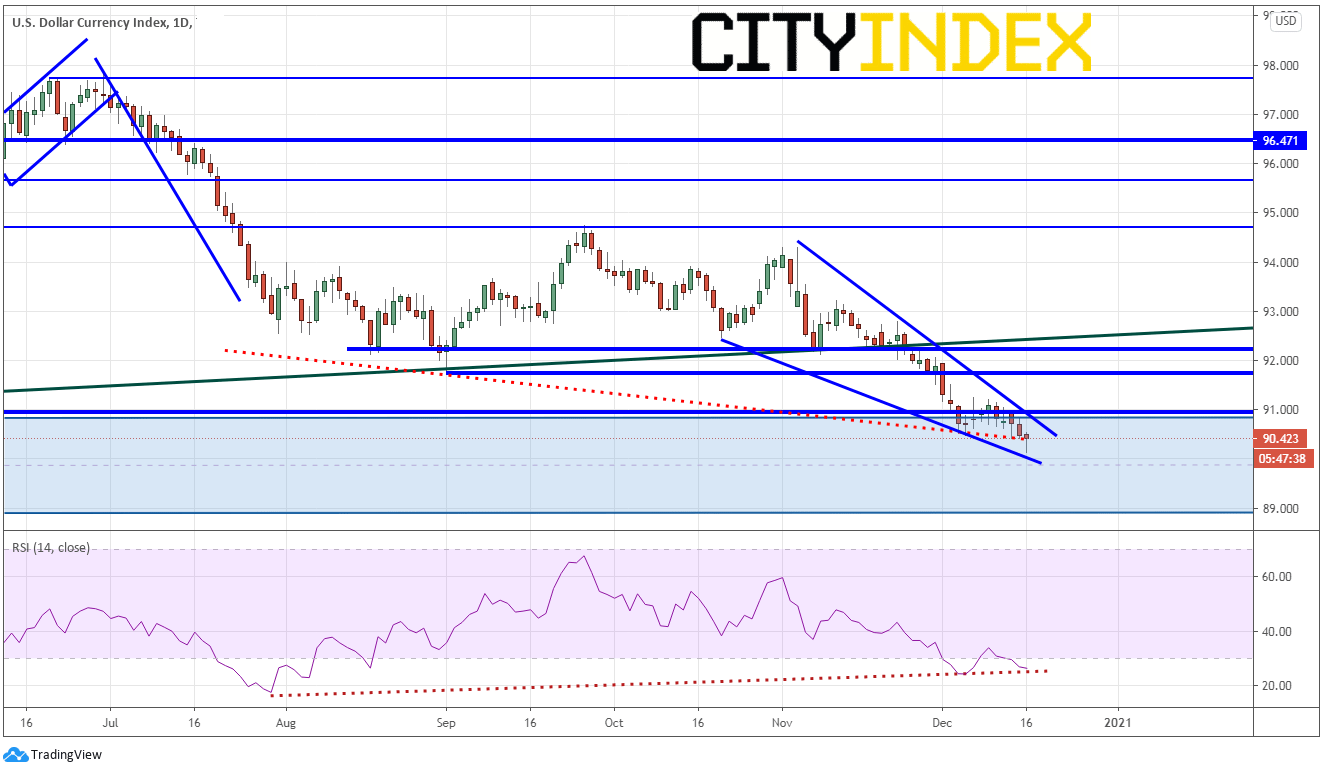

DXY

The US Dollar index (DXY) had been holding up well in the support zone between 89.00 and 91.00 since the beginning of December. However, today, price moved to lows not seen since April 2018. On a daily timeframe, the RSI continues to diverge with price in oversold conditions. In addition, DXY has formed a descending wedge. On a surprisingly more hawkish Fed (less dovish is expected), the index can rally out of wedge. The target for a descending wedge is a 100% retracement, which is near 94.30. However, first it must get through resistance near 91.50 and 92.10.

Source: Tradingview, City Index

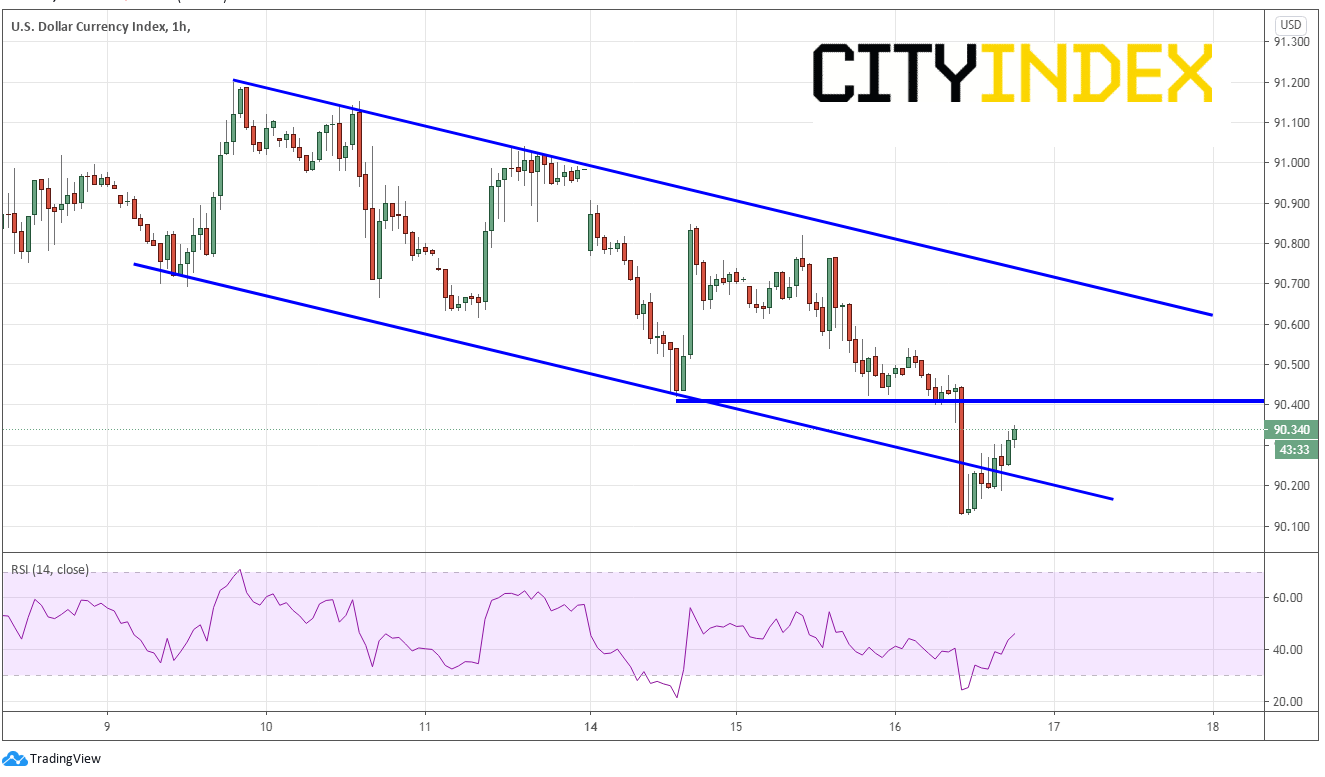

On a 60-minute timeframe, price has broken through the bottom of a descending channel, only to fail at lower levels and bounce back into it. A move above horizontal resistance at 90.41 could thrust the index up the top line of the channel near 90.65, then horizontal resistance near 90.82. Support is at today’s lows near 90.12. In addition, DXY is currently is the previously mentioned support area, all the way down to near 89.00.

Source: Tradingview, City Index

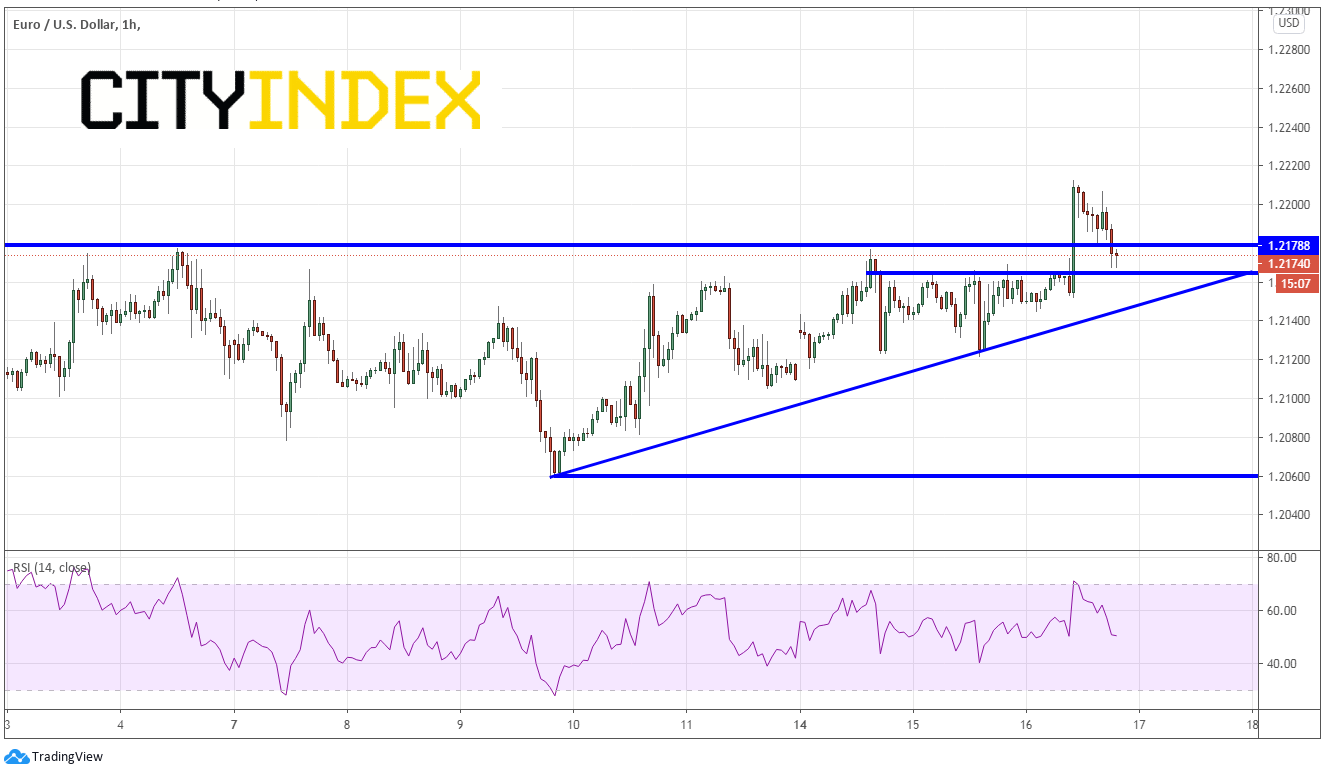

EUR/USD has done completely the opposite as the US Dollar Index on a 60-minute timeframe. The pair busted above 1.2180 to hits highest level since April 2018. Traders appear to be taking profits ahead of the FOMC as the pair has pulled back from its highs of 1.2212. On more hawkish forecasts, watch for the US Dollar to go bid, and EURUSD to test short-term support near 1.2166 and the upward sloping trendline near 1.2145. The December 9th horizontal lows could also come into play near 1.2060.

Source: Tradingview, City Index

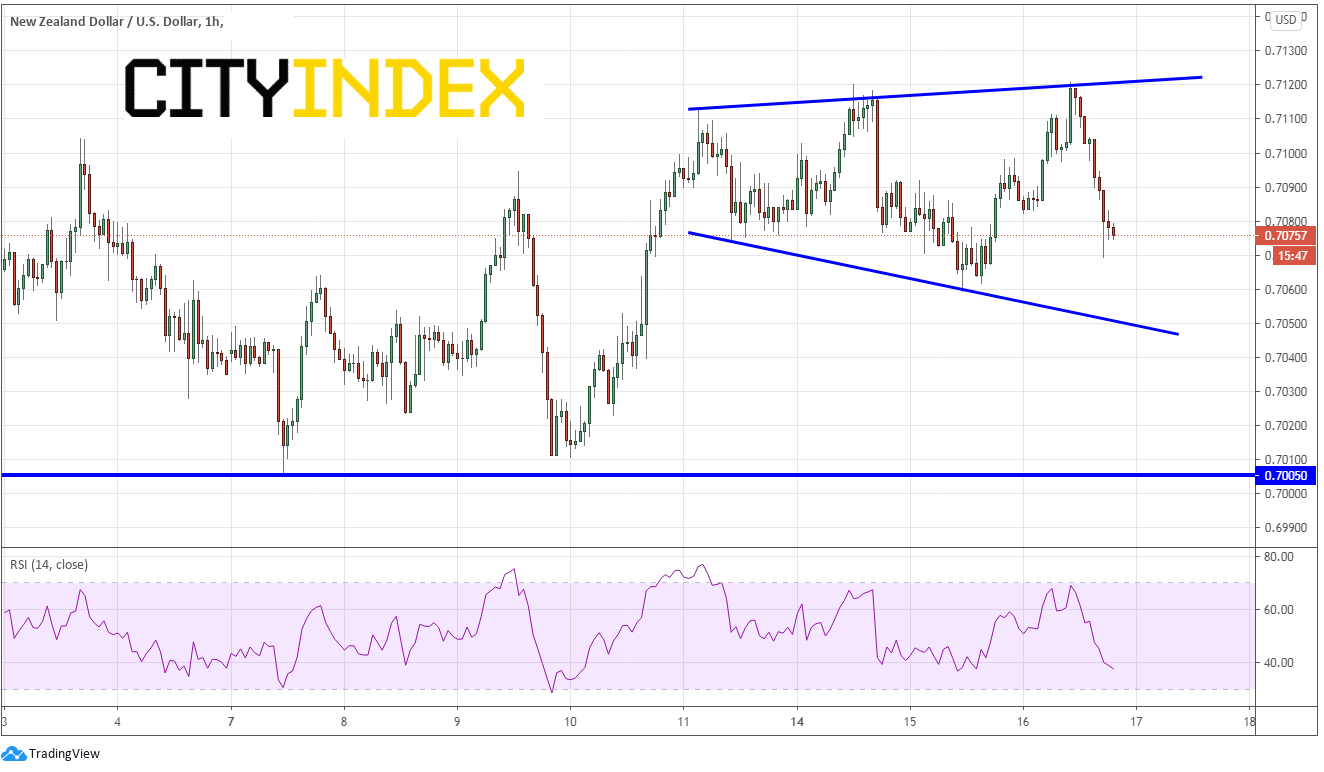

NZD/USD didn’t seem to have been struggling to breakout above previous highs, and therefore, had a stronger pullback than the EUR/USD. The pair moved to 0.7120, only marginally making a new high, then pulled back aggressively into the expanding megaphone pattern on the 60-minute timeframe. Watch for the move to continue on a stronger than expected forecasts. Support is at yesterdays lows near 0.7060 and the downward sloping trendline of the megaphone pattern near 0.7050, Below there is December 7th low and the psychological round number resistance near 0.7000.

Source: Tradingview, City Index

Other US Dollar pairs look similar to these. If the FOMC forecasts tend to be more on the upbeat side, markets may assume less stimulus, and therefore, and stronger US Dollar. If that happens, traders can look for short-term opportunities so fade US Dollar weakness.

Learn more about forex trading opportunities.