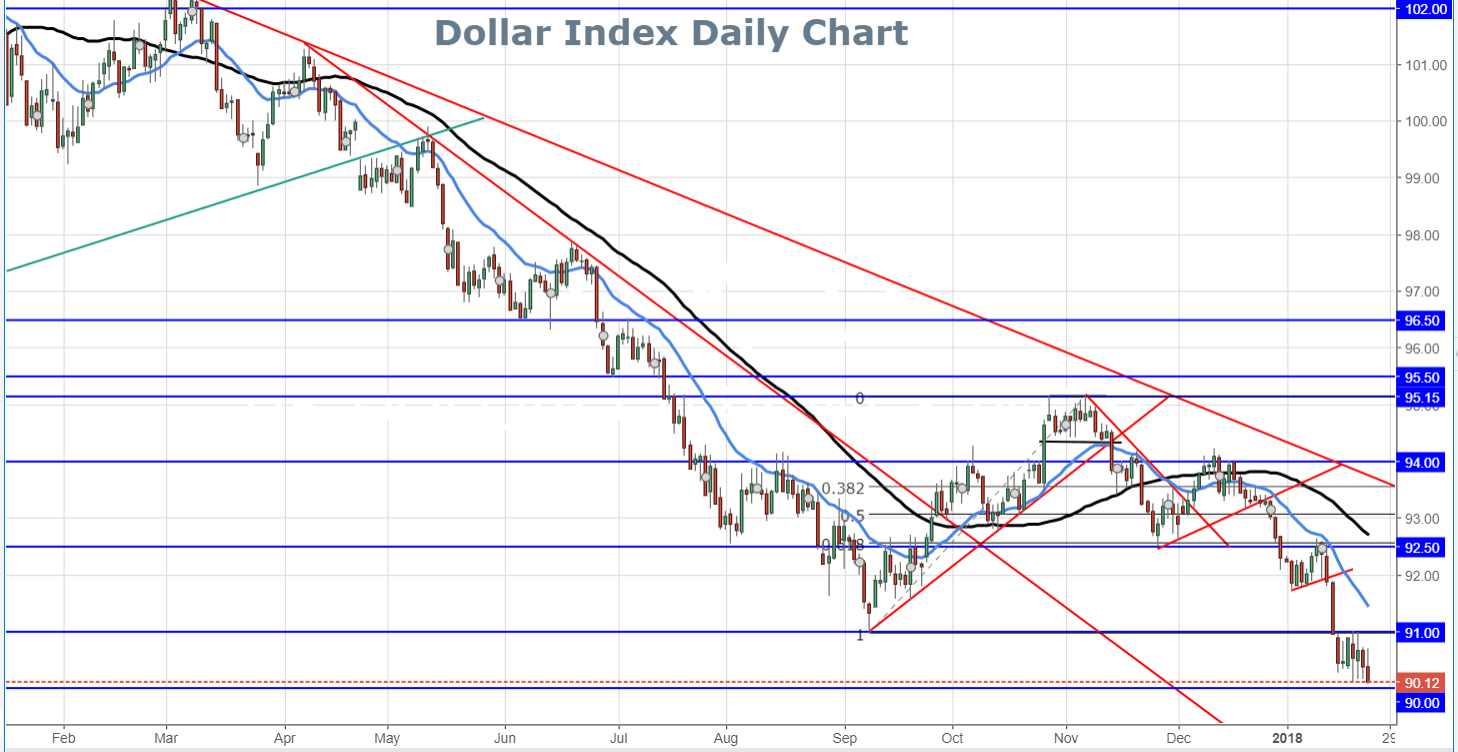

As the euro, pound, and yen all remained relatively well-supported on Tuesday, the US dollar index was once again on its back foot, as it dipped slightly below the troughs of the last few days to establish a new 3-year-low near the 90.00 psychological level. Against the dollar’s main rivals, the British pound reached a new high around the 1.4000 milestone, EUR/USD revisited its recent 1.2300-area highs, and USD/JPY fell back to approach the 110.00 support level once again. All of these moves occurred on the back of persistent weakness in the US dollar.

Dollar sentiment has been sharply bearish since early January. This bearishness has extended the weakness seen throughout much of last year. Potentially exacerbating this sentiment to a certain degree has been US President Trump’s approval this week of tariffs on imported goods including solar cells and washing machines. These protectionist moves have been seen as a harbinger of the US trade stance going forward, and occur as Trump is scheduled to speak this week at the World Economic Forum in Davos, Switzerland. Also potentially weighing on the dollar may be concerns over the US debt ceiling, which still looms this quarter despite the government having just ended its brief shutdown.

Perhaps even more pressing for the dollar, however, will be key events and economic data on the immediate horizon. This week features the US advance GDP reading, which is expected to come in at an annualized 3.0%. And the following week will potentially deliver an even greater impact on the dollar with the first FOMC decision of the year occurring on Wednesday, followed by the US jobs numbers on Friday.

Ahead of these major events and releases, bearish sentiment continues to weigh heavily on the dollar index. Having just dipped down to hit a new long-term low on Tuesday, the index has tentatively confirmed a continuation of the sharp downtrend that began a year ago in early 2017. With any continued bearish momentum triggered by a potential breakdown below the 90.00 psychological support level, the dollar index could be heading for further losses towards a key downside target around the 88.00 level.