The rising Covid19 infection curve in the U.S is beginning to show up in leading economic data. Overnight retail sales were weaker than expected and with more U.S states imposing restrictions, the risks are for softer numbers and economic activity into year-end.

The market has become more comfortable with the prospects of a diminished U.S. fiscal support package. However geopolitical risks have re-emerged after reports surfaced that President Trump canvassed senior leaders about military options to strike Iran. This and a reluctance by Trump to concede defeat in the recent U.S. election, warn we are yet to hear the last from President Trump.

The reason why these near term obstacles have been highlighted is that some readers will have come across headlines like the one that ran yesterday in the Australian Financial Review “Vaccine is kryptonite for the US dollar”, citing research from Citigroup, calling for a 20% fall in the U.S. dollar in 2021.

While the U.S. dollar does appear vulnerable to further declines, it’s important to remember that a lower U.S. dollar view is consensus and the position broadly held. Also, recent U.S dollar weakness has taken it to key levels in many pairs.

Yesterday, the .7340/50 level in the AUDUSD was cited that has the potential to become a double top. Likewise for the NZDUSD at .6918. Not a reason to exit longs in either of these pairs, more a reason to raise the stop loss to protect existing long positions.

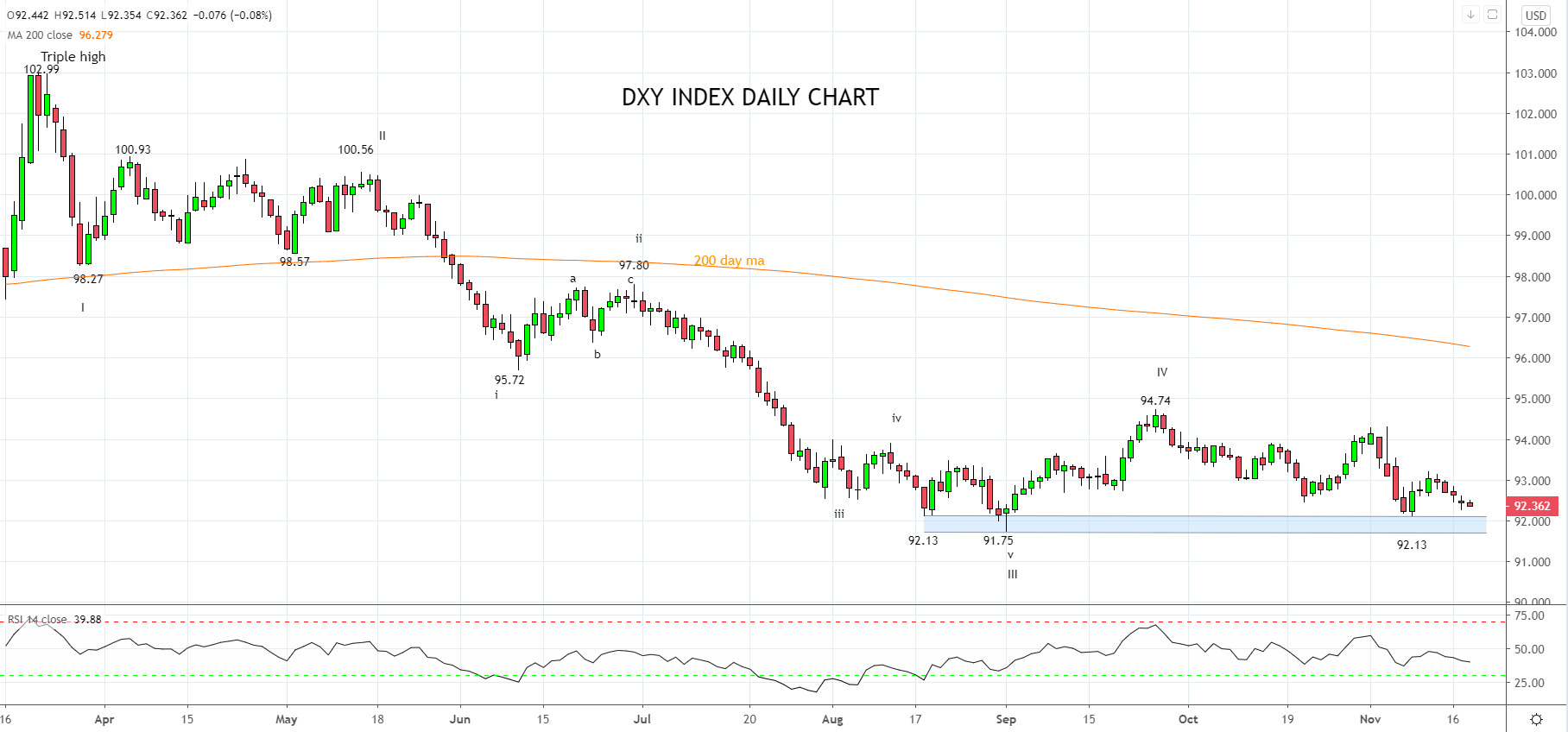

In terms of the U.S dollar index, the DXY has been very well supported in recent months between 92.13 and 91.75. We would be hesitant in acting prematurely on headlines such as the one above, preferring instead to wait for a sustained break of the 92.13/91.75 support band, to confirm the next leg lower in the U.S. dollar has commenced.

Source Tradingview. The figures stated areas of the 18th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation