US Dollar Higher, Euro Lower as PMIs are Released

The US Dollar traded to an 11-day high at 98.83 as German and Eurozone Manufacturing PMIs came out worse than expected. German Manufacturing PMI came in at a dismal 43.5 vs 44 expected and the Eurozone Manufacturing PMI was 47 vs 47.3 expected. In contrast, the US Manufacturing PMI was released at 51 vs 50.3 expected.

Source Tradingview, FOREX.com

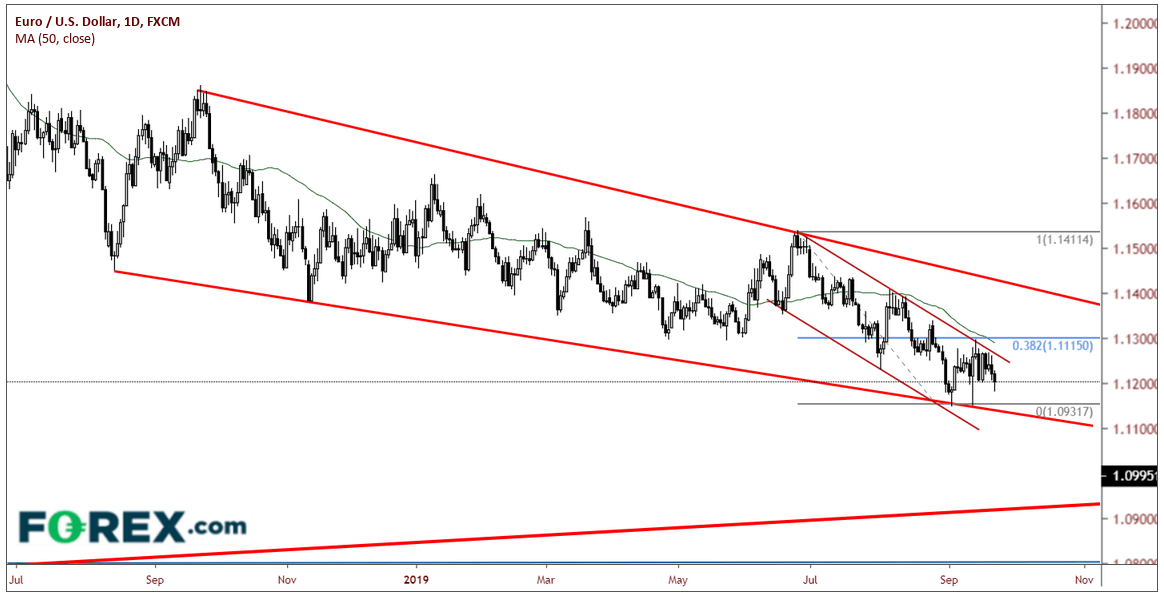

As one may expect, EUR/USD is trading lower on the day, however only about .25% at 1.0990, as ECB's President Draghi says he is confident that inflation will converge to target and the labour market is gradually improving. This is helping to keep the Euro afloat on the day. EUR/USD is currently trading in a downward sloping channel within a falling wedge. After putting in a double bottom earlier in the month, the pair could only bounce to the 38.2% retracement level at 1.1115from the June 24th highs to the double bottom lows. It also couldn’t take out the 50 Day Moving Average near that same level. EUR/USD is now in danger of taking out the double bottom at 1.0931 and the bottom trendline of the descending wedge near that same level. Resistance back at the 1.1115 level.

Source: Tradingview, FOREX.com

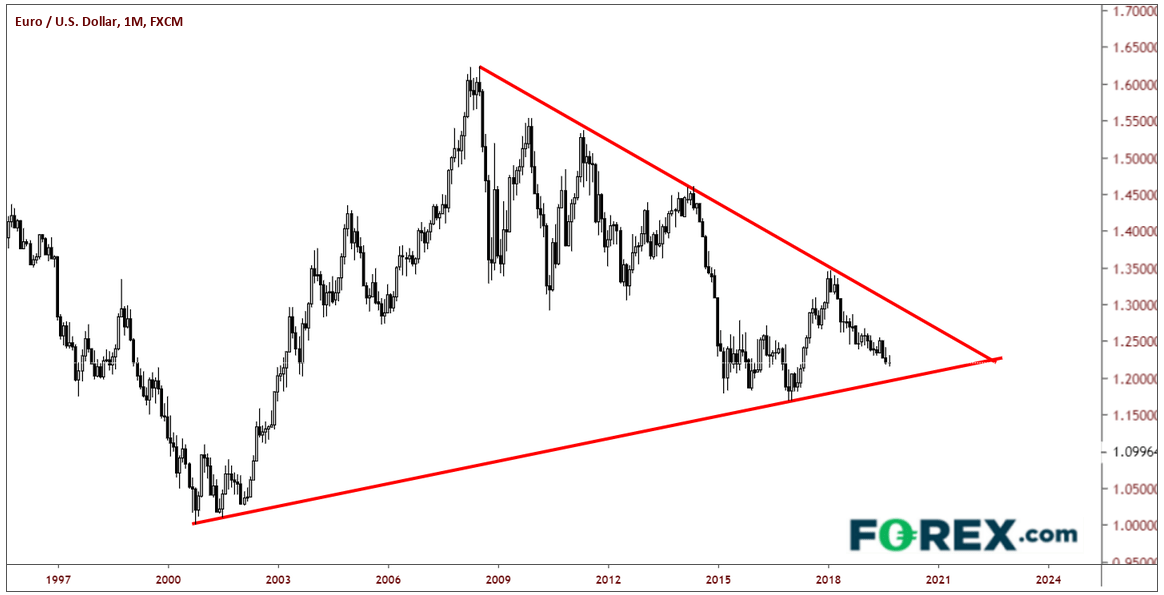

Below that, we need to start paying attention to the ascending trendline dating back to October 2000. The trendline comes in near 1.0650, which may not be that far off if EUR/USD breaks the bottom trendline of that descending wedge.

Source: Tradingview, FOREX.com