US Crude Oil CFD: The Resumption of Previous Uptrend

OPEC+ has not decided to delay the plan for January output increase after the OPEC meeting. The Panel of OPEC+ ministers said: "All participating countries need to be vigilant, proactive and be prepared to act, when necessary, to the requirements of the market."

The American Petroleum Institute (API) reported that U.S. crude-oil inventories rose 4.17M barrels in the week ending November 13. Later today, the International Energy Agency (EIA) will release official crude oil inventories data for week ending November 6.

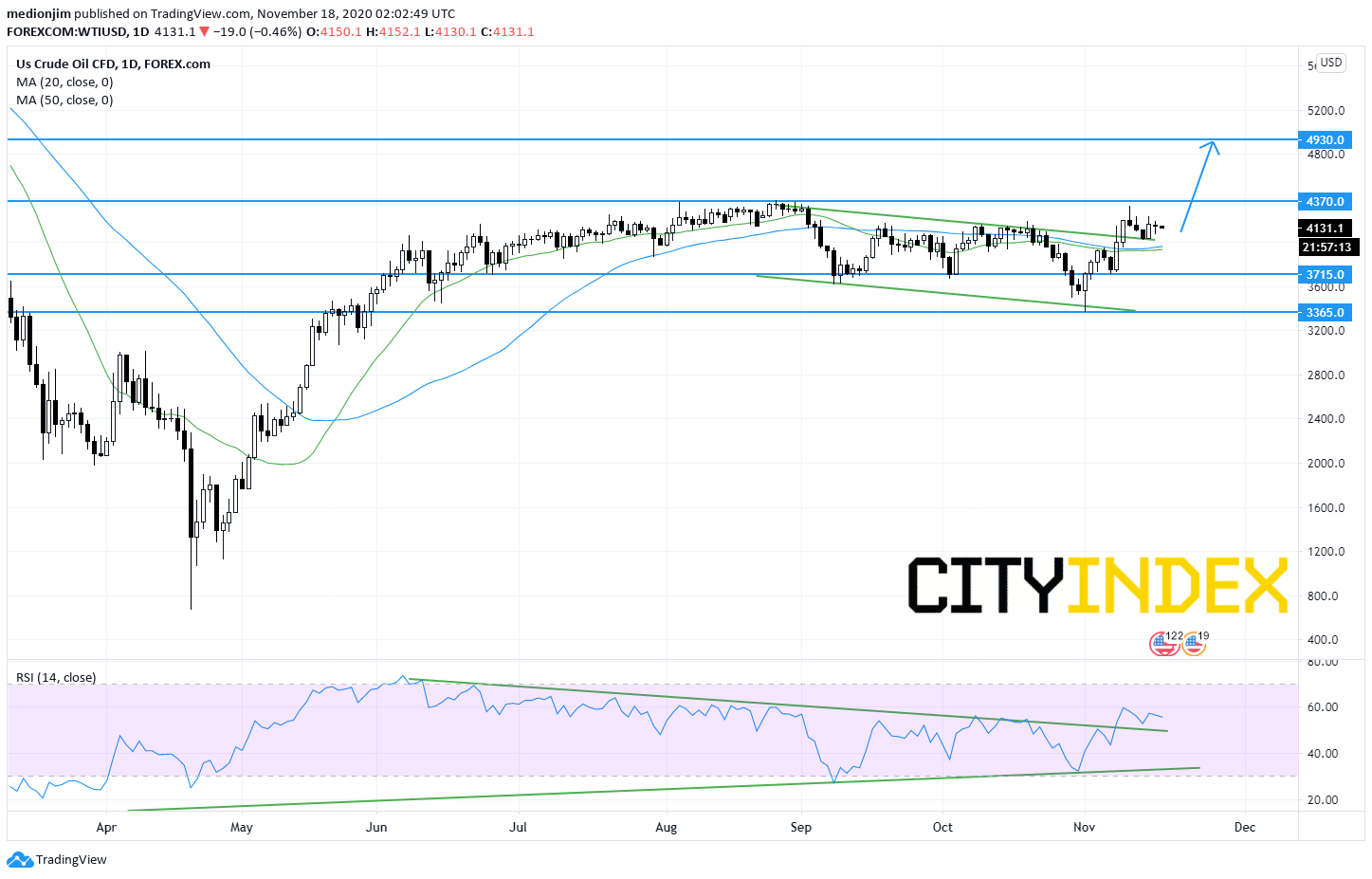

From a technical point of view, US Crude Oil CFD broke above the declining channel, suggesting a bullish signal. Currently, the CFD prices are trading above both 20-day and 50-day moving averages. The relative strength index is also supported by a rising trend line and has broken above the declining trend line.

Bullish readers could set the support level at 3715, while resistance level would be located at 4370 and 4930.

Source: GAIN Capital, TradingView

The American Petroleum Institute (API) reported that U.S. crude-oil inventories rose 4.17M barrels in the week ending November 13. Later today, the International Energy Agency (EIA) will release official crude oil inventories data for week ending November 6.

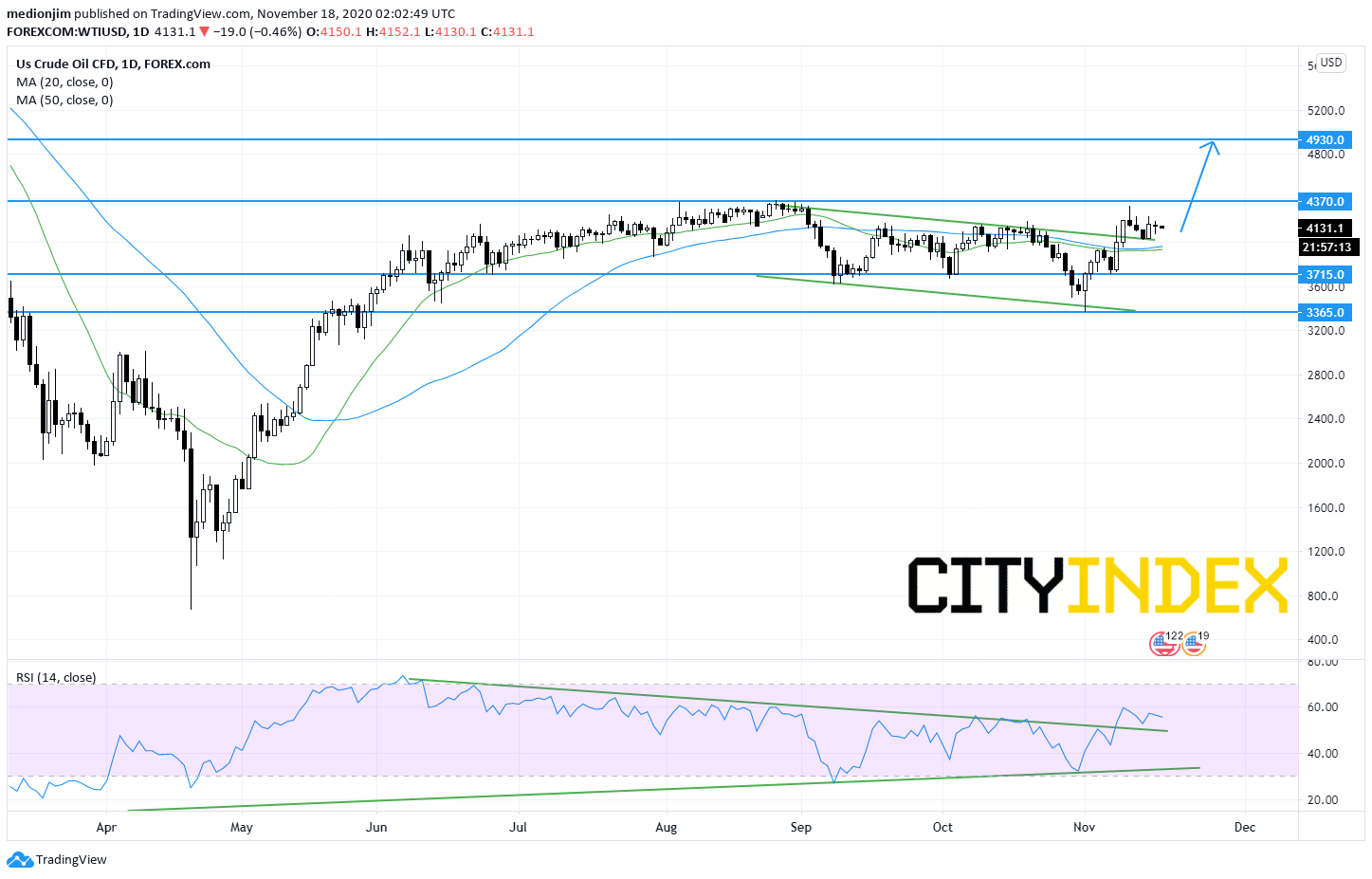

From a technical point of view, US Crude Oil CFD broke above the declining channel, suggesting a bullish signal. Currently, the CFD prices are trading above both 20-day and 50-day moving averages. The relative strength index is also supported by a rising trend line and has broken above the declining trend line.

Bullish readers could set the support level at 3715, while resistance level would be located at 4370 and 4930.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM