US CPI recap: Have hopes of a Jackson Hole taper announcement been dashed?

With Federal Reserve members growing increasingly hawkish following Friday’s strong NFP report, traders and policymakers were keying in on this morning’s US Consumer Price Index (CPI) reading from July as the next major update on the performance of the world’s largest economy.

As it turns out, the report came out roughly in line with expectations, with the headline CPI reading rising at 0.5% month-over-month as anticipated and the year-over-year rate printing at 5.4%, a tick above the 5.3% reading expected. Meanwhile, the Core CPI reading came out at 0.5% m/m and 4.3% y/y, in-line with economists’ expectations.

Notably, used car prices, which had driven a significant portion of the price pressures in recent months amidst the global semiconductor shortage, rose “just” 0.2% m/m; the moderation in used car prices represents a proverbial feather in the cap for Jerome Powell and the rest of the “inflation is transitory” camp, a development that could reduce some of the near-term pressure on the central bank to announce its tapering plans this month.

As it stands, many traders currently expect the Fed to make an announcement on this front around its September policy meeting, though it’s still worth watching the Jackson Hole Symposium at the end of this month for any updates or surprises.

Market reaction

On balance, we’ve seen a “risk on” reaction to the CPI print, with US index futures ticking higher, yields on the benchmark 10-year US treasury bond falling 3bps to 1.34%, gold tacking on a quick 10 points to $1746 so far, and the US dollar index retreating 20 pips from resistance in the 93.20 area to trade back near 93.00. Viewing these movements as a mosaic, the market’s reaction to the CPI report suggests that some traders were still holding out hopes that another scorching inflation print could spook the Fed into announcing its taper plan at Jackson Hole; with today’s data merely meeting expectations, those hopes may now be dashed.

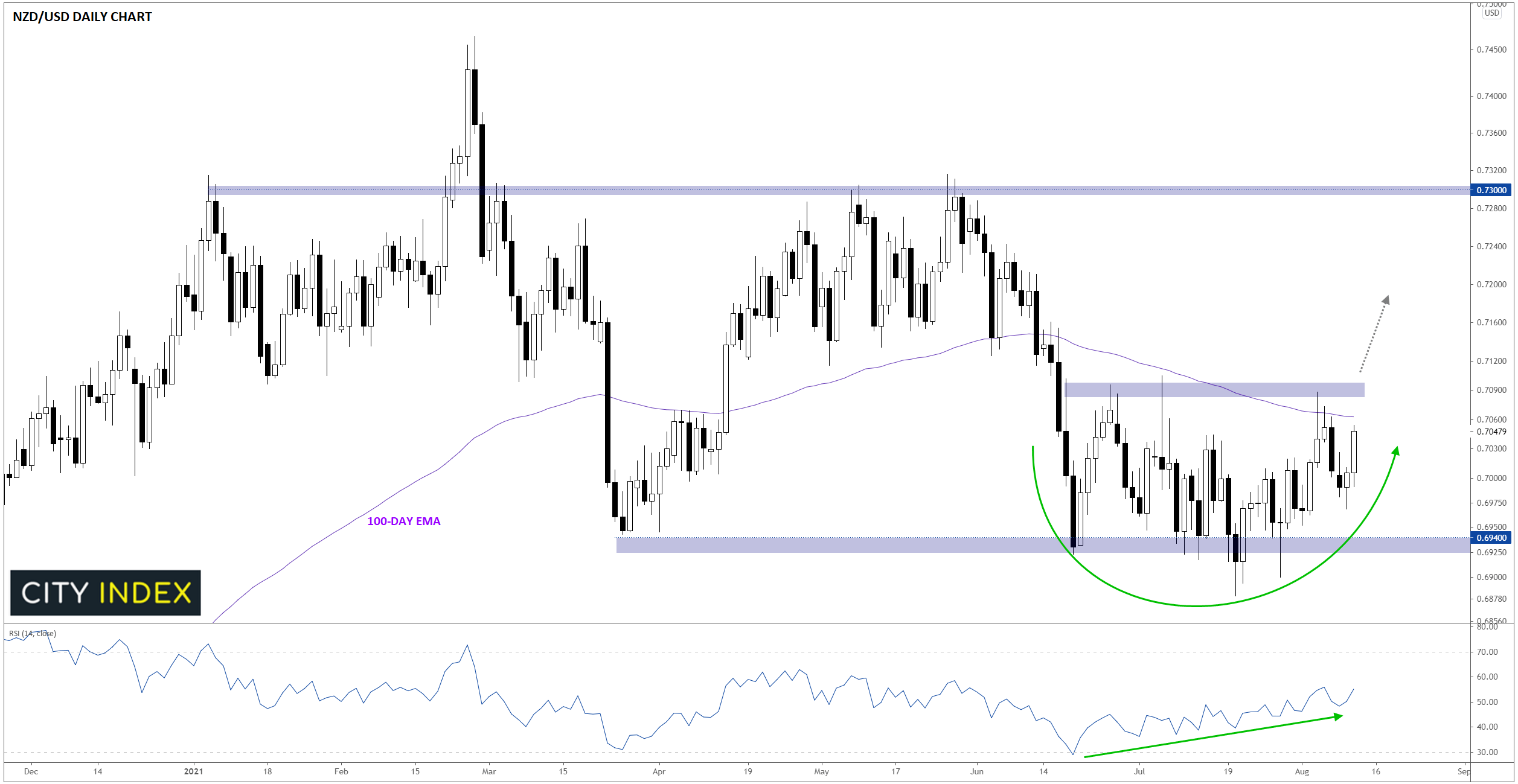

To highlight a specific setup, NZD/USD is the biggest mover among the major currency pairs today. The pair appears to be forming a potential “rounded bottom” pattern near support in the lower-0.6900s over the last two months. Now, traders will be looking for a breakout to above the 100-day EMA and previous resistance near 0.7100 to confirm the pattern and open the door for a bullish continuation toward the next resistance zone around 0.7300.

Source: StoneX, TradingView

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.