The pound was experiencing a rare up day, rebounding from a 4-month low as investors reacted to the better than expected employment data. UK unemployment held steady at a 44-year low whilst UK average wages unexpectedly jumped in the three months to April. Wages increased 3.4%, higher than the 3.3% previously and significantly above the 3.1% forecast.

US PPI hit dollar ahead of Wednesday’s CPI

Improved sentiment on the trade front and worse than forecast PPI data from the US hit demand for the dollar. Inflation at wholesale level dropping to 1.8% doesn’t bode well for future consumer inflation and only served to reinforce expectations that the Fed will be cutting interest rates, possibly as soon as the July meeting.

The market is currently pricing in a 78% probability of a rat cut in July and a 92% chance of a cut in September.

Traders will now turn their attention to US CPI data on Wednesday. Expectations are for consumer inflation to drop to 1.9% yoy from 2.1% in April. Weaker data could boost expectations of a rate cut further and drag the dollar lower.

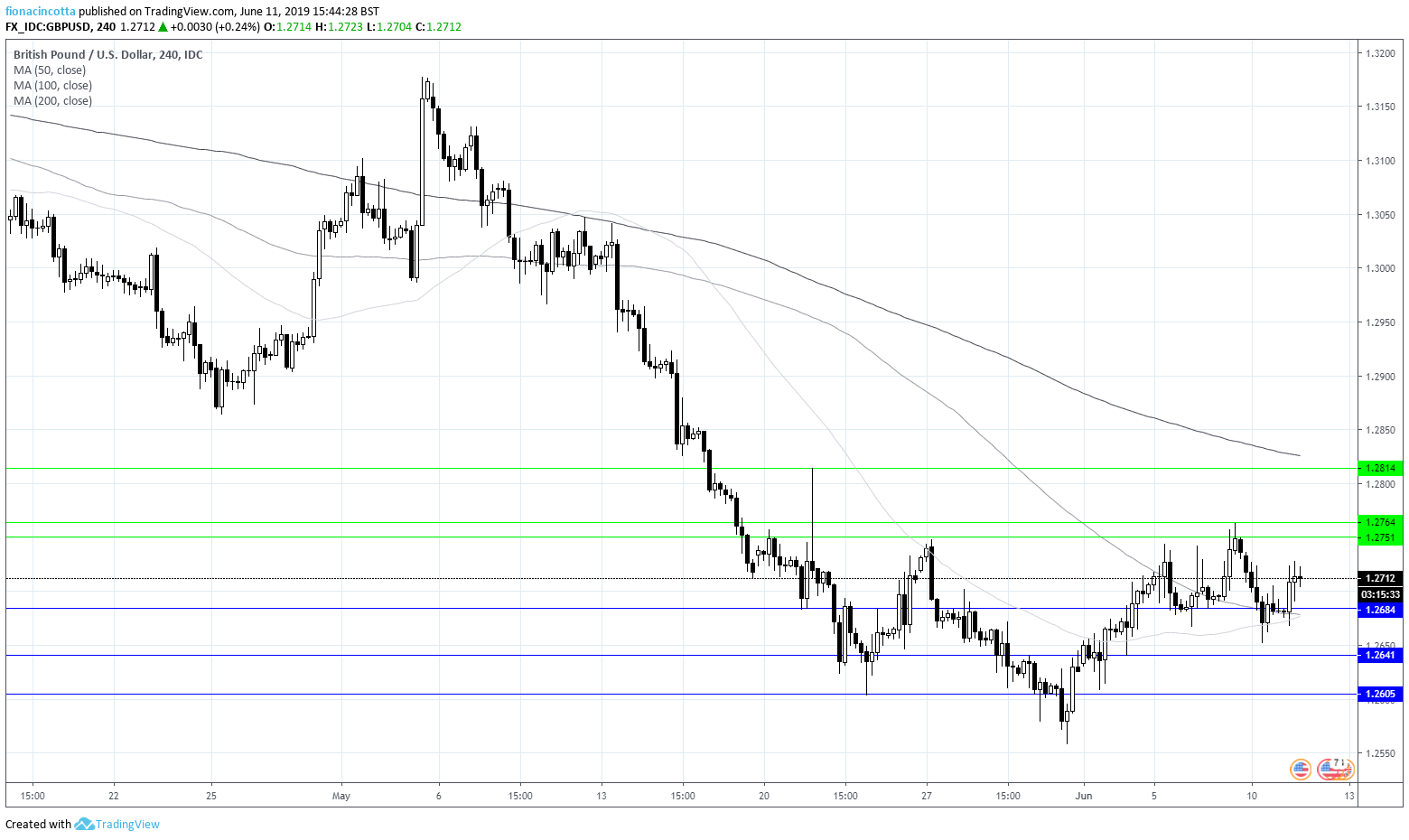

GBP/USD Levels to watch:

GBP/USD uptrend is marginally positive as it trades above 50 and 100 sma, but below 200 sma. Support can be seen at $1.2685 prior to $1.2640 and $1.2605. On the upside resistance $1.2750, $1.2763 and $1.2815.