As rising prices have become the primary focus of the Federal Reserve (and the broader public) in recent months, inflation readings have surpassed the Non-Farm Payrolls report as the marquee data release each month. And while the public tends to focus more on the CPI reports, the Fed will be most interested in Friday’s Core Personal Consumption Expenditures (PCE) report, the final such reading before the central bank meets next month to decide whether to raise interest rates by 0.25% or 0.50%.

What to expect from Core PCE?

After the most recent US CPI report showed consumer prices rising 7.5% and producer prices surging 9.7% in January, it’s unlikely that this week’s Core PCE report will show an immediate easing of price pressures.

In terms of expectations, economists are anticipating a slightly-less-dramatic 5.2% increase from Friday’s report (for reference, core PCE rose a slightly-less-dramatic 4.9% in December, up from a 4.7% rise in November). Indeed, even Fed Chairman Jerome Powell is expecting an elevated reading; in his January press conference, he noted that "since the December meeting, I would say that the inflation situation is about the same but probably slightly worse. I’d be inclined to raise my own estimate of 2022 core PCE inflation…"

Core PCE and Fed interest rates

As noted above, the Core PCE report will have a big impact on the Fed’s March decision. As it stands, traders are pricing in about a one-in-three chance of a 50bps “double” rate hike in March, but if Friday’s report shows inflation still accelerating, say with a 5.4%+ y/y reading, it could tilt the odds in favor of a more aggressive move. Meanwhile, a sub-5.0% reading would support the view that we may be seeing price pressures cresting and would likely provide a “green light” for a more traditional 0.25% interest rate increase from the Fed next month.

Either way, with traders split between two potential outcomes, Friday’s release is likely to lead to market volatility as market participants adjust to arguably the most important data release ahead of the Fed’s expected liftoff.

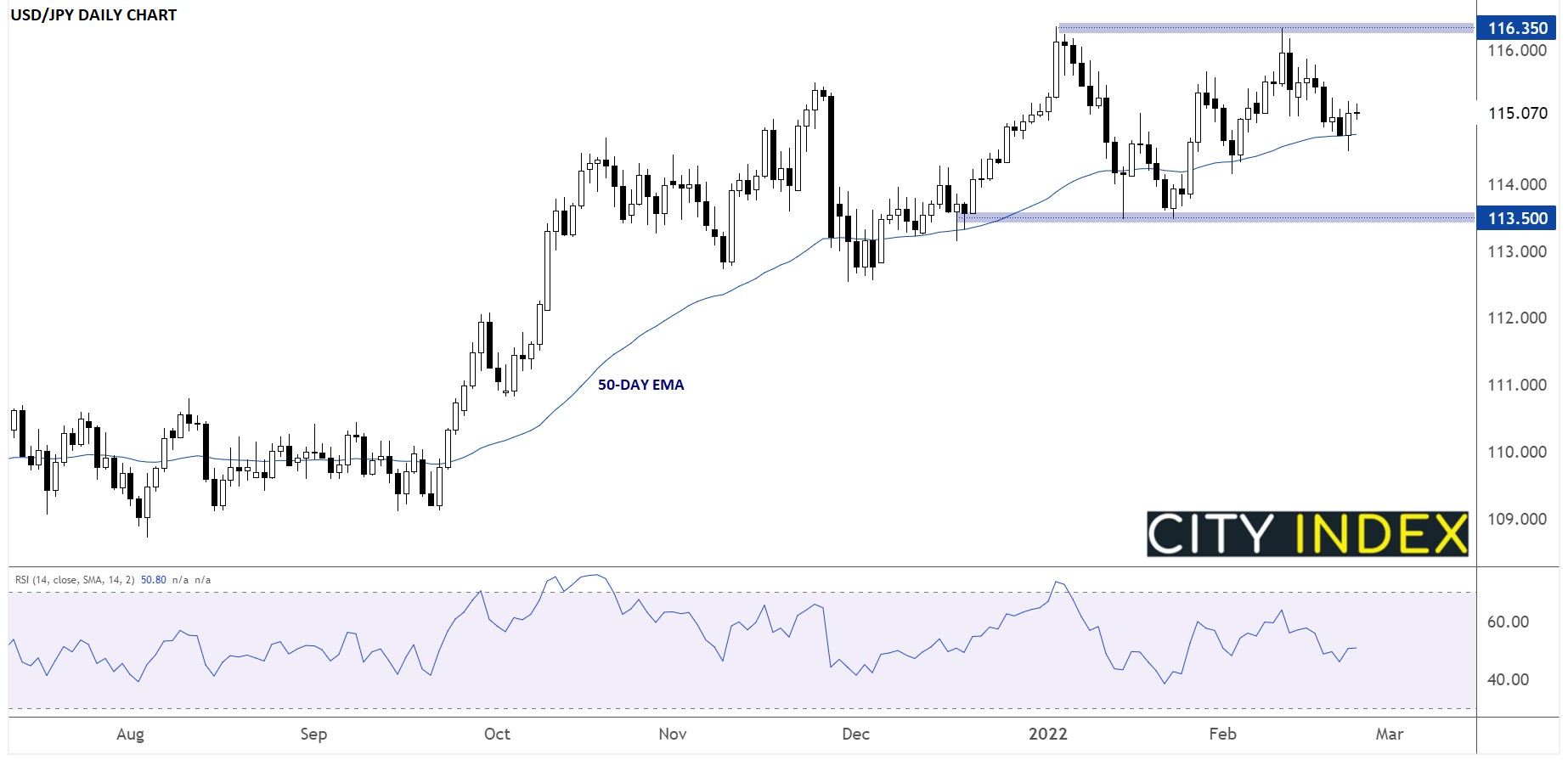

In terms of specific markets to watch, USD/JPY may well see a clean reaction to Friday’s release. The pair is currently holding above its rising 50-day EMA, and a hot inflation reading could extend the bounce toward resistance above 116.00 as traders price in a higher likelihood of a 50bps hike in three weeks’ time. Meanwhile, a soft Core PCE print could see USD/JPY drop below this week’s low at 114.50 and bring the year-to-date lows around 113.50 into view for bears.

Source: TradingView, StoneX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade