The Chinese financial technology giant was due to carry out a dual listing in Shanghai and Hong Kong which was set to raise $34.5 billion, making it the biggest IPO of all time.

However, the record break debut has hit a snag and China is stopping Jack Ma’s record-breaking IPO from going ahead, in a very surprising move.

The official line is that the most hotly anticipated IPO can’t go ahead due to a significant change in the regulatory environment, although no more details are being given.

Alibaba tanks

Alibaba, Ant’s one third shareholder dived -6% on the news as the doubts over the future of Ant emerge. A meeting between Jack Ma, China’s central bank and top financial regulators is a clear sign that regulatory pressures are going to be increasing. Ant could be treated more like a bank than a tech firm, bad news for Ant.

Alibaba, Ant’s one third shareholder dived -6% on the news as the doubts over the future of Ant emerge. A meeting between Jack Ma, China’s central bank and top financial regulators is a clear sign that regulatory pressures are going to be increasing. Ant could be treated more like a bank than a tech firm, bad news for Ant.

Could this feed back into the wider market?

The move by the authorities to halt the listing under the direct glare of the media could have even deeper repercussions. Alibaba is considered an example of how the Communist party in China has enabled entrepreneurs to flourish, in its political system. Could this move by the authorities cast a shadow over the financial markets in China just as Premier Xi Jinping is attempting to create stock exchanges that rival those of the US?

The move by the authorities to halt the listing under the direct glare of the media could have even deeper repercussions. Alibaba is considered an example of how the Communist party in China has enabled entrepreneurs to flourish, in its political system. Could this move by the authorities cast a shadow over the financial markets in China just as Premier Xi Jinping is attempting to create stock exchanges that rival those of the US?

------------------------------------------------------------------------------------------------------------------------------

What is Ant Group?

Ant Group in the financial arm of Alibaba, the e-commerce giant. Headquartered in the Chinese city of Hangzhou, Ant provides financial and payment services to over 700 million users, processing trillions of dollars every year. As you might expect with these huge fintech giants this is an all in one platform where users can spend, save, invest use credit or debit, in addition to the distribution of wealth management and insurance products. Over the past 12 months, ending in June Ant reported that it processed $17 trillion in digital payments, recording $18 million in revenue and $2.8 billion in profits.

Ant Group in the financial arm of Alibaba, the e-commerce giant. Headquartered in the Chinese city of Hangzhou, Ant provides financial and payment services to over 700 million users, processing trillions of dollars every year. As you might expect with these huge fintech giants this is an all in one platform where users can spend, save, invest use credit or debit, in addition to the distribution of wealth management and insurance products. Over the past 12 months, ending in June Ant reported that it processed $17 trillion in digital payments, recording $18 million in revenue and $2.8 billion in profits.

When, Where & How Much

Ant shares are expected to start trading in Hong Kong and Shanghai on November 5th, two days after the US election.

Ant shares are expected to start trading in Hong Kong and Shanghai on November 5th, two days after the US election.

Ant is poised to raise $17.2 billion on Shanghai’s STAR market and approximately the same in Hong Kong

The mega deal would value Ant at around $312 billion a punchy 31 times next years’ forecast earnings. The company is set to smash records on many levels. If it achieves its valuation, Ant is will be the fourth biggest financial company in the world after Berkshire Hathaway, Visa and Mastercard. The money raised at the IPO will also obliterate the $29.4 billion listing of Saudi Arabian Oil Co (Aramco) last year.

Oversubscribed

Demand has proved to be incredibly strong after Ant’s order books on the Hong Kong offering to institutional investors was oversubscribed just one hour after the launch. 97.5% of the Hong Kong shares will go to institutional investors. According to Reuters, Ant Group’s Shanghai retail book was 872 time oversubscribed as retail investors scrambled to get a piece of the world’s largest IPO. Fear of missing out can’t be ignored here.

Demand has proved to be incredibly strong after Ant’s order books on the Hong Kong offering to institutional investors was oversubscribed just one hour after the launch. 97.5% of the Hong Kong shares will go to institutional investors. According to Reuters, Ant Group’s Shanghai retail book was 872 time oversubscribed as retail investors scrambled to get a piece of the world’s largest IPO. Fear of missing out can’t be ignored here.

Some of the demand can also be put down to big indexes. Creators of MSCI and FTSE are expected to add Ant’s Hong Kong shares within days. Those tracking will be fearful of being left out of potentially huge gains.

Investors are seemingly paying little attention to concerns over growing regulatory crackdown from Beijing for its lucrative consumer credit business. And its not just on home ground either, concerns are also growing over the US State Department’s proposal to the Ant Group to a trade blacklist. That said if Trump doesn’t win the election tomorrow, then the latter could be less of a concern given expectations that Joe Biden will adopt a softer approach with China.

Not Always Plane Sailing

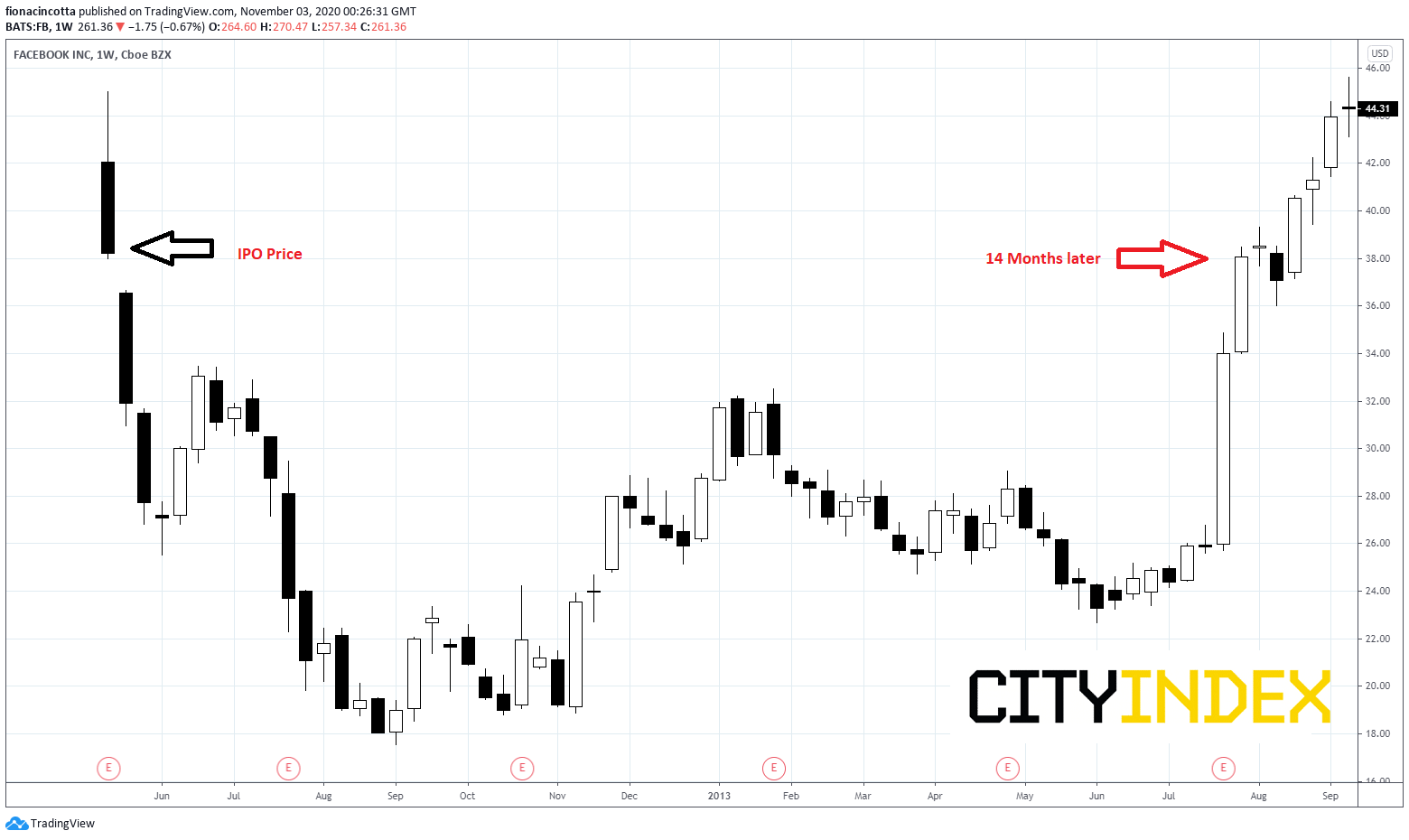

We know from the likes of Facebook and even Alibaba, Ant’s one third shareholder, that these hotly anticipated IPO’s don’t always go as planned. FB’s 2012 $16 billion public debut saw the shares tumble 10% within the first two days of trading, which then took over a year to be clawed back to its $38 IPO price.

Meanwhile Alibaba popped 38% in its IPO. However, it then went from trading at around 44 times expected earnings to 22 the year after the IPO.

Ant has huge expectations to live up to. Broadly speaking Ant's future looks promising, but that doesn't mean that its immune from a short term swoon.

Facebook Chart

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM