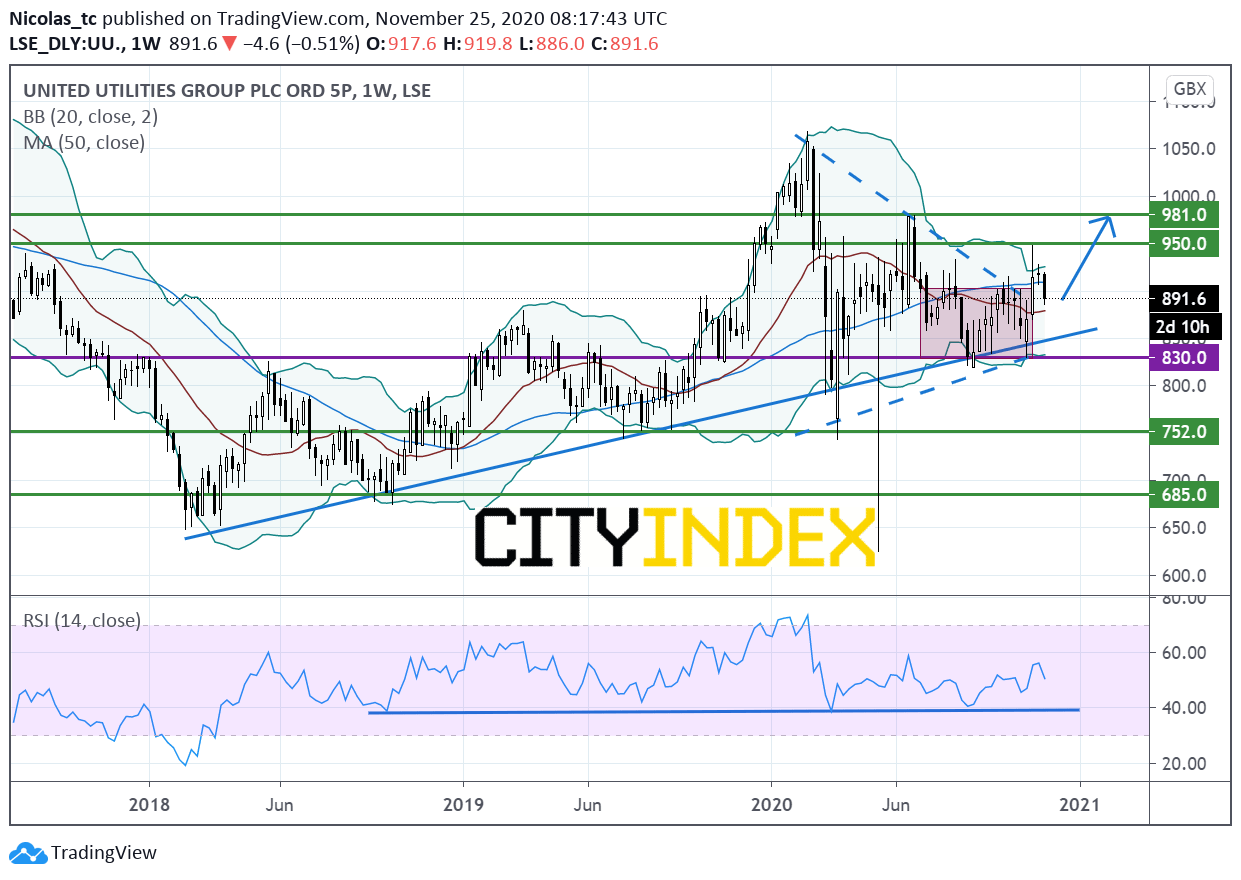

United Utilities shares supported by a rising trend line

United Utilities, a water company, announced that 1H underlying profit after tax dropped 16.0% on year to 174 million pounds and underlying operating profit slid 18.5% to 319 million pounds on revenue of 894 million pounds, down 4.4%. The company proposed an interim dividend of 14.41p per share, up from 14.20p per share in the prior-year period.

From a chartist point of view, the stock price is supported by a rising trend line in place since February 2018. A potential inverted Head & Shoulders pattern is taking shape. However, the 50WMA started to flatten out. Readers may consider the potential for opening Long positions above key support at 830p with 950p and 981p as targets. Alternatively, a break below the long term rising trend line would call for a reversal down trend towards 752p and 685p.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM