Unilever withdraws guidance - Morning star pattern is a sign of hope

Unilever, a consumer goods company, posted a 1Q trading update: "Underlying sales were flat with volume growth of 0.2% and negative price of 0.2%. Turnover increased 0.2%. The unknown severity and duration of the pandemic, as well as the containment measures that may be adopted in each country, mean that we cannot reliably assess the impact across our markets and our business. We are therefore withdrawing our previous growth and margin outlook for 2020."

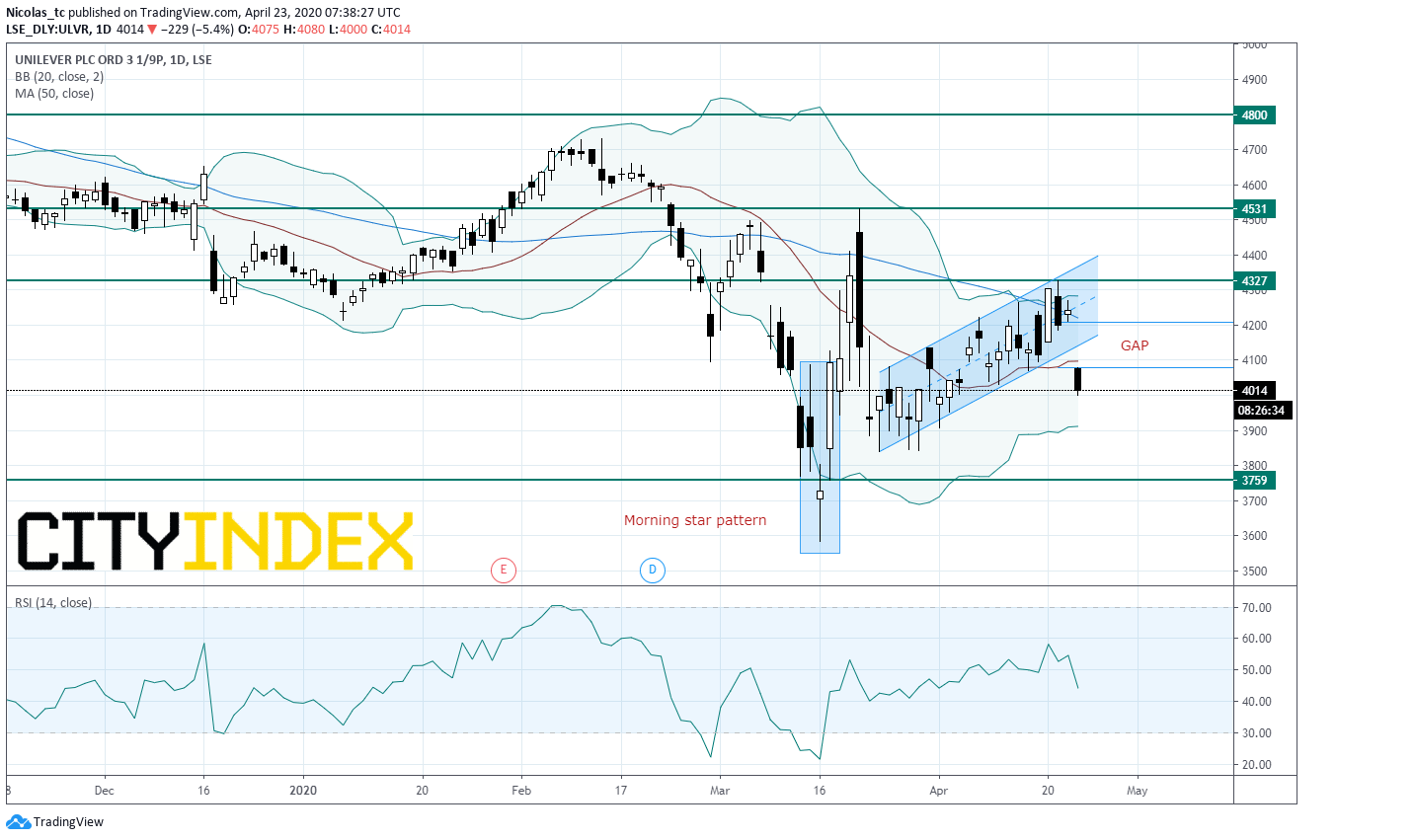

From a technical perspective, the morning star pattern formed in March on a daily chart remains in play. It is a sign of a reversal in the previous price down trend. However, the daily Relative Strength Index (RSI, 14) failed to confirm the breakout of its neutrality area at 50%. The 50-day simple moving average is still descending and plays a resistance role around the gap opened this morning. The configuration is mixed.

From a technical perspective, the morning star pattern formed in March on a daily chart remains in play. It is a sign of a reversal in the previous price down trend. However, the daily Relative Strength Index (RSI, 14) failed to confirm the breakout of its neutrality area at 50%. The 50-day simple moving average is still descending and plays a resistance role around the gap opened this morning. The configuration is mixed.

Prices need to break above April 21th high at 4327 in order to validate a bullish signal. It would lead to the validation of a piercing line pattern on a weekly chart. If the resistance at 4327 is broken, look for 4800.

Caution: A break below 3759 would call for a new down trend towards 3415.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM