Mid-cap focused FTSE 250 can extend outperformance vs. FTSE 100 even if sterling stays weak

UK-centric assets were in the spotlight on Friday, helped by optimism that Brussels and London are on the scent of a Brexit deal. Ireland’s foreign Minister Simon Coveney served a reality check, though, noting that a Brexit deal is “not close”.

The pound duly returned most of it 0.8% gain to its highest levels since July. It traded around $1.25 again at last check from closer to $1.26 earlier. Its slide trimmed rallies of Brexit-sensitive markets like Britain’s FTSE 250 for a while. The mid-cap index’s constituents generate more of their revenues in the United Kingdom (now about 46%, according to FactSet) than the FTSE 100 benchmark (around 23%). MCX slipped to a gain of as little as a tenth of a percentage point though eventually recouped to close 0.4% higher, with the FTSE 100 ending a tad lower. Initial rebounds by consumer-tied sectors like housebuilders and retailers also partially unwound.

Still, with the FTSE 250 reasserting its long-term outperformance of the FTSE 100 so far this year, does the mid-cap gauge even need a sterling rally these days in order to strive? It’s worth noting that FTSE 250 firms now make less of their sales in Britain than in recent history—about 46% in 2018, according to FactSet. That compares with closer to 60% within the past decade. FactSet pegs the FTSE 100’s UK revenues at 24%.

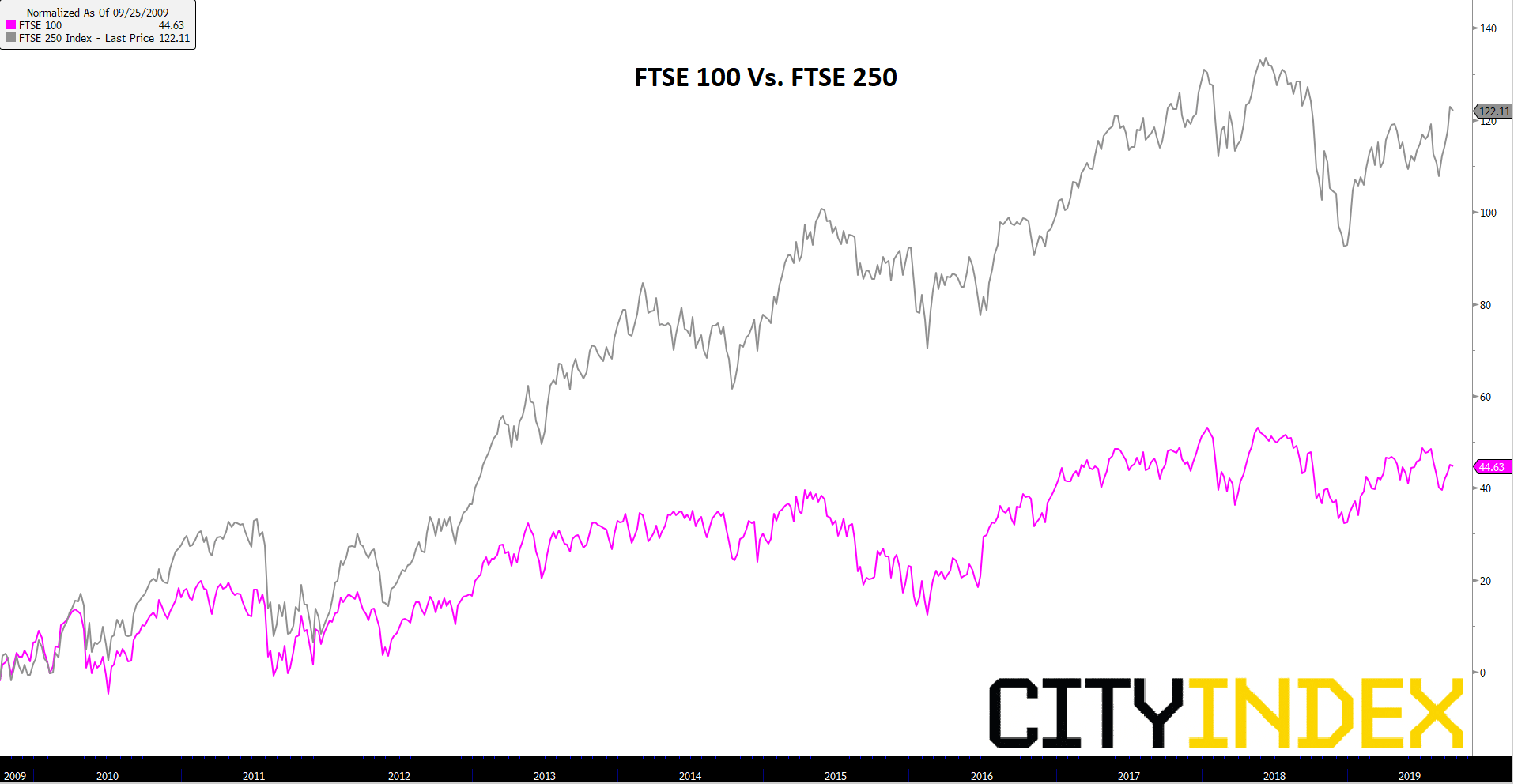

As demonstrated on Friday, a weakened link to sterling doesn’t exempt the FTSE 250 from Brexit related turbulence. On the other hand, whilst Britain’s ‘lower-tier’ market was initially dented by Britain’s vote to leave the European Union, the index has certainly not been weighed down by the pound relative to its counterpart, the FTSE 100. The two UK indices are normalised over a decade in the chart below.

Normalised chart: FTSE 100; FTSE 250 – 25-09-2019 to date

Source: Bloomberg/City Index

We can rationalise the FTSE 250’s strength relative to the benchmark in many ways. For one, perhaps the mid-cap markets’ composition of more ‘growth’ shares than the stodgy FTSE 100 give it the edge. This edge seems resilient too. As Brexit reached a crescendo this year the MCX barely kept its lead against UKX. Yet over the last month, the FTSE 250 is again pulling definitively ahead. The FTSE 250 has risen 15% so far this year whilst the FTSE 100 is up 9%.

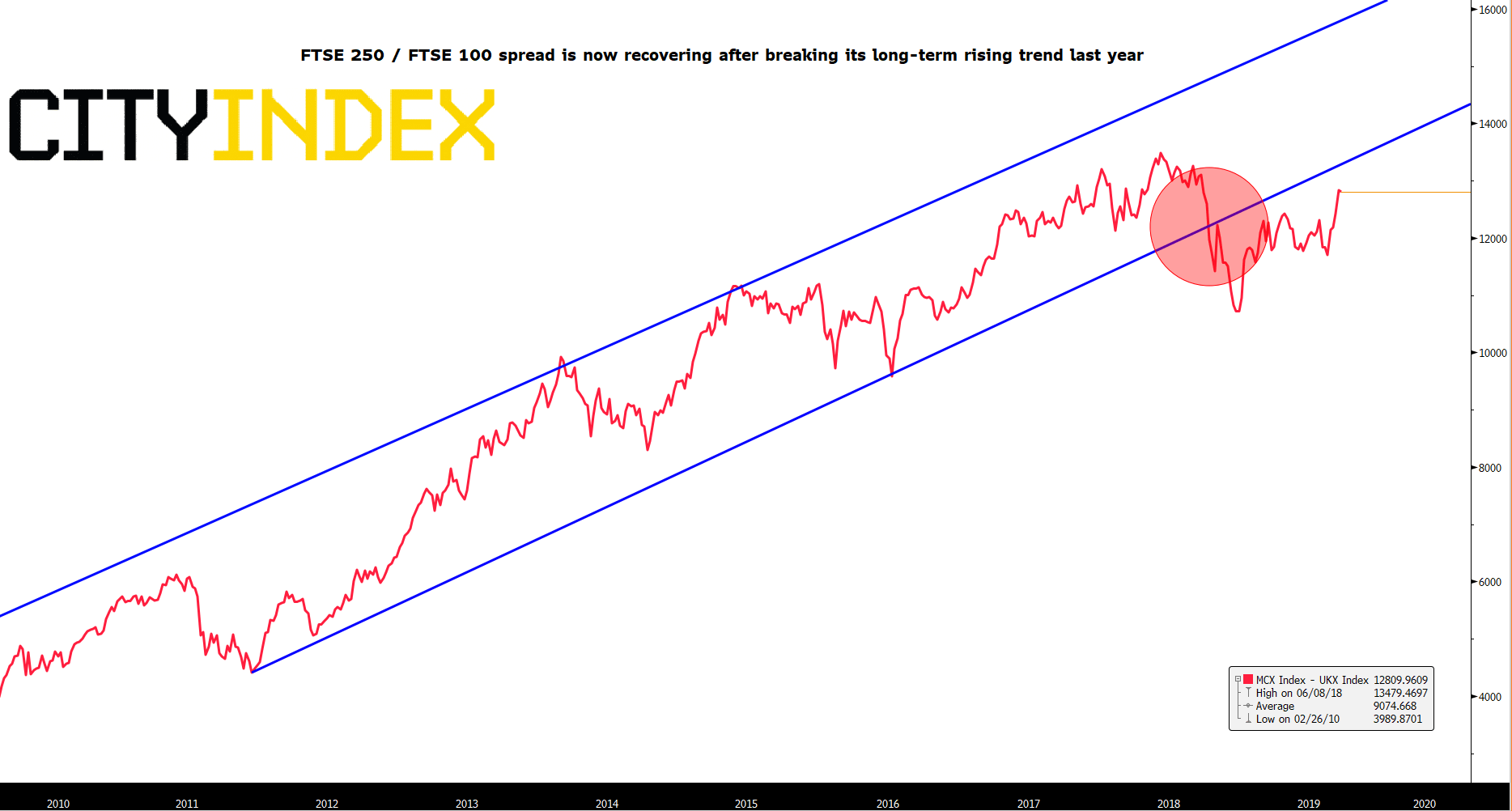

From a chart perspective, resumption of MCX strength relative to UKX appears to be at an early stage, though it shows promise. The FTSE 250/FTSE 100 spread broke below its bullish long-term channel late last year. However it has sustained an upswing since then and looks on course to re-enter the structure. If it does, the market can be expected to extend its uptrend further, possibly to the detriment of the FTSE 100. The FTSE could only get the upper hand if the FTSE 250 fails to regain its prior trend in the medium term.

FTSE 250 / FTSE 100 spread – weekly

Source: Bloomberg/City Index