UK Lockdown Pushing GBP Pairs lower: GBP/USD. GBP/CAD, GBP/AUD

Over the weekend, PM Boris Johnson announced that the UK will enter a national lockdown from Thursday until December 2nd, when the current local tier system will be used again. Although restaurants and bars and non-essential stores will close as they did in the first lockdown, schools, colleges and universities, and manufacturing businesses will remain open. Combine this with Brexit jitters and an expected dovish BOE on Thursday, the Pound pairs are anxious.

For complete analysis of GBP/USD, please see Currency Pair of the Week.

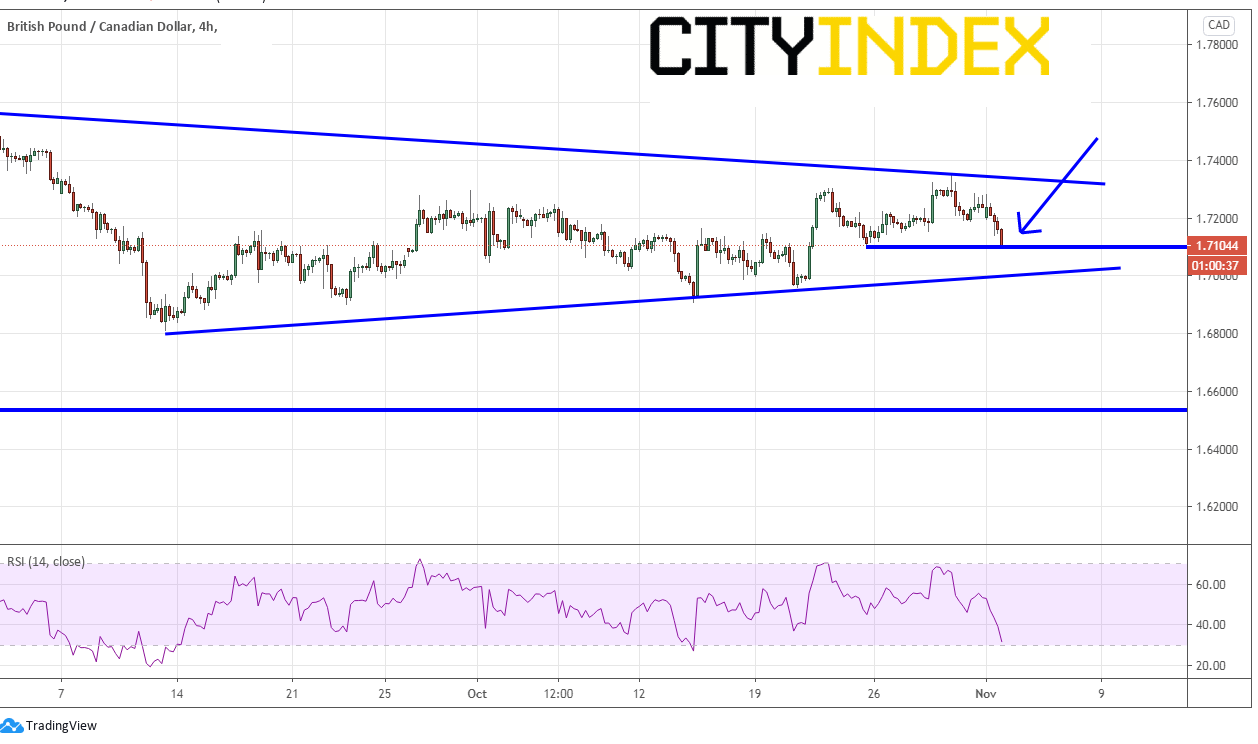

GBP/CAD

GBP/CAD has been trading in a symmetrical triangle since late July. Currently the pair is at support in the middle of the triangle at support near 1.7100. Watch for the pair to trade lower to the bottom, upward sloping trendline of the triangle near 1.7000, especially if Crude Oil trades higher (which means stronger Canadian Dollar, therefore weaker GBP/CAD).

Source: Tradingview, City Index

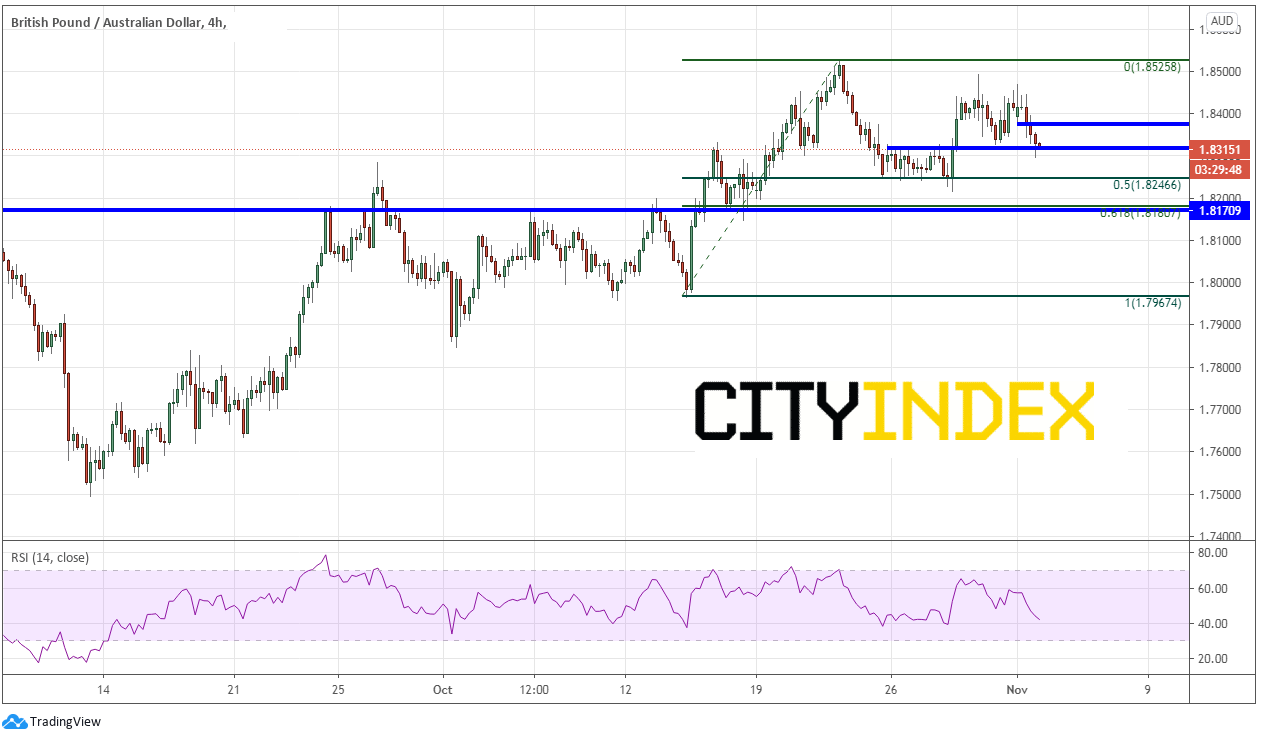

GBP/AUD

GBP/AUD was trading higher into mid-October, however with uncertainty surrounding Brexit and strengthening fundamentals in Australia, the pair began moving lower, Today the pair briefly pushed through horizontal support near 1.8320 and bounced, currently holding that level. If the pair does break lower, next support is near 1.8250, which is the 50% retracement level from the lows of October 14th to the highs of October 20th. Short term horizontal resistance is near 1.8360, then the previous highs at 1.8525.

Source: Tradingview, City Index

As mentioned in the Currency Pair of the Week, please be sure to trade GBP pairs lightly this week, with tight stops and small size. Headline risk is huge this week!!