UK inflation puts BoE on target

UK December CPI reached the Bank of England’s 2.0% target for the 1st time since Nov 2009 when it hit 1.9%. The last time the […]

UK December CPI reached the Bank of England’s 2.0% target for the 1st time since Nov 2009 when it hit 1.9%. The last time the […]

UK December CPI reached the Bank of England’s 2.0% target for the 1st time since Nov 2009 when it hit 1.9%. The last time the 2.0% was hit was in April 2006.

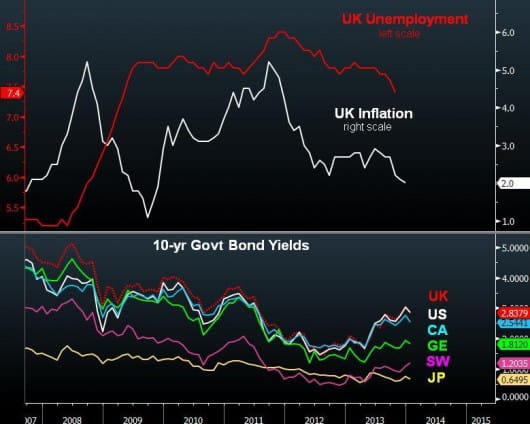

With inflation at 2.0% (down 61% from 2011 highs) and unemployment at 7.4% (down 24% from 2011 highs), the Bank of England is the only G7 central bank attaining its inflation target along a clear downward trajectory in unemployment.

The bulk of the slowdown in inflation emerged from food and non-alcoholic beverages, which registered the slowest rise in 7 years. Transport was the biggest gainer in the CPI figures, resulting from motor fuel.

Despite the fall in oil prices, petrol prices remained on the rise. Looking forward, doubts about the staying power of these figures stem from recent energy price hikes and the extent to which rising house prices will spread beyond London.

Sterling’s trade weighted index is at neatly 5 ½ year highs and up 10% from the lows of March 2013. This could help cap any rebound in inflation emerging from rising gas and electricity costs in the months to come.

No goal-line technology from the BoE

The inflation slowdown towards the Bank of England’s 2.0% target bolsters the credibility of the central bank’s forecasts, while ultimately reiterating the question whether the 7.0% unemployment threshold will be lowered as part of forward guidance.

As long as 10-year gilt yields remain suppressed under 3.30% (due to downside economic surprises in the UK and abroad and/or impending equity market selloff), the BoE will be in no hurry to move the goal posts of its forward guidance. Thus, the 7.0% unemployment threshold can still be maintained as long as the BoE skillfully shifts emphasis away to slowing inflation; thereby reducing the need to tighten policy. The BoE’s success in talking down yields will be in function of bond traders’ manoeuvres in the face of falling jobless rate.

With plenty of talk about the USD gaining dominance in 2013 due to policy normalisation from the Fed and higher GDP growth, GBP deserves more credit as inflation stands above that of the US; while UK unemployment declines at similar pace to the US. The UK “housing bubble” may be avoided by broadening supply (which was not the case in 2007). We expect GBP/USD to remain supported at $1.5880 in Q1 before regaining $1.7000 in late Q2.