UK GDP in-line, GBP/USD bulls watching for a break above 1.3900

After yesterday’s highly-anticipated US Consumer Price Index (CPI) report, traders refocused their attention across the Atlantic to the Q2 UK Gross Domestic Product (GDP) report.

While GDP data is by definition backward-looking and stale by the time it gets released, it can still provide valuable insight on the trends in the underlying economy. As it turns out with this morning’s report, the market got almost exactly what it was expecting: The UK economy expanded by 4.8% in Q2 following a 1.6% contraction in Q1. Digging into the details, both consumption (7.3% growth vs. -4.6% in Q1) and government spending 6.1% growth vs. 1.5% in Q1) were areas of strength, while business investment came in soft (up 2.4%, well below the 6% economists were expecting).

On balance, the GDP report highlights the stop-and-start nature of the economic recovery in the UK, where the start of Q2 saw strong growth before slowing in June. With the July PMI report coming in above expectations and UK COVID cases (hopefully) past their peak, there are reasons for optimism around the UK economy heading into Q3.

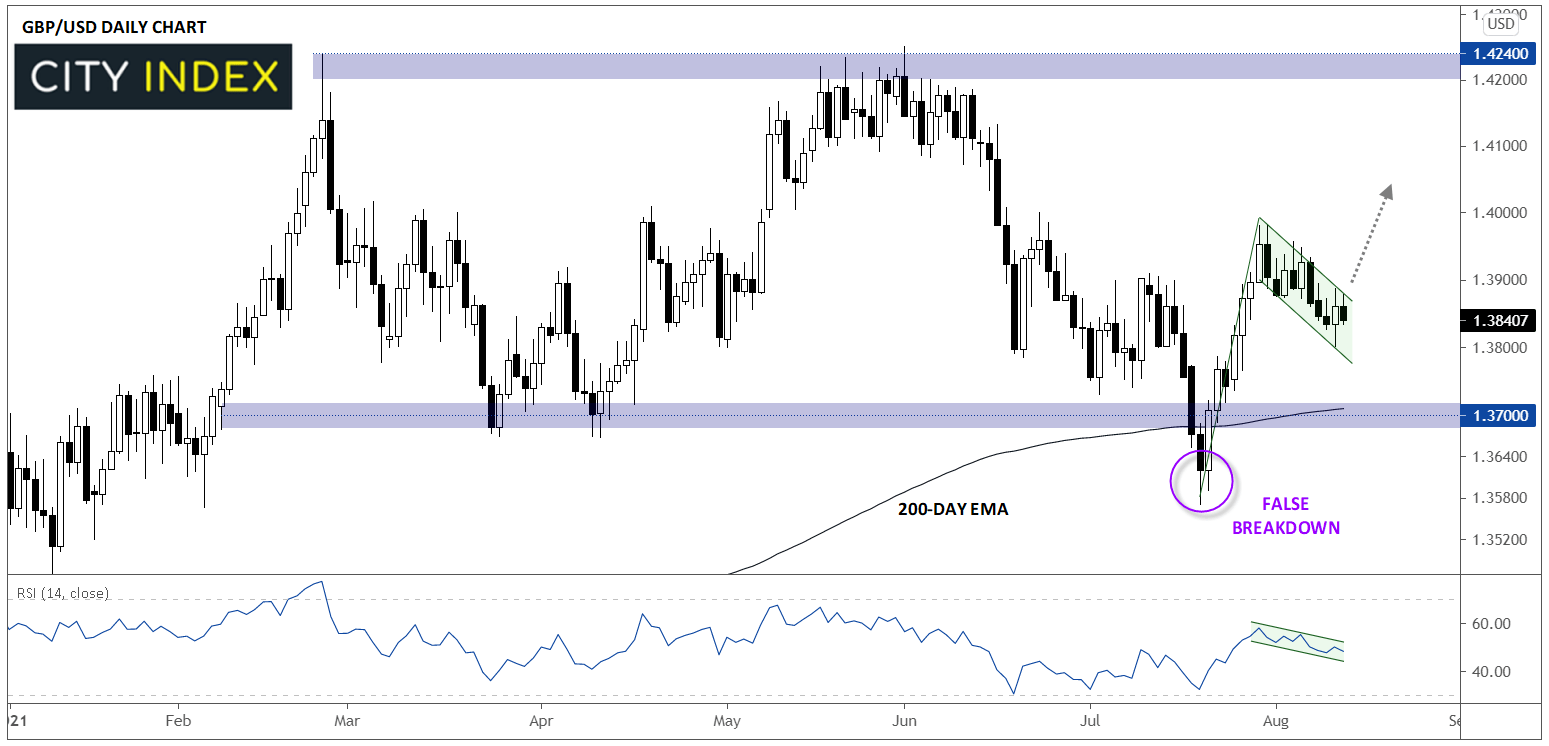

Looking at the chart of GBP/USD, rates are pulling back slightly today, keeping the pair within its tight two-week bearish channel. Taking a step back, cable is in the middle of its 6-month range after a false breakdown below 1.3700 midway through last month; from a bigger picture perspective, the false breakdown is a potentially strong bullish signal and raises the odds of GBP/USD eventually retesting the top of its range near 1.4200:

Source: StoneX, TradingView

Viewing the price action since the breakdown as a small “bullish flag” pattern, readers may want to consider buy opportunities if the unit can break above this week’s high in the 1.3900 area (ideally accompanied by an equivalent breakout in the RSI indicator), with room to rally toward 1.4100 or 1.4200 and a stop in the 1.3800 area. A break to new weekly lows would call the bullish bias into question and portend a potential retest of the 200-day EMA near 1.3700.

Looking ahead, the economic calendar is devoid of market-moving data until the UK employment report on Tuesday, a day that also features US retail sales figures, industrial production data, and an update from Fed Chairman Jerome Powell.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.