UK data dumped! GBP weaker

Earlier in the week, we discussed the upcoming data releases for the UK. The data has been released and the GBP/USD is not taking it so well. The Claimant Count Change for February was +86,600 was -17,000 expected. In addition, today’s CPI data was worse than expected, with headline CPI for February (MoM) of 0.1% vs 0.5% expected. That left the YoY rate at 0.4% vs and expectation of 0.8% and a previous reading of 0.7%! The core inflation rate (MoM) was just as bad, coming in a 0% vs 0.5% expected! The only bright spot the PMI data. Both Manufacturing and Services PMIs were much stronger than expected, resulting in a composite print of 56.6 for February vs 51.1 expected and 49.6 last! However, although GBP/USD bounced after the PMIs, the employment and inflation data seems to be overshadowing the PMI data, as the pair remains weak.

Have a look at some of the more common economic indicators

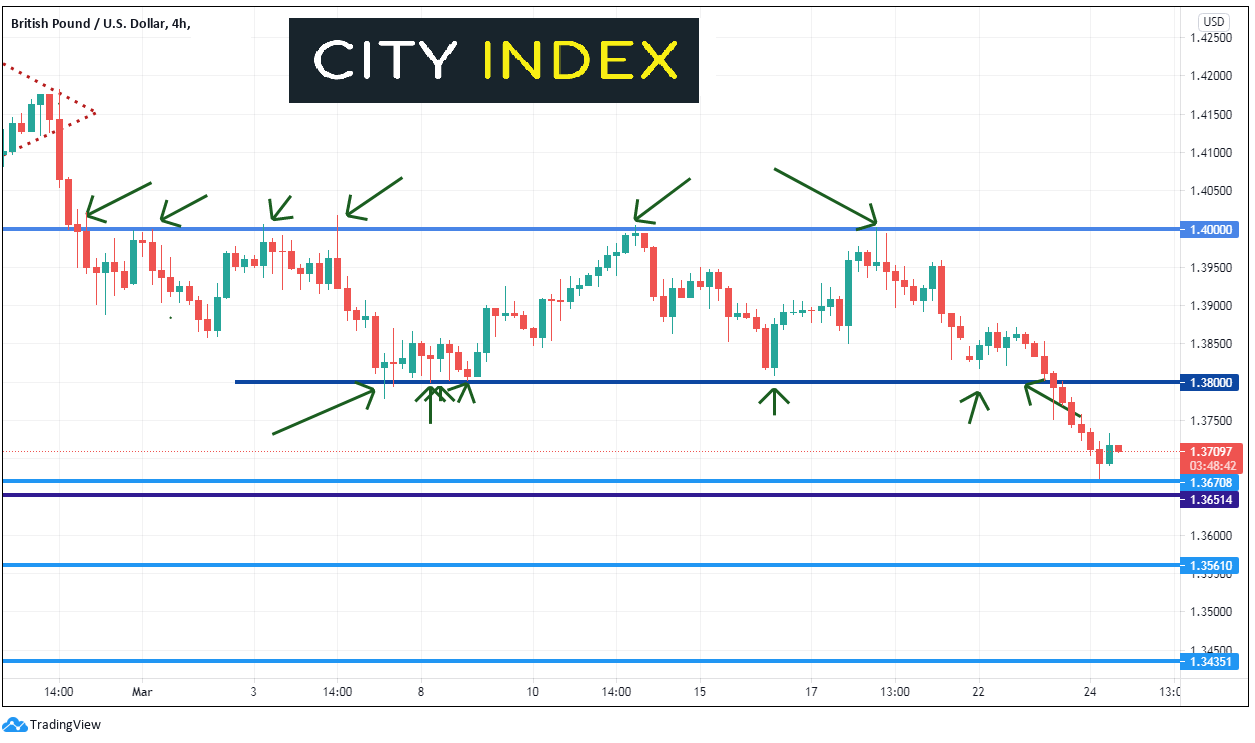

GBP/USD had been rangebound between 1.3800 and 1.4000. We speculated that the next direction in the pair could be dependent on the data. The weaker employment pushed GBP/USD below 1.3800 and the ensuing CPI data helped the pair move to 1.3670 before bouncing. Just below is horizontal support near 1.3650.

Source: Tradingview, City Index

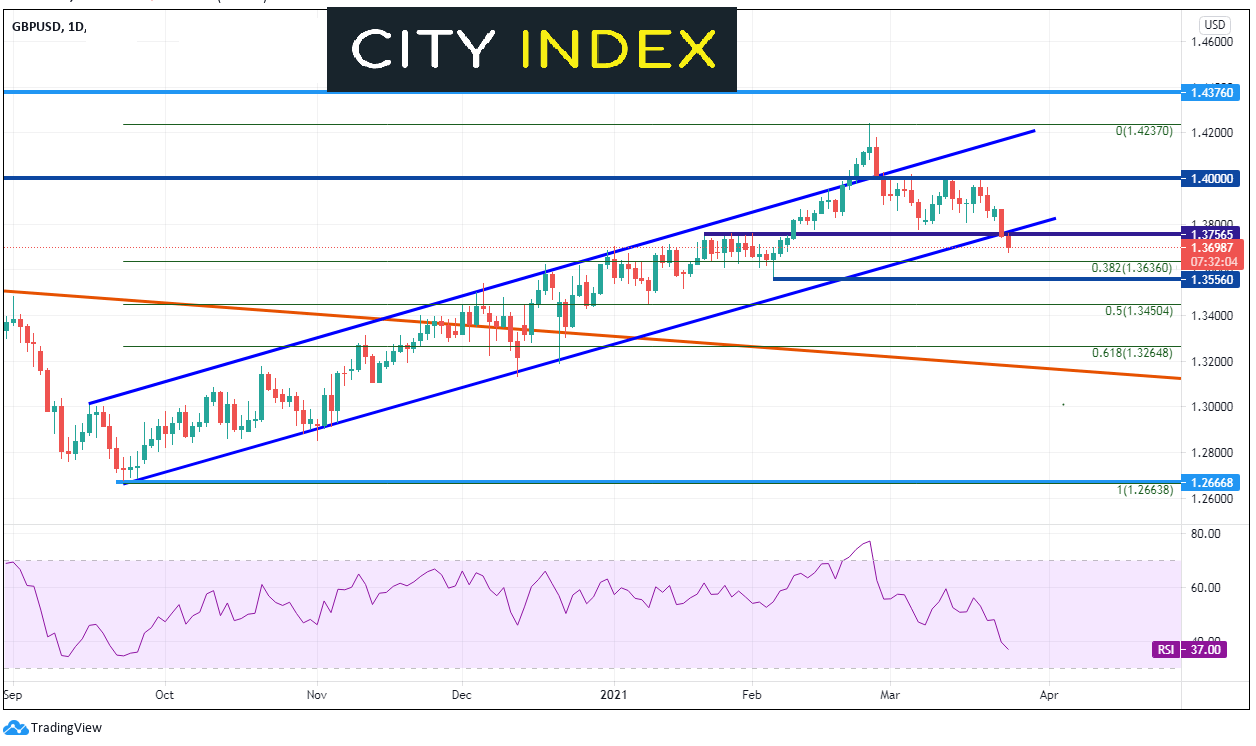

On a daily timeframe, note that GBP/USD broke below confluence of support, below the upward sloping bottom trendline and horizontal support. The next level of support is the 38.2% Fibonacci retracement level from the September 23, 2020 lows to the February 24th highs near 1.3636. Below there is horizontal support near 1.3556 and the 50% retracement level from the same timeframe near 1.3450. Resistance is at the previous confluence breakdown near 1.3756, the March 5th lows near 1.3778, and a series of horizontal resistance levels between 1.3800 and 1.4000.

Source: Tradingview, City Index

The bullish US Dollar over the past few days hasn’t helped GBP/USD either. The DXY moved from roughly 91.80 to 92.60 over the same time period.

If the US Dollar continues to rise, comments for BOE officials remain dovish, or poor inflation and employment data continue to come out of the UK, GBP/USD may have more room to go on the downside.

Learn more about forex trading opportunities.