UK data dump could trigger move in GBP

This week the UK will release a barrage of economic data that could fire up the GBP, as it is up against some key levels. At last week’s BOE meeting, the central bank said they will not tighten until they see significant progress being made in eliminating spare capacity and achieving the 2% inflation target sustainably. This week’s data may provide the markets some direction as to if the economy is moving towards the BOE’s goals! Below are the more important UK releases this week:

Claimant Count Change (FEB):

- Although there are a few parts to the jobs data to be released on Tuesday, the Claimant Change is the most recent, and therefore, most important. Expectations are for -17,000 people claiming unemployment benefits vs -20,000 in January (however the number had increased to 1.4 million since the pandemic began).

CPI (FEB):

- Expectations are for a rise of +0.5% MoM vs -0.2% in January. The YoY number is expected to by +0.8% vs +0.7% prior. The Core CPI is expected to rise +0.5% MoM vs -0.5% in January. However, the YoY number is expected to be unchanged at 1.4%.

Markit/CIPS Manufacturing PMI Flash (MAR):

- The manufacturing sector has been holding up well during the lockdowns and Brexit. Expectations are for a decrease to 55 from 55.1 in February. The reading has not been below the contraction/expansion 50 level since June 2020.

Markit/CIPS Services PMI Flash (MAR):

- The service sector hasn’t fared as well as the manufacturing sector over the last few months. However, expectations are for a rise to 51 for March vs 49.5 in February. This would be the first reading above the contraction/expansion 50 level since October 2020.

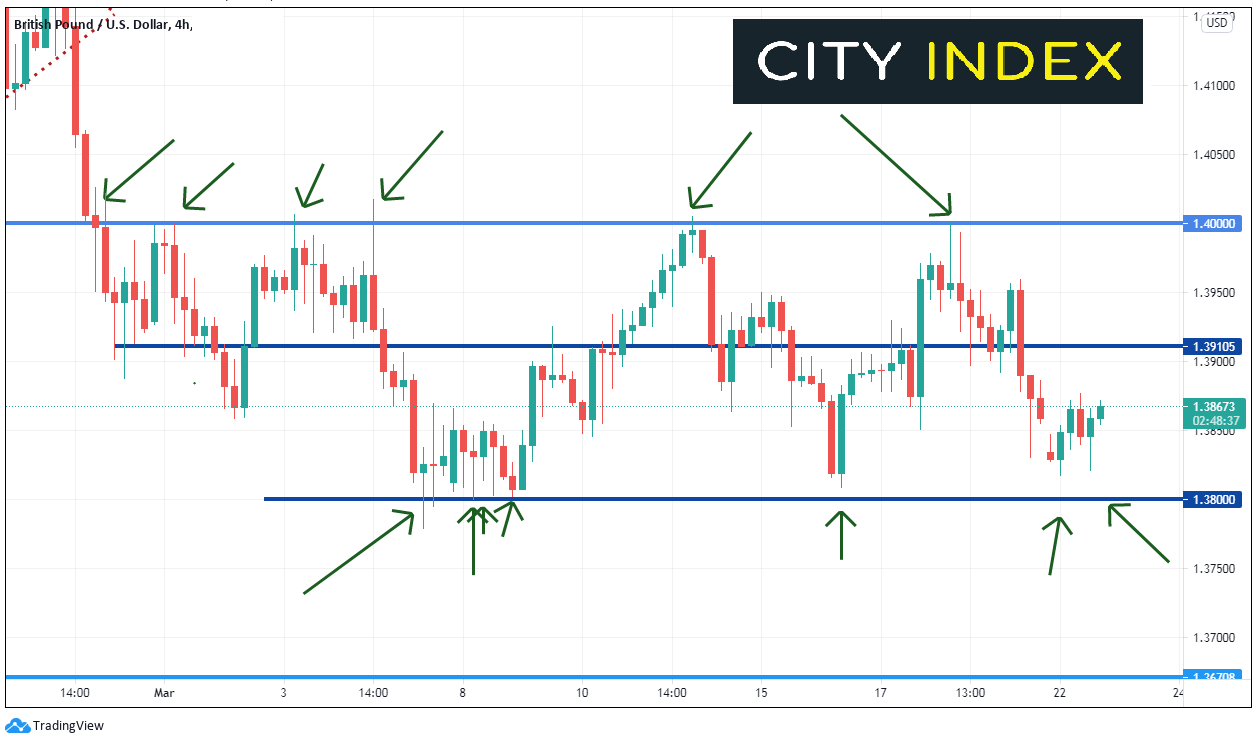

After a nice rally dating back to November of last year, GBP/USD has been in a consolidation pattern between 1.3800 and 1.4000.

Source: Tradingview, City Index

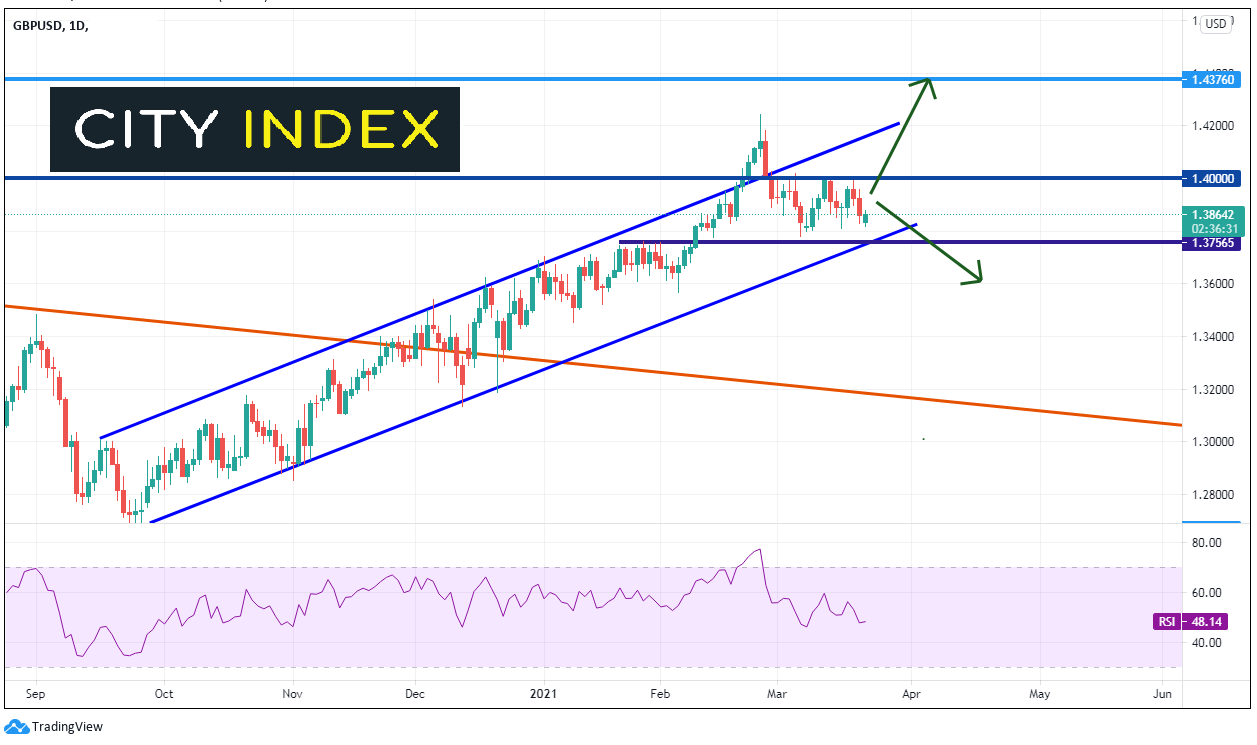

Stronger data could thrust the Pound back towards recent highs and channel trendline resistance near 1.4241. Worse than expected data could push the pair below the bottom of the channel and horizontal support near 1.3755.

Source: Tradingview, City Index

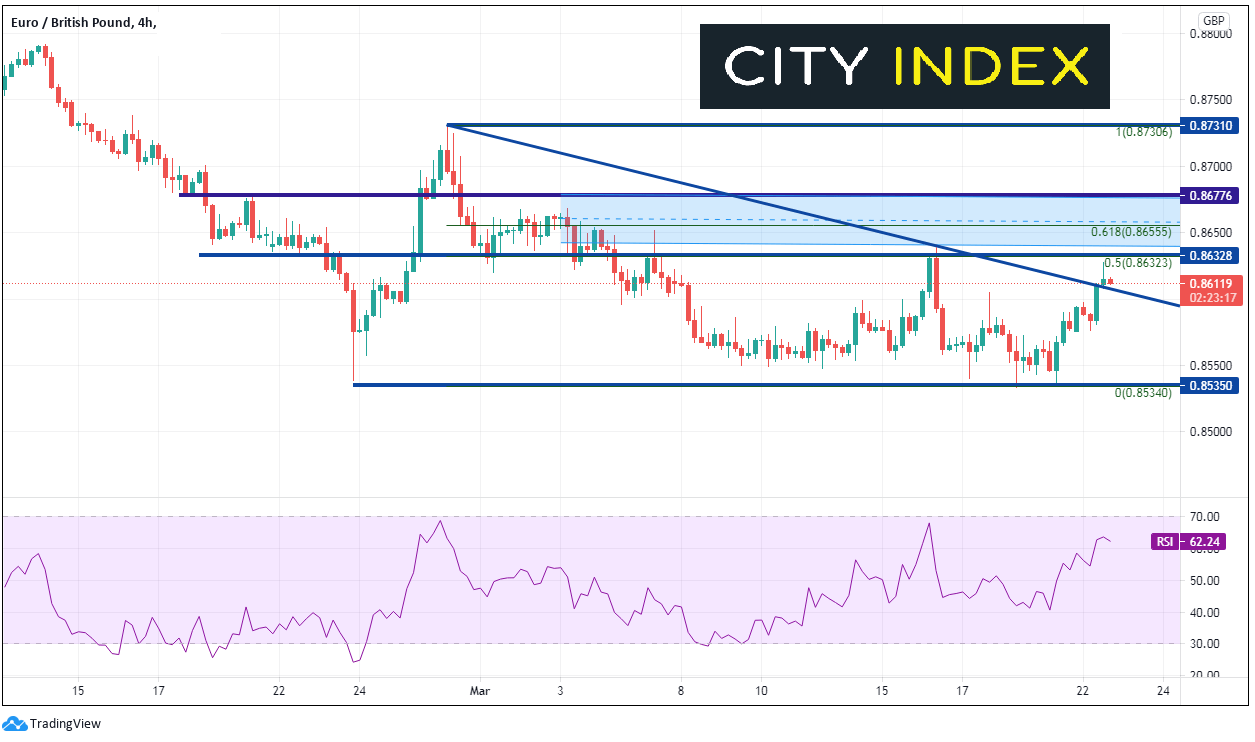

The pair has been moving lower since December 2020 and finally found support at 0.8533. EUR/GBP bounced over the weekend and has taken out a short-term, downward sloping trendline above 0.8584 and came to a halt near the 50% retracement level from the February 26th highs to the March 18th lows, near 0.8632.

Source: Tradingview, City Index

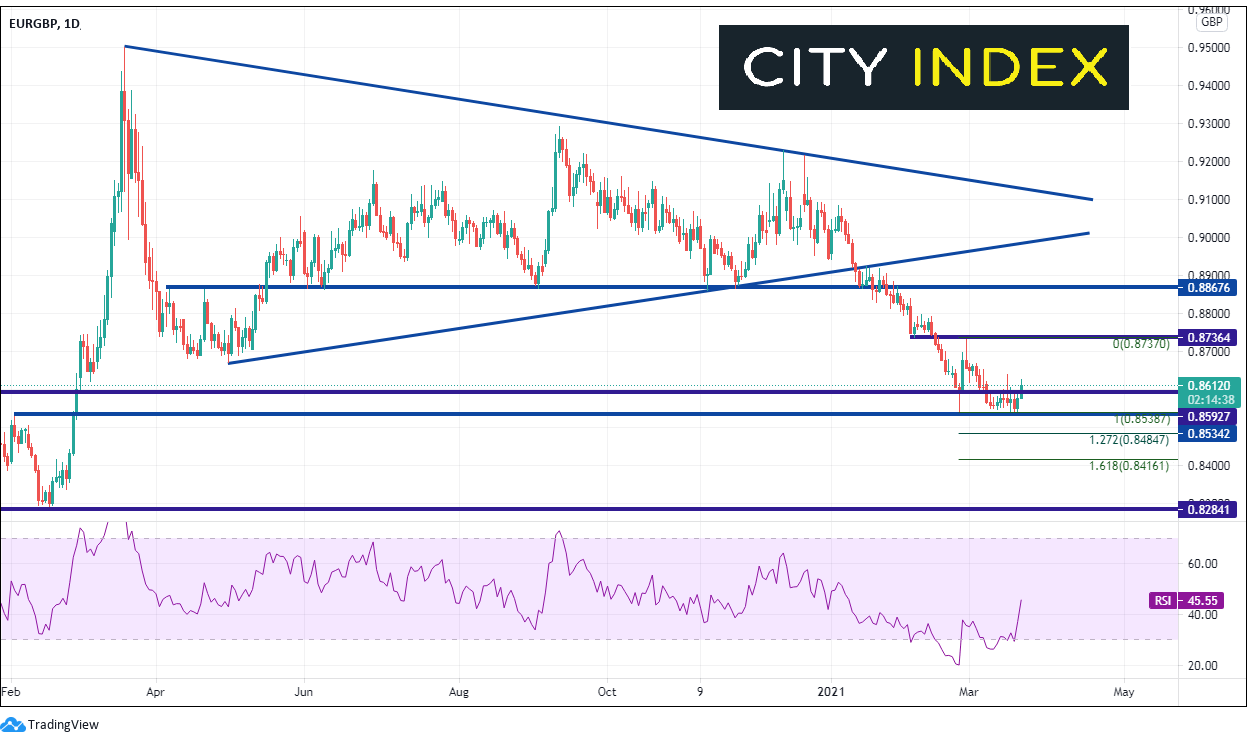

Stronger than expected data could push the pair below recent support at 0.8533 towards the Fibonacci extensions from the February 24th lows to the February 26th highs at 0.8485 (127.2%) and 0.8416 (161.8%). Horizontal support below crosses at 0.8284. Weaker data could push EUR/GBP above the February 26th highs at 0.8736. However, notice the sideways price action over the last 2 weeks allowed the RSI to return to neutral, which now allows the pair to move lower without the RSI in oversold territory.

Source: Tradingview, City Index

If trading the GBP pairs, watch for volatility around the data this week. Some GBP pairs have been consolidating for 2 weeks. Much stronger or weaker data could take out stops on either side of the ranges and allow these pairs to run!

Learn more about forex trading opportunities.