UK Claimant Count Better than Expected

The UK’s Claimant Count Change for January was +5,500 vs an expectation of +22,600 and a lower revised December reading of +2,600. For those keeping track at home, the claimant count measures the change in the number of unemployed over a given month. This is different than in most countries, where the change in the number of employed is measured. Therefore, a lower claimant count is better than expected and a higher claimant count is worse than expected. With the revision lower to December’s number, the combined 2-month total is only +8,100! This is stronger than any single month going back almost 2 years.

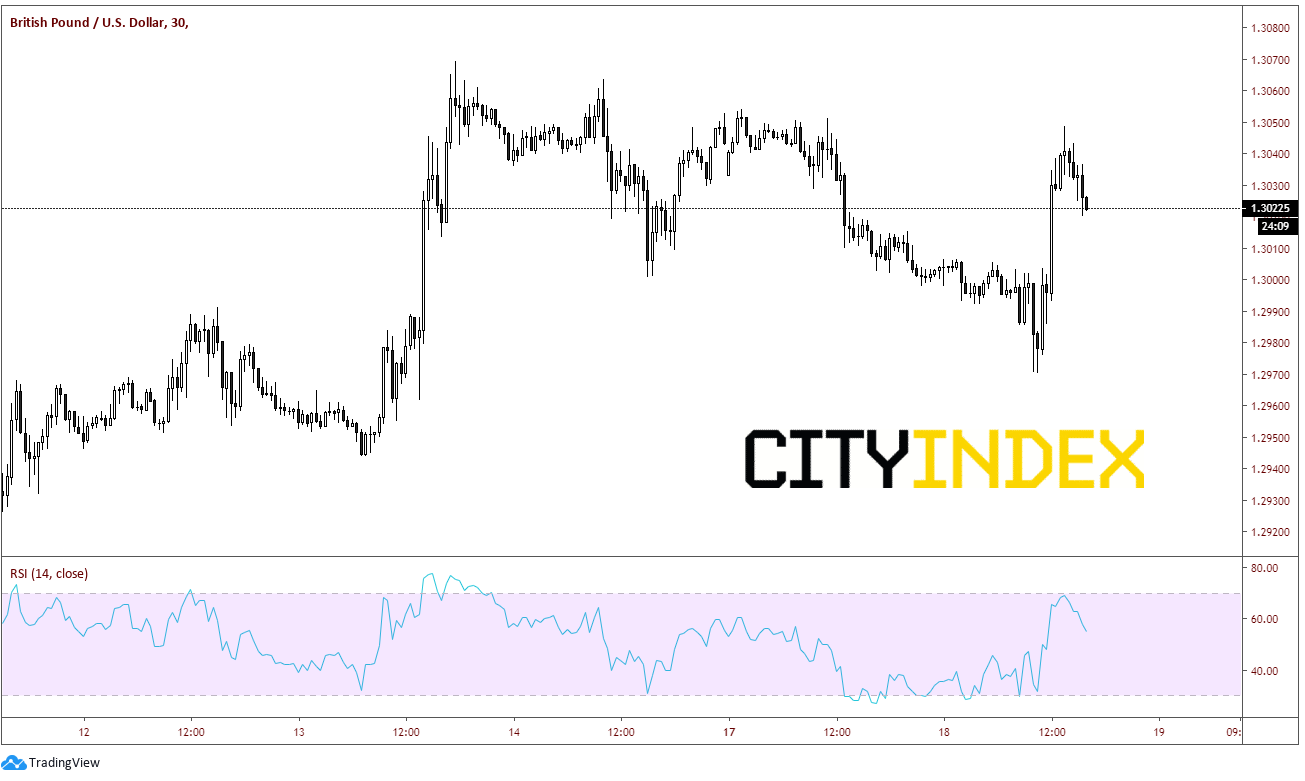

GBP/USD was already moving higher before the data, however once the pair broke through 1.3000, it was off to the races:

Source: Tradingview, City Index

Price traded as high as 1.3050 before pulling back. Resistance is 1.3050, then previous highs near 1.3070.

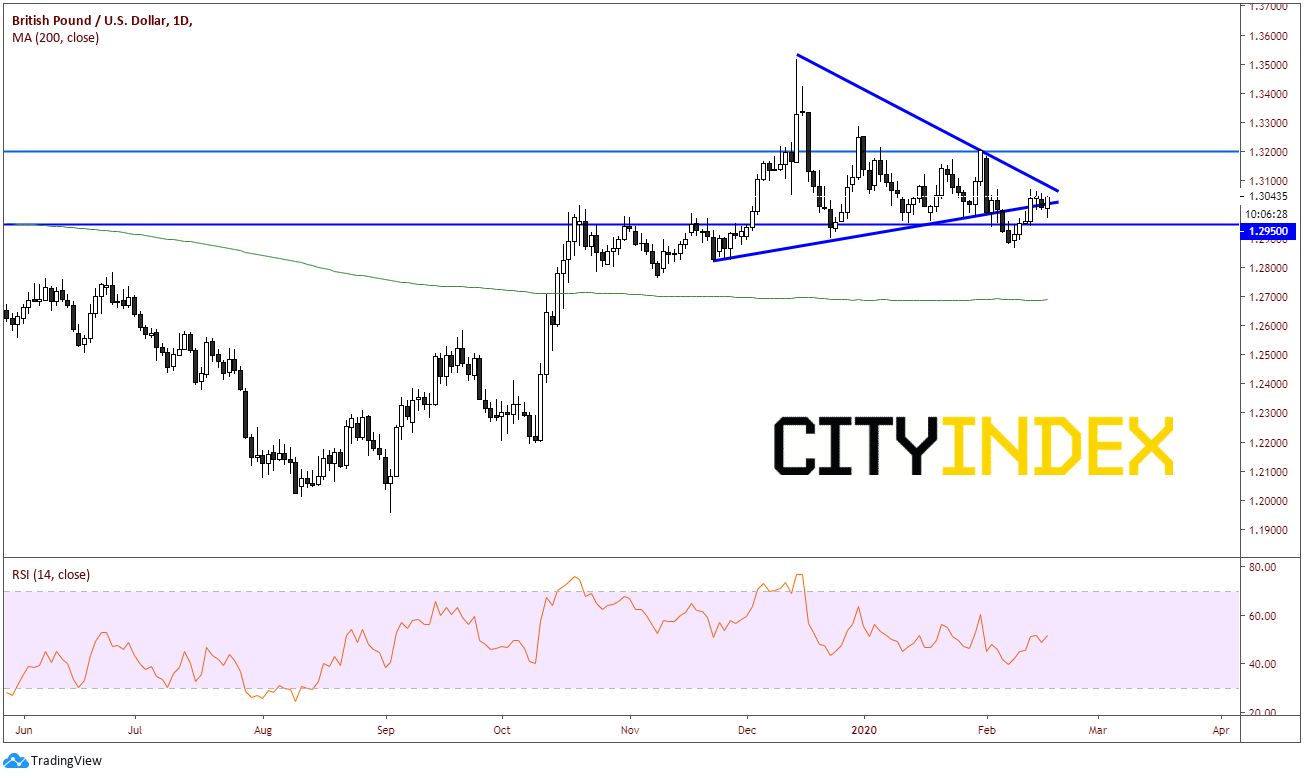

The move higher came despite comments yesterday from David Frost, the UK’s Brexit negotiator, that the UK will not agree to following EU regulation in exchange for a free-trade agreement and is willing to accept a degree of trade friction. (Reuters). Price action yesterday snapped a 5-day winning streak. However today, GBP/USD is on the move higher once again trying to move back inside the apex of the symmetrical triangle on the daily timeframe. Resistance on the daily now comes in at the downward sloping trendline near 1.3070 (the previous highs mentioned on the 30 minute), then horizontal resistance near 1.3200. Horizontal support is near 1.2950 and then previous daily lows near 1.2872.

Source: Tradingview, City Index

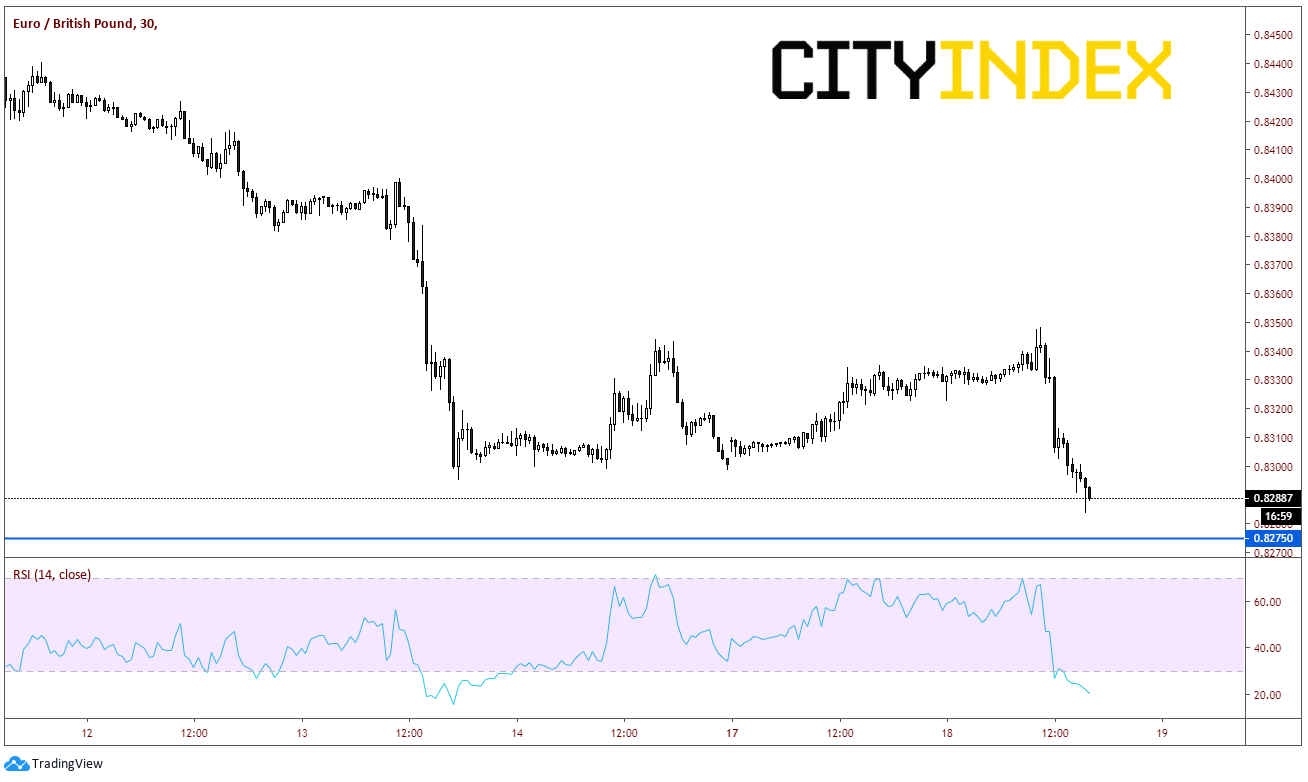

The strong move higher in the Pound can be seen in EUR/GBP as well. The pair was already moving lower (stronger GBP) into the data release. However, after the release, EUR/GBP pushed much lower and is currently testing the 2019 lows at .8275. Notice however that the RSI is near extreme oversold conditions, indicating price may be ready for a short term bounce. Sellers will look to add to positions to try and push price below .8275 looking for stops.

Source: Tradingview, City Index

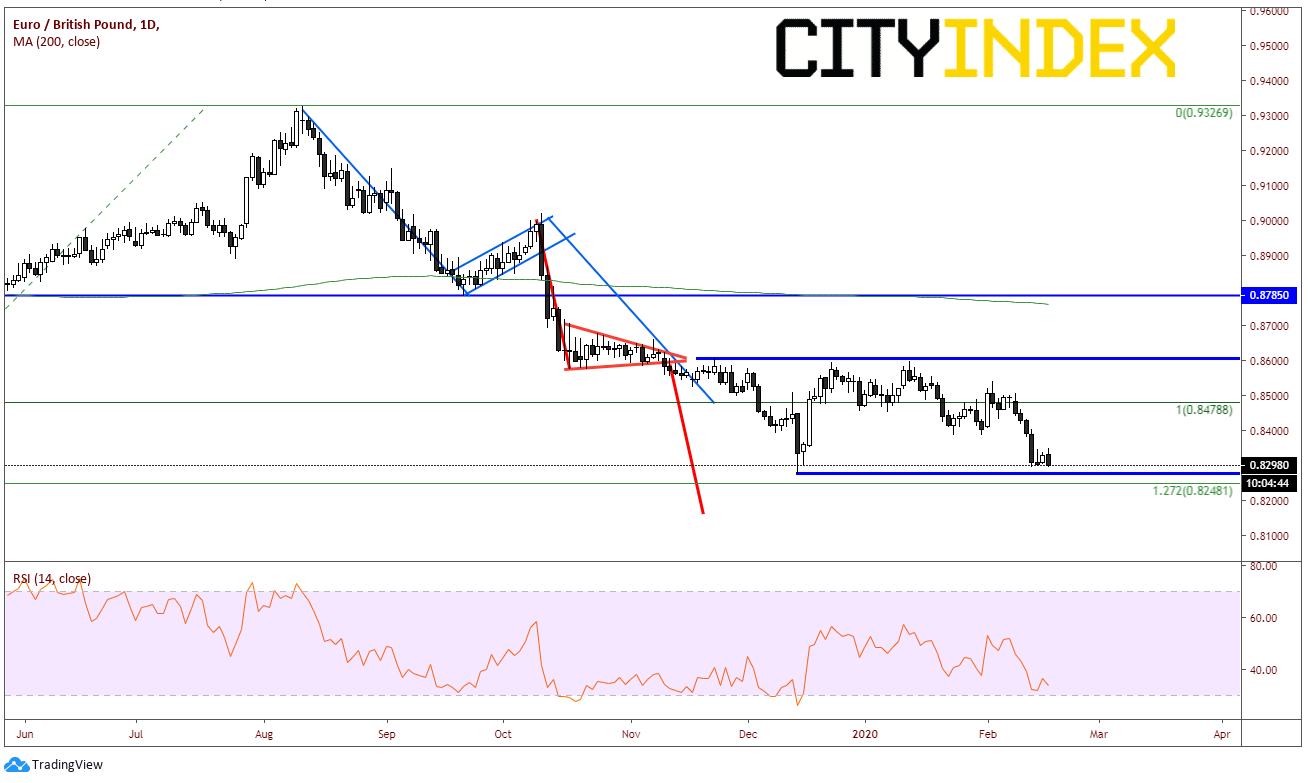

And as we wrote about last week, below there is horizontal support and the 50% retracement level from the July 2015 lows to the summer 2019 highs, near .8115. Although that level is 200 pips lower, if price does reach it, there are likely to be strong buyers with ahead of that level with stops building below it. Horizontal resistance is 90 pips higher near .8375.

Source: Tradingview, City Index

Price action for the Pound is going to be more likely driven by comments regarding trade negotiations between the UK and EU (which also may keep data subdued until there are agreements). Although one data point does not make a trend, don’t be surprised to see spikes in GBP if data such as this continues to impress.